In early March over 265 financial advisers came together in Melbourne and Sydney for S&P Dow Jones Indices’ 9th Annual Indexing and ETF Masterclass. This half day Masterclass provided advisers with the opportunity to hear from, and interact with, both local and international peers, S&P DJI subject matter experts, as well as leaders in the ETF industry in Australia.

The timing of this year’s Masterclass, just one month after the findings of a Royal Commission into Misconduct in the Financial Services industry could not have been better. The Royal Commissioner, Kenneth Hayne, made 76 recommendations for change across the industry, with a number of those recommendations affecting the financial advice industry. Perhaps the most significant recommendation is for the removal of all commissions, including those commission arrangements that were subjected to grandfathering under the Future of Financial Advice reforms earlier this decade.

Delegates at the Masterclass heard how shifting an advice business from being a stock-picking practice, or a practice that tries to select the best and most successful active fund managers, to a practice that focuses on asset gathering and asset allocation, sets advisers up for greater success. This is where ETFs come into their own, as they are perfect vehicles by which to express that asset allocation. With the increasing number of ETFs now listed on the ASX, and with increasing AUM, ETFs are the perfect tool by which to achieve great client outcomes.

At Masterclass this year, we were privileged to have Geoff Eliason from Peak Capital Management, and Registered Investment Adviser (RIA) firm based in Denver, Colorado join us. Geoff delivered the keynote address as well as participating in a panel discussing S&P DJI’s custom indexing capabilities. Geoff’s firm has developed an algorithm that uses ETFs to hedge downside risk within portfolios, while participating in most of the upside. To keep Geoff’s firm honest, and to ensure that they follow the algorithm, Peak Capital commissioned S&P DJI to develop four custom indices that reflect the investment philosophy behind four of Peak Capital’s funds. Investors with Peak can easily compare the performance of their investments against the independently calculated custom index, giving them the assurance that Peak Capital stays true to their algorithm.

A highlight of Masterclass this year was having three alumni from the annual S&P DJI Financial Adviser tour to the United States. One delegate from 2017, who has developed his own ETF model portfolios, is moving towards having custom indices developed for those portfolios so that he can show his clients how portfolios are tracking against an independently calculated index.

The two other alumni discussed how off the back of their experience in the U.S. in 2017 and 2018, they returned knowing that they both needed to ‘rewire’ their practices away from stock-picking and active fund manager selection, to asset allocation and the use of ETFs as vehicles to express this allocation. Both advisers have been successful in transitioning client’s core holdings to ETFs while keeping some funds available for stock-picking.

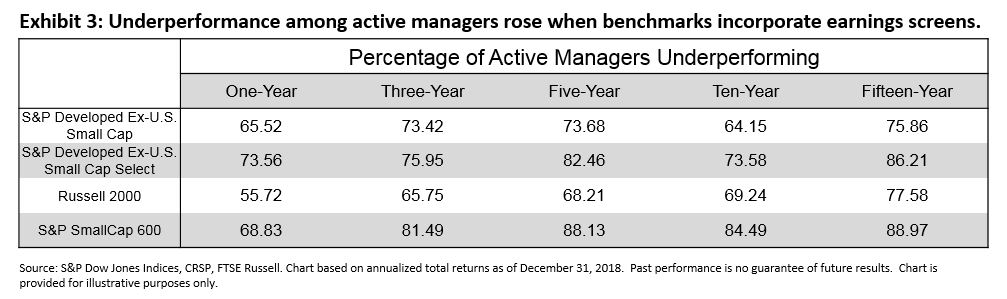

The key message from this year’s Masterclass, in talking to advisers, is that they realize that it is difficult, if not impossible, to consistently outperform the market, either by selecting stocks, or selecting active managers. And this was supported with the timely release of the full-year 2018 SPIVA® Australia Scorecard that showed that a full 86.69% of actively managed Australian Equity General Funds were outperformed by the S&P/ASX 200 index. The result for actively managed Australian Bond funds was even more dire, with 98.36% of funds outperformed by the S&P/ASX Australian Fixed Interest 0+ Index.

To this end, Australian Financial Advisers are more and more inclined, and are in fact acting, to ensure their client’s core holdings are held in index-linked ETFs. This is music to our ears!

The posts on this blog are opinions, not advice. Please read our Disclaimers.