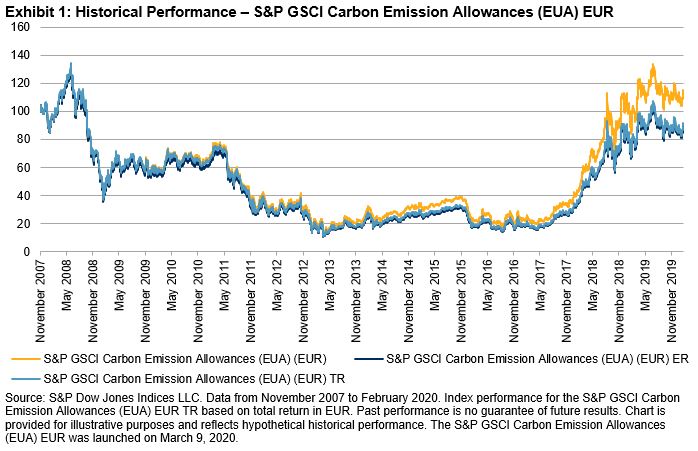

The S&P GSCI Carbon Emission Allowances (EUA) EUR represents an expansion of the single-commodity series of indices based on the S&P GSCI and is the first index of its kind in the market. The S&P GSCI Carbon Emission Allowances (EUA) EUR is designed to provide investors with a reliable and publicly available investment performance benchmark for European Carbon Emission Allowances. The S&P GSCI Carbon Emission Allowances (EUA) EUR is based on the ICE EUA Futures Contract.[1]

Carbon emissions trading is a market-based method for reducing global greenhouse gases. Carbon trading in the EU was implemented as a result of the Kyoto Protocol—created by the United Nations Framework Convention on Climate Change (UNFCCC), aimed at fighting global warming. The objective was to develop a market that manages worldwide greenhouse gas emissions based on economic and trading principles that are common across commodities markets. This approach allows countries to reduce pollution with a cap and trade system that operates through regulated markets.

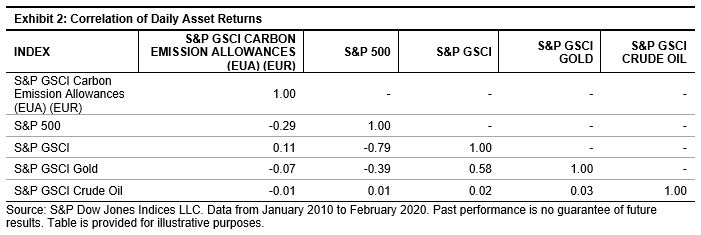

Emissions trading markets have become increasingly robust over recent years, offering a market-based approach to limiting pollution by providing economic incentives for achieving reductions in pollutant emissions. A liquid, transparent market for carbon and a robust price for carbon are critical to facilitating the reduction of greenhouse gas emissions. The S&P GSCI Carbon Emission Allowances (EUA) EUR seeks to offer access to the return stream of a unique asset that is uncorrelated to major commodities and other asset classes and, at the same time, may promote a transition to a lower carbon economy.

Investors may choose to utilize the carbon emissions trading market to express specific views on the price of carbon, to hedge or offset more carbon-heavy investments in their portfolio or combine carbon emissions with other assets to create energy-transition or low-carbon strategies.

There may also be opportunities for participants in the physical carbon emissions market to utilize financial products based on the S&P GSCI Carbon Emission Allowances (EUA) EUR in conjunction with other risk management instruments. Broadening the number of financial instruments available to hedgers in the global carbon market is an important goal of the S&P GSCI Carbon Emission Allowances (EUA) EUR.

[1] https://www.theice.com/products/197/EUA-Futures

The posts on this blog are opinions, not advice. Please read our Disclaimers.

A recent study,

A recent study,