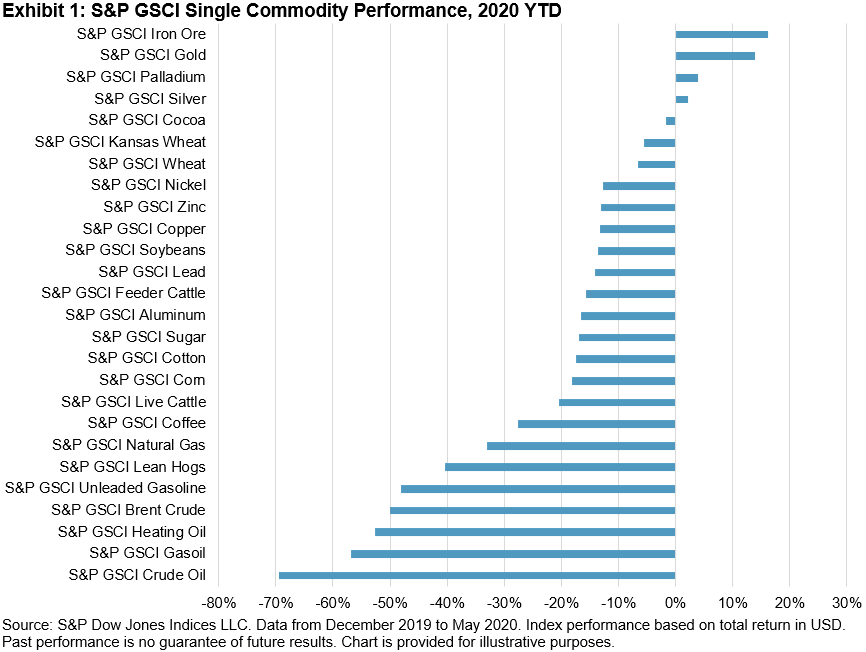

Just like the ironclad battleships of the 19th century, the S&P GSCI Iron Ore has steamed through 2020 in the explosive sea battle atmosphere of this year’s highly volatile markets. It stayed afloat when most commodities sunk to negative YTD returns (see Exhibit 1).

The S&P GSCI Iron Ore was up 22.1% YTD as of June 12, 2020. Launched Nov. 26, 2018, and based on the SGX futures, this index was timely in its creation due to the significant growth in the iron ore market. Similar to gold with its many positive catalysts, iron ore has a lot going for it in 2020. My first blog post from one year ago highlighted the fundamental reasons behind the strong iron ore price at the time. In its first full year of life as an index, the S&P GSCI Iron Ore rose 82% in 2019, hitting several new highs. It set a new all-time high in 2020 one month ago on May 18.

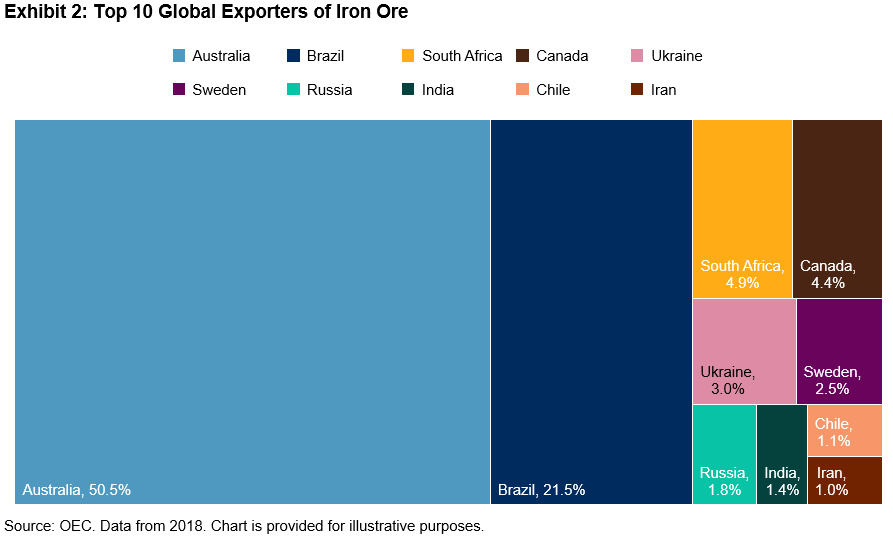

This year, another issue has cropped up to affect the supply picture—market concerns in the form of Brazilian mine shutdowns due to COVID-19. Brazil is the second-largest exporter of iron ore behind Australia (see Exhibit 2). China is the top importer, and no other country comes close to its 62% global share. New COVID-19 cases in Brazil are still escalating, making it a hot spot for the pandemic. This may also affect other major commodities’ production, such as soybeans, of which Brazil is the top exporter.

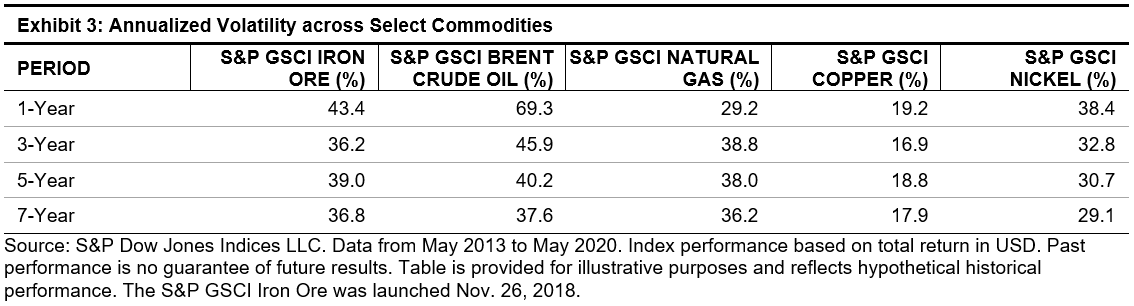

For such a historically volatile commodity, this year iron ore has displayed less volatility than Brent crude and all other major energy commodities, yet it was more volatile than other industrial type metals. While launched Nov. 26, 2018, the S&P GSCI Iron Ore has a first value date of May 7, 2013, giving us seven years of back-tested performance. Exhibit 3 highlights the volatility of the S&P GSCI Iron Ore and other select commodities.

For a more in-depth look at the financialization of the iron ore market, check out the recent collaborative paper from S&P Global Platts and S&P Dow Jones Indices here. Single commodities, whether iron ore, gold, or soybeans, can be useful to investors looking to express investment themes that are dependent on unique geopolitical, demographic, structural, climate, and even health and disease factors.

The posts on this blog are opinions, not advice. Please read our Disclaimers.