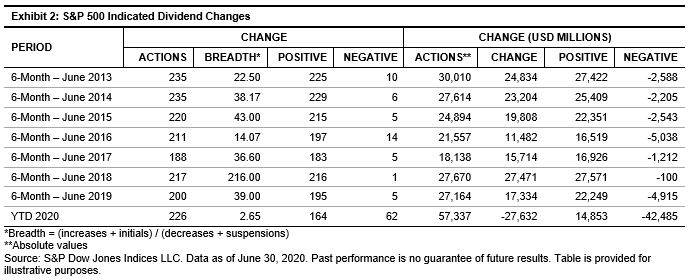

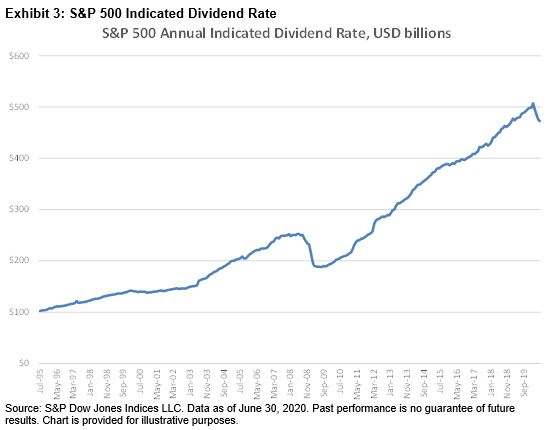

In the first half of 2020, the total amount of dividends paid out by S&P 500 companies rose 5.1% on a year-over-year basis (see A YTD History of S&P 500® Dividend Increases, Cuts, and Suspensions). However, the forward declarations for Q3 2020 show a decline. With 84% declared for July 2020, the month is poised to post a 4% payment decline (year over year). Based on the current public statements (and expected schedules), August is expected to post a 10% decline, with September showing a slight tick up (0.1%), leaving Q3 down 5% compared with Q3 2019.

The reality of Q3 2020 should start hitting market participants soon as companies declare their Q3 dividends (almost 70% of the issues are scheduled to report earnings in July 2020, with dividends typically around the release date). Big banks are expected to continue paying their rate (helped by the additional liquidity from suspending buybacks), with the exception of Wells Fargo, which decreased its rate, following the Federal Reserve’s stress test results.

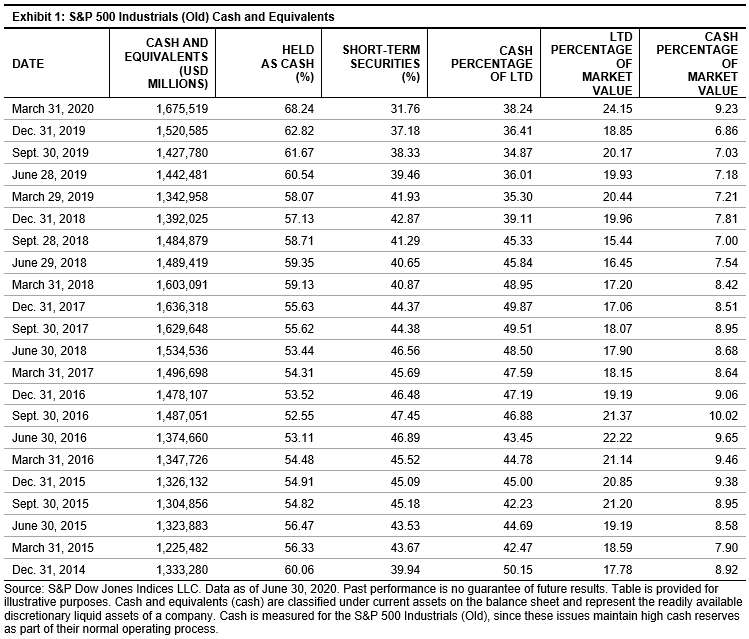

The market is expecting much smaller increases for those increasing, with one penny now being the new wink. As for cuts, we expect few within the S&P 500 for the current Q3 period (but more than the historical average), as companies wade through the reopening and their cash flow (and cash burn). Of note, S&P 500 Industrials (Old)[1] issues had a record amount of cash reserves at the end of Q1 2020 (USD 1.68 trillion) and have been adding to those reserves via issuance (which has affected the divisor, especially with fewer buybacks) and debt, as liquidity remains a top priority.

For many market participants, the Q4 2020 payments remain more of a guessing game. If one takes a bullish approach toward the overall recovery and regions’ ability to limit the further spread of the virus, then the base estimate is for a 7%-8% year-over-year Q4 2020 decline in actual payments, assuming companies with a history of increasing payments would continue to do so, be it at a much lower rate.

In the near term, we do not anticipate dividend figures materially improving, as companies will likely remain careful with cash flows. Hence, after a record Q1 2020 payment, an impressive Q2 2020 payment, and calculating reduced Q3 and Q4 payments, the current working estimate for the S&P 500 2020 payment has improved to a modest 2% decline in the actual payment.

So, what is the picture for 2021 dividends? Before projecting for 2021, we must get through 2020 first, with the U.S. presidential election right around the corner. Politics, particularly tax policy, plays a significant role for dividends, similar to the economy. The August 2020 Democratic and Republican conventions and party policy platforms will give some insight, as the presidential and congressional election results will shore up the view (and market reaction). As for the economy, to some degree, the ability of regions to contain the current outbreak, as well as the depth and duration of the spread over the summer, and the development of drugs (to control or restrict the virus, or at least move the penalty for infection out of the death column) should dictate consumer behavior, which in turn drives the economy and the market.

[1] The S&P 500 Industrials (Old) consists of the S&P 500 minus Financials, Real Estate (which was part of Financials), Utilities, and Transportation (which is now a subgroup of the GICS® Industrials sector. Note the S&P 500 Industrials (Old) dates back for decades, so when the GICS classifications were developed and one of the new sectors was Industrials, the former group was referred to as the S&P 500 Industrials (Old).

The posts on this blog are opinions, not advice. Please read our Disclaimers.