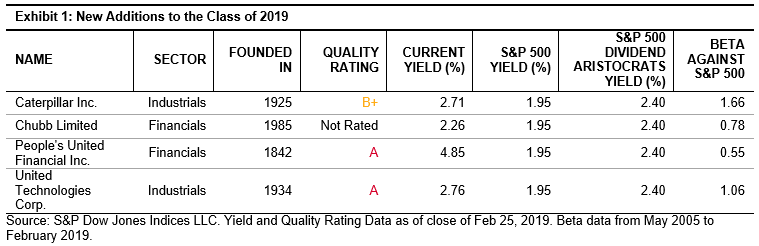

Today we examine the impact of the members of the S&P 500 Dividend Aristocrats Class of 2019 on the index’s factor risk and sector composition. In our previous blog, we introduced these new constituents and discussed their quality ranking.

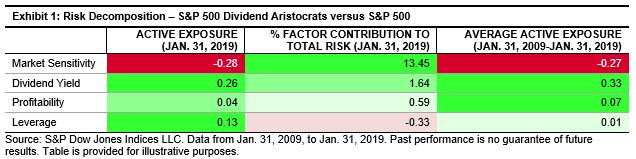

Risk decomposition of the S&P 500 Dividend Aristocrats using Axioma’s US Fundamental Equity Risk Model MH4 supports the view that the index contains elements of the quality factor. Our definition of quality uses return on equity, accruals ratio, and financial leverage ratio. Of these three calculations, Axioma’s Risk Model decomposes risk into profitability (return on equity) and leverage. A snapshot of the index on Jan. 31, 2019, shows us that the index is more actively exposed to those two factors than is the S&P 500, with profitability’s active exposure at 0.04 and leverage’s at 0.13. Profitability’s contribution to risk is relatively small at 0.59%, and leverage reduces it by 0.33%.

Moreover, the average active exposure for the 10-year period studied was 0.33 and -0.27 for dividend yield and market sensitivity, respectively. In other words, the S&P 500 Dividend Aristocrats achieved higher dividend yield than its benchmark, and at the same time was less sensitive to the market. This shows us that the index was more quality oriented, had lower active exposure, and achieved higher yield than the benchmark.

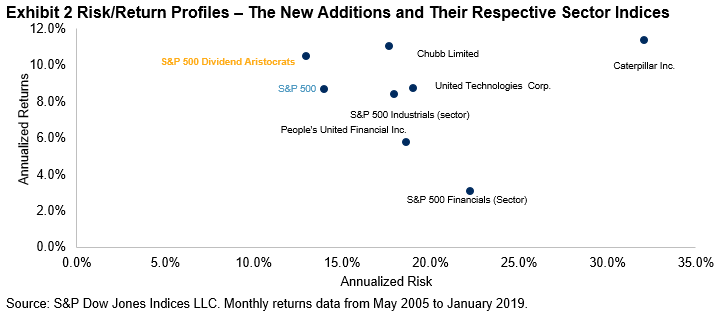

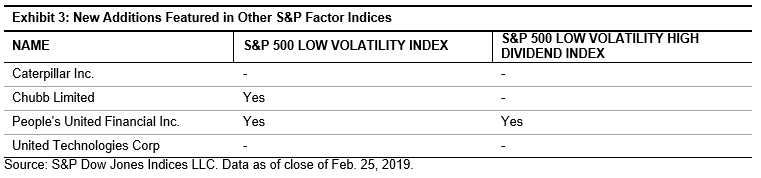

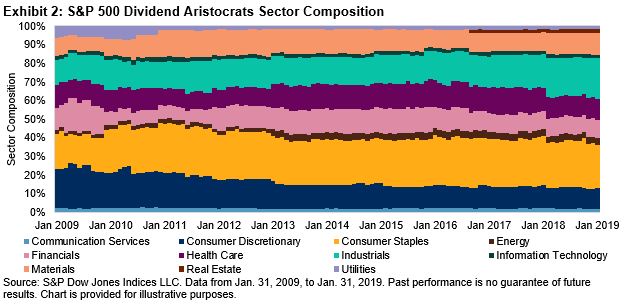

Exhibit 2 shows that the S&P 500 Dividend Aristocrats had heavy Consumer Staples and Industrials sector biases. The Class of 2019 further shifts the bias toward the Industrials sector, from a weight of 20.8% to 21.6%. This is significant because half of the companies added to the index were from the Industrials sector and the index constituents are equally weighted (Consumer Staples index weight was 23.4%).

In the S&P 500, the Consumer Staples and Industrials sectors have much lower weights, of 7.2% and 9.5%, respectively. The weight difference between the benchmark and the S&P 500 Dividend Aristocrats suggests that the latter’s Consumer Staples and Industrials sectors may have more quality due to their greater ability to provide consistent dividends. The new constituents of the S&P 500 Dividend Aristocrats Class of 2019 not only enhance the quality factor of the index, but also deepen the Industrials sector bias.

In our next blog we will discuss the historical performance of the S&P 500 Dividend Aristocrats.

The posts on this blog are opinions, not advice. Please read our Disclaimers.