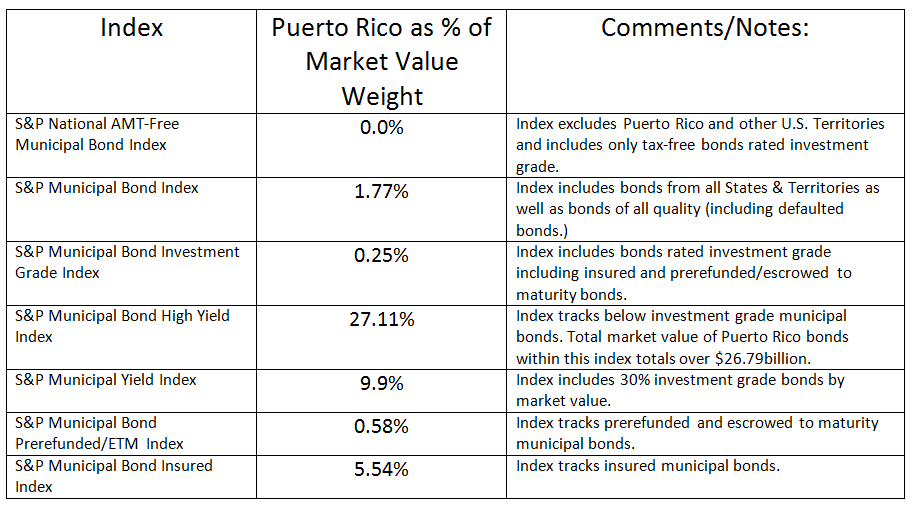

Puerto Rico remains a puzzle unsolved. The large amount of Puerto Rico debt continues to weigh on the municipal bond market with the heaviest exposure in the high yield (below investment grade) segment. Puerto Rico municipal bonds have over 27.1% market value weight in the S&P Municipal Bond High Yield Index and represent over $26.7billion in market value of bonds in that benchmark.

The broadest municipal bond index S&P publishes, the S&P Municipal Bond Index , tracks over $1.7trillion in market value of municipal bonds. The sum of all Puerto Rico bonds in that index represents 1.77% of the total market value of the index. This total includes bonds that are in default, insured, prerefunded as well as bonds that are escrowed to maturity.

The S&P National AMT-Free Municipal Bond Index is an investment grade index that excludes Puerto Rico bonds as well as bonds from other U.S. Territories. There is no Puerto Rico exposure in that index.

There are $9.7billion in market value of insured Puerto Rico bonds that are tracked in the S&P Municipal Bond Insured Index . The insured Puerto Rico bonds represent slightly over 5.5% of the total market value of that index.

Table 1) Select S&P municipal bond indices and the percentage of Puerto Rico bonds by market value in each index

Please join me on Twitter @JRRieger and LinkedIn

The posts on this blog are opinions, not advice. Please read our Disclaimers.

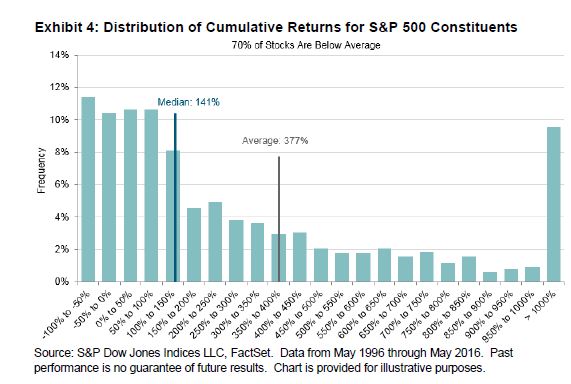

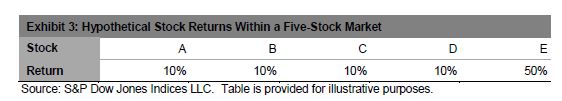

We can form portfolios of various sizes from these five stocks. There are five possible one-stock portfolios, four of which underperform the market as a whole. Alternatively, there are also five possible four-stock portfolios, four of which outperform the market as a whole. The expected return of the complete set of one-stock and four-stock portfolios is the same 18%, but the distribution of portfolio returns is different. In this case, holding more stocks increases the likelihood of outperformance.

We can form portfolios of various sizes from these five stocks. There are five possible one-stock portfolios, four of which underperform the market as a whole. Alternatively, there are also five possible four-stock portfolios, four of which outperform the market as a whole. The expected return of the complete set of one-stock and four-stock portfolios is the same 18%, but the distribution of portfolio returns is different. In this case, holding more stocks increases the likelihood of outperformance.