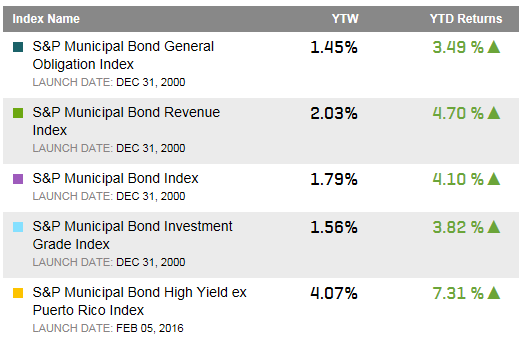

The municipal bond market tracked by the S&P Municipal Bond Index has seen a 4.11% year-to-date return. Investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index have seen a 3.95% return.

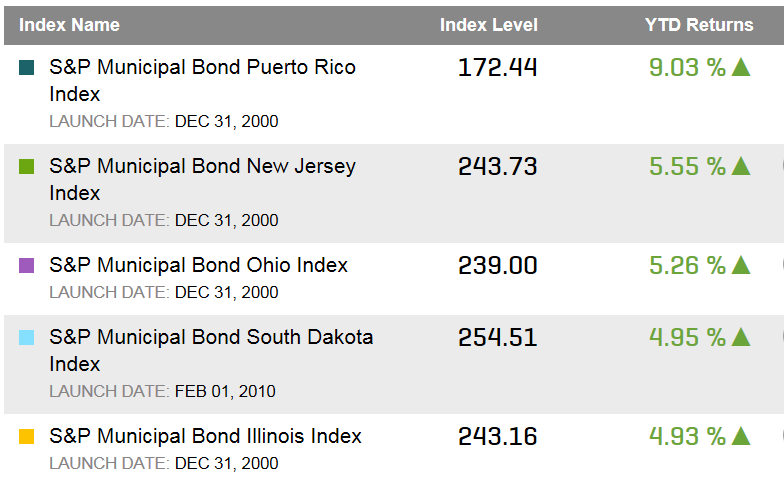

What states are leading the pack? The answer includes some of the states that have been performance drags in the past. Municipal bonds issued within Puerto Rico, New Jersey and Illinois are in the top five at this point in 2016. Puerto Rico revenue bonds have held on to their bounce off the bottom despite Puerto Rico’s default earlier this month. As for bonds from other states, the demand for bonds with any incremental yield over other bonds has helped push up the prices of bonds issued within states such as New Jersey and Illinois.

Throwing anchor at the bottom of the pack are bonds issued from Virgin Islands which represent a relatively small segment of the municipal bond market but a lot of debt to carry for a small population. As a result, bonds from Virgin Islands are suffering in the shadow of Puerto Rico’s struggles. Municipal bonds from oil states such as New Mexico and North Dakota remain in positive return territory but are beginning to show the impact of the economic drag low priced oil has created.

Table 1) Top five state municipal bond indices sorted by year-to-date total returns:

Table 1) Bottom five state municipal bond indices sorted by year-to-date total returns:

Please join me on Twitter @JRRieger and LinkedIn

The posts on this blog are opinions, not advice. Please read our Disclaimers.