The 19th Party Congress of China, one of the most important political events in China this year, has cemented President Xi Jinping’s position as one of the most powerful leaders in decades. His name and political ideology are enshrined in the party constitution, known as “Xi Jinping’s Thought on Socialism with Chinese Characteristics for a New Era”. A long-term economic roadmap of the country has been set in the congress for the new era.

What does “New Era” mean to equity investors?

President Xi emphasized the following in the congress that will guide the policy making by the Party over the next few years.

1. To pursue “quality” economic growth

Growth target no longer being emphasized and specified in the Party’s work report. President Xi outlined a long-term roadmap for building a prosperous, strong, democratic, culturally advanced, harmonious and beautiful China by the mid-21st century.[1] He reiterated the government’s commitment to transitioning the economy from a high growth model to a more sustainable and high-quality development model.

2. Rebalancing of resources allocation

The principal contradiction facing Chinese society now is a tension between “people’s ever-growing needs for a better life” and “unbalanced and inadequate development”. Rebalancing of resources allocation is the key to resolve the problem. Deepening of structural and supply-side reforms become the highest priority, while pushing for a market economy could achieve better resources allocation through market guidance.

Regarding improvement on productivity, emphasis on innovation, cutting excess capacity, advancement and utilization of information technology, moving up the value chain in manufacturing and services were announced.[2]

3. “Belt and Road” initiative

Rebalancing of regional development through initiatives such as One-Belt-One-Road could increase the economic activities and investment in the middle and western part of China where the GDP and income level are far lagged behind the coastal regions.

4. To build a “Beautiful China”

The emphasis on building a “beautiful China” shows that the policy makers will focus more on environmental protection and provide more support to green industry. The Ministry of Industry and Information Technology (MIIT) recently announced that China aims to increase boost the output of advanced environmental protection equipment to 1 trillion RMB by 2020. MIIT says the government will provide more financial support to boost green manufacturing and technology innovation.[3]

How to capture the investment opportunity in the “New Era”?

The key leadership reshuffle showed that President Xi has a tightened grip on power, which may enable the government to push economic reforms further in the next 5 years.

We expect mixed ownership SOE reform and supply-side reform will continue to be carried out in old economy sectors like commodity, materials, oil & gas, electricity and chemicals. Higher operation efficiency and improved profits could be achieved. Banking and finance sector could benefit from strengthening the implementation of policy regarding deleveraging and direct finance to private sectors. The “Belt and Road” initiative and rural development are the key focus of the government and could boost the demand for infrastructure and construction materials.

For the new economy, such as consumer, advanced manufacturing could be benefited from consumption and industrial upgrade, while information technology and health care sectors could be boosted by government’s support to R&D and innovation. The determination of building a “Beautiful China” by the government would encourage the investment in green industry such as renewable energy, environmental protection equipment and electrical vehicle.

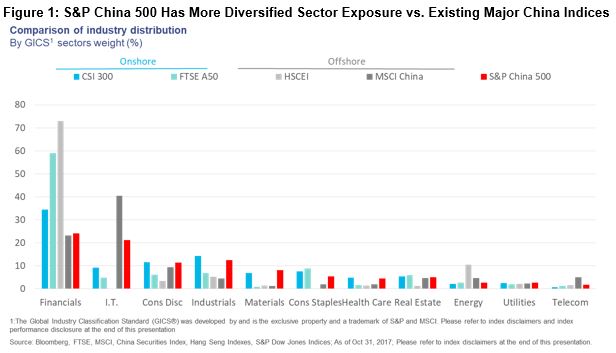

The diversified and all-inclusive S&P China 500 Index solution reflects the investment opportunity in both the old and new economy in one-click (Figure 1). For the year, the index has been performing strongly with YTD return of 39.64% (as of Oct 31, 2017).

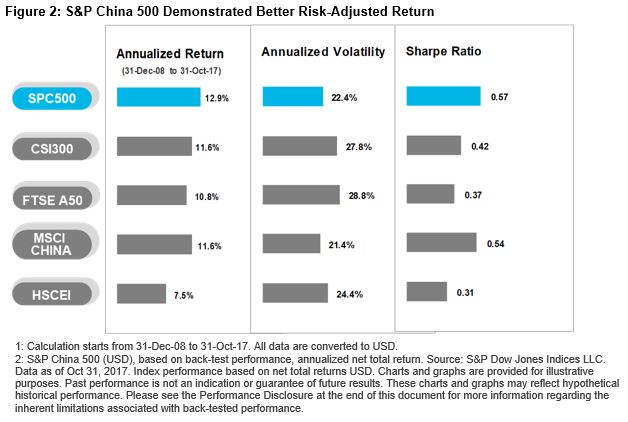

Benefited from its diversification in markets and sectors exposure, S&P China 500 has demonstrated better risk-adjusted returns (Figure 2). During the period from 31 Dec, 2008 to 31 Oct, 2017, the S&P China 500 generated an annualized return of 12.9% and Sharpe ratio of 0.57, both are the highest among the major China indices.

[1] China Daily. Oct 19, 2017. https://www.chinadaily.com.cn/china/2017-10/19/content_33428169.htm

[2] People.cn. Oct 19, 2017. http://cpc.people.com.cn/19th/n1/2017/1019/c414305-29595277.html

[3] Reuters. Oct 25, 2017. https://www.reuters.com/article/us-china-environment-equipment/china-urges-green-equipment-thrust-to-check-pollution-idUSKBN1CU17X