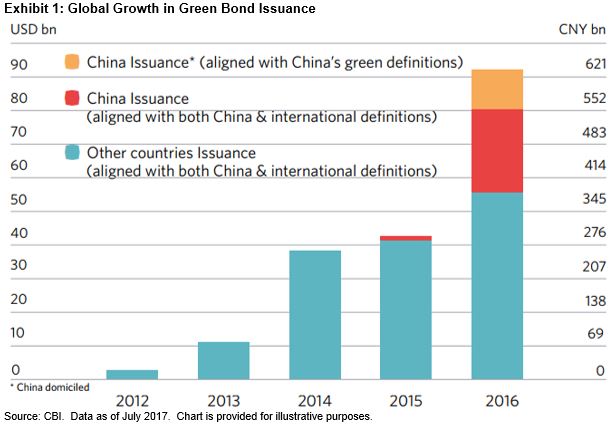

China has emerged as a global leader in green finance, especially green bonds, and from 2014 to 2016, it was the fastest-growing market in the region for sustainable investing. The total amount of green-labeled bond issuances amounted to USD 93.4 billion at the end of 2016 and reflected strong China-based issuances (40% of labeled green bond issuance in 2016 was from China) and momentum from the Paris Agreement.

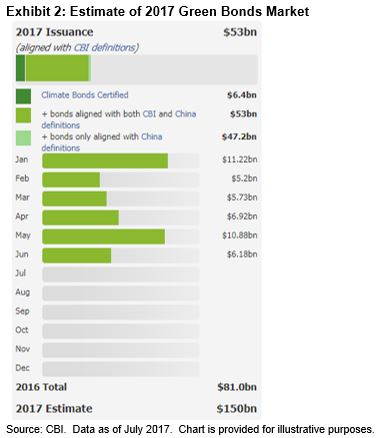

According to the Climate Change Initiative’s estimate, the labeled green bond issuances that are aligned with the Climate Bonds Initiative (CBI) definition could reach up to USD 150 billion in 2017 (see Exhibit 2). The total issuances year-to-date reflect China’s position as a leader.

S&P Dow Jones Indices has also been part of the green bond development. We were one of the first to market when we launched the S&P Green Bond Index in 2014 to encourage market growth and momentum. In February 2017, S&P DJI broadened its green bond effort and launched the S&P Green Bond Select Index. The index forms the basis for one of the world’s first green bond ETFs.

The posts on this blog are opinions, not advice. Please read our Disclaimers.