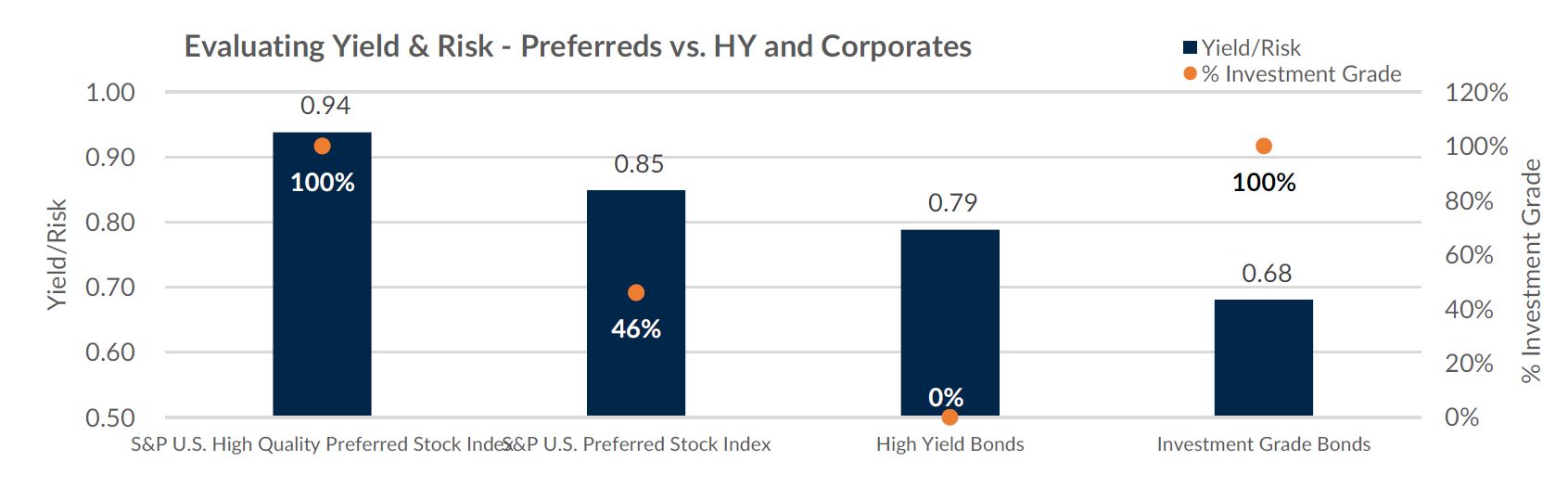

As income seekers are forced to take additional risk to meet income needs in today’s near zero interest rate environment, preferreds may be considered over high yield bonds for the following five reasons:

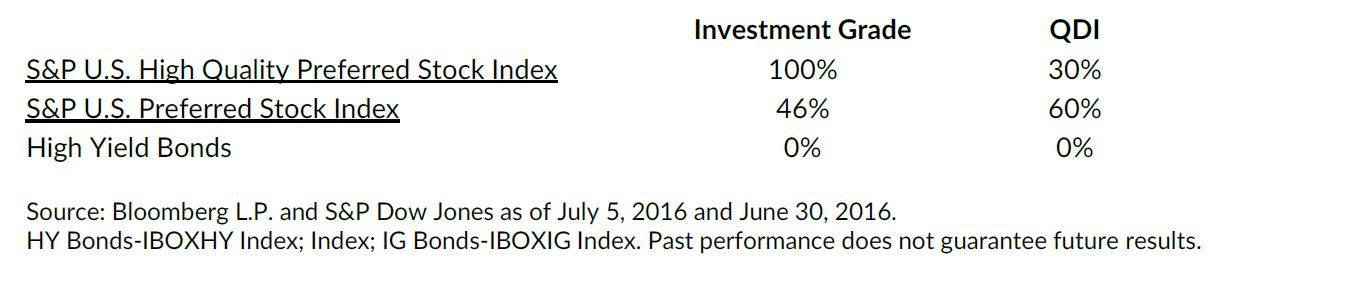

1. Significantly higher credit quality

2. Comparable yields and lower volatility

3. Tax advantages on income

4. Call risk appears limited in near term for preferreds

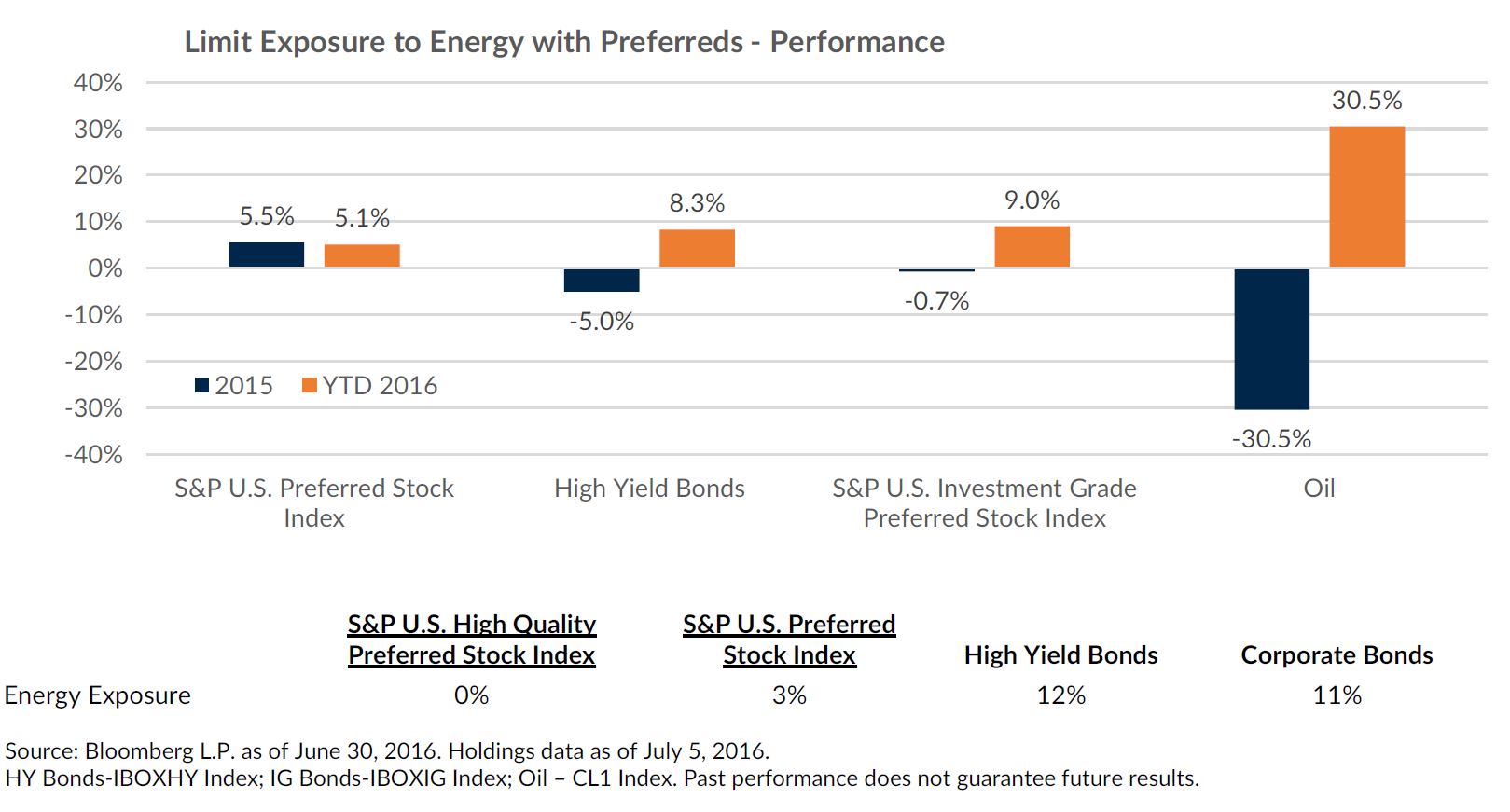

5. Lower exposure to energy and oil drawdowns

Higher Credit Quality, Lower Volatility and Comparable Yields

Preferreds have significantly higher credit quality than high yield bonds, have exhibited lower volatility and can offer similar yields with potential tax advantages on income as some preferreds provide QDI.

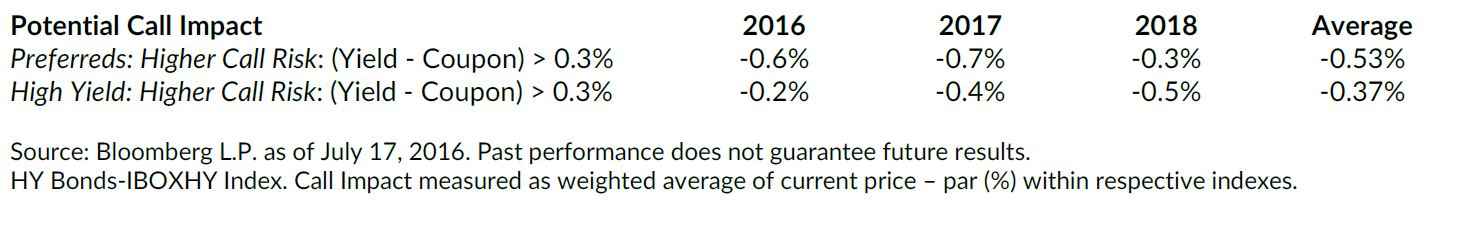

Call Risk Appears Limited for Preferreds

Both preferreds and high yield bonds share call risk, though preferreds tend to have more callable issues. The analysis of the S&P U.S. Preferred Stock Index shows that if all preferreds at increased risk of being called are indeed called over the next three years, preferreds would lose approximately 17bps per year versus high yield. For yield-focused investors, the preferreds’ call risk appears insignificant.

Low Exposure to Energy – High Yield bonds continue to be heavily influenced by energy prices.

High yield has both direct and indirect exposure to energy and has been heavily influenced by oil’s extreme volatility. Preferreds have little to no exposure to energy and may help investors diversify their risk away from energy sensitive assets like high yield bonds.

Conclusion

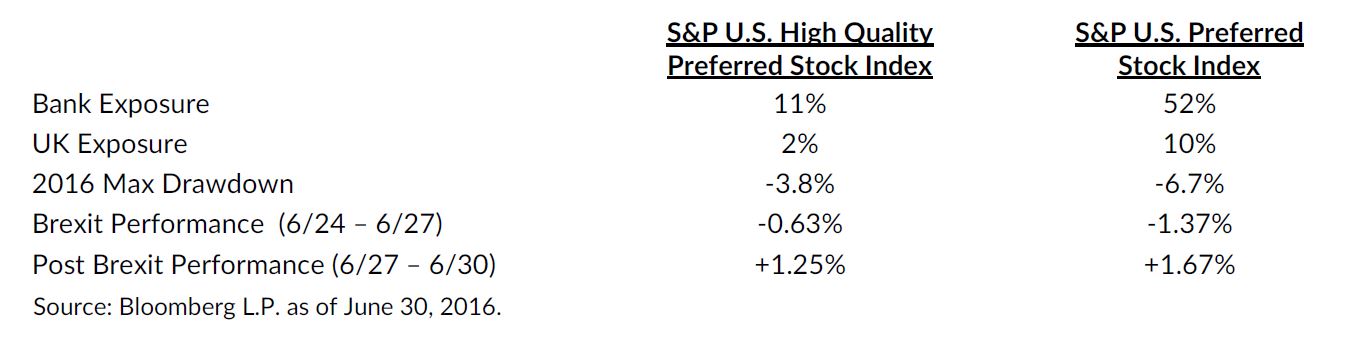

Within the preferreds space, high quality, investment grade preferreds offer investors access to preferreds while providing unique exposure outside of banks or the UK as well as a defensive tilt to hedge against down markets. In summary, preferreds appear well positioned against high yield bonds for investors looking for a combination of higher yields and lower risks.