The bond markets are certainly not “Lost in Space”1. There is good rationale as to why the bond markets are in the position they are today; compressed spreads are the result of low rates coupled with strong demand out pacing supply for yield assets. However, the homogenization of the US corporate bond markets is worrisome and should begin to raise some eyebrows in the junk bond markets. What am I worried about? Credit spreads widening.

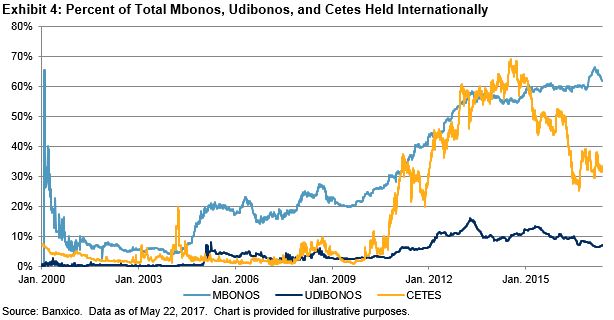

Chart 1: The S&P 500 BB High Yield Corporate Bond Index spread to the S&P 500 Investment Grade Corporate Bond Index:

Some rationale behind the angst:

- Elevated risk vs. potential reward

- Size of market. The S&P U.S. High Yield Corporate Bond Index has grown in market value from $715billion in December 2006 to over $1.5trillion in June 2017.

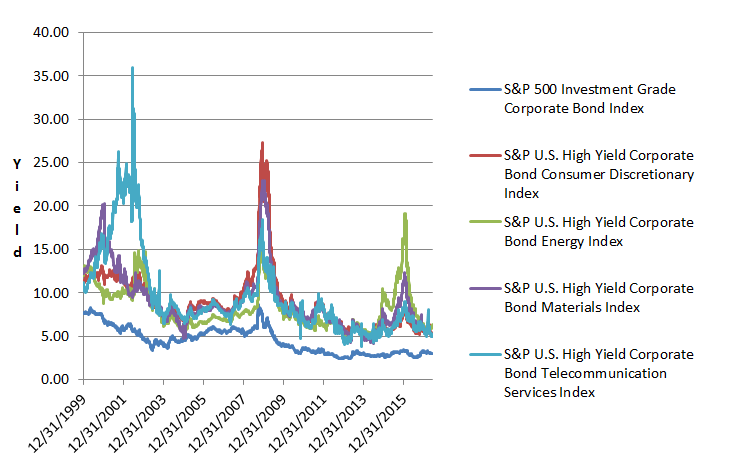

- More than half of that index, by market value, is comprised of consumer discretionary, energy, telecom and materials related issuers.

- Weakness in consumer discretionary. The drumbeat of bad news in the retail consumer discretionary markets: stores closing, companies closing, downsizing or reorganizing. The S&P U. S. High Yield Consumer Discretionary Bond Index tracks over $304billion in market value.

- Oil. The S&P U.S. High Yield Energy Corporate Bond Index tracks over $233billion in market value of bonds from the energy sector.

- Competition in telecommunications. The S&P U.S. High Yield Telecommunication Corporate Bond Index tracks over $132billion in market value.

- Materials. The S&P U.S. High Yield Materials Corporate Bond Index tracks over $142billion.

Chart 2: Select indices and their yields over time:

The past is not prologue and no one has ever seen this type of market before. Monitoring the spread risk in the high yield sectors seems prudent at this juncture.

1Lost in Space was a 1960’s sci-fi television series of the Robinson family traveling through space. The protagonist son, Will, was protected by a robot who would warn him of pending danger by waiving its arms and saying “Danger, Will Robinson”.

For more information on S&P’s bond indices including methodologies and time series information please go to SPDJI.com.

Please also join me on LinkedIn .

The posts on this blog are opinions, not advice. Please read our Disclaimers.