This morning’s Wall Street Journal described one aspect of the “Brave New World” occasioned by ultra-low (or negative) interest rates:

Tellingly, strategists at Citigroup have created a basket of stocks for what they call “bond refugees”—investors who want yield but without the big swings in prices associated with equities. To do so, they looked for stocks with high dividend yields, but that fall by relatively less in price when markets take a tumble. That produced a list of large, defensive, global stocks, including PepsiCo, Nestlé, Roche and McDonald’s. The strategy produced a total return of 8.2% in the first half…

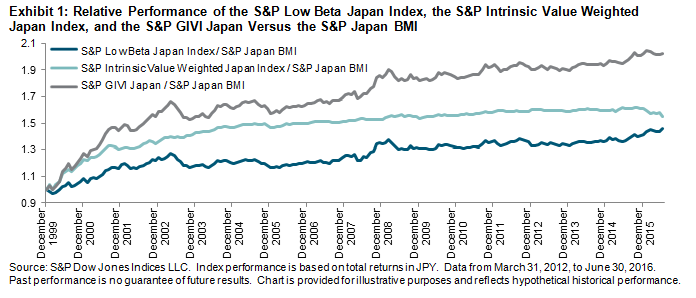

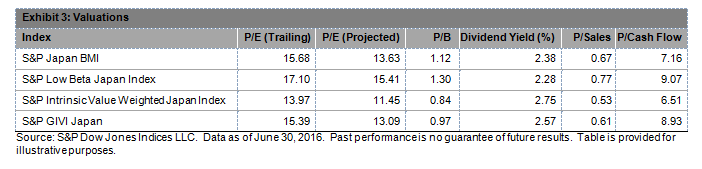

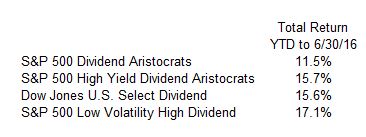

8.2% is an impressive total return for the first half of 2016, well above the S&P 500’s 3.84%. But of course, the strategists in question weren’t trying to beat the S&P 500, they were trying to find stocks with high yields and relatively stable prices. Could we indicize high yield and stable prices? Indeed, there are a number of indices that aim to do exactly that:

When we speak of “indicizing,” we mean to provide, in passive form, a strategy formerly available only via active management. As this simple example shows, high yield equity strategies can be readily indicized. Investors who opt for passive, indicized strategies can count on transparency, reliability, and low cost. They might also (as in today’s example) achieve better performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.