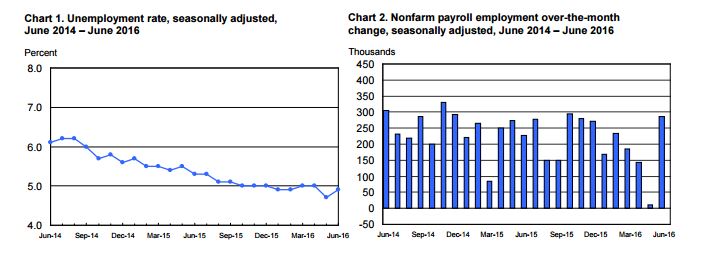

Payrolls jumped with 287,000 new jobs in today’s employment report sparking a stock market rally that boosted the S&P 500 to within five points of a new record high and renewed questions about a Fed rate hike. The employment report was welcome and put to rest worries that the labor markets were weakening. However, the Fed is likely to remain on hold until the fourth quarter or longer. Even with this report, job growth is easing a bit: over the last three months job growth has averaged 147,000 per month compared to 199,000 per month over the 12 months through June. The labor force participation rate and the employment population ratio remain flat; the unemployment rate ticked up to 4.9%. Labor market conditions look better than they did before the report, but the overall picture is little changed.

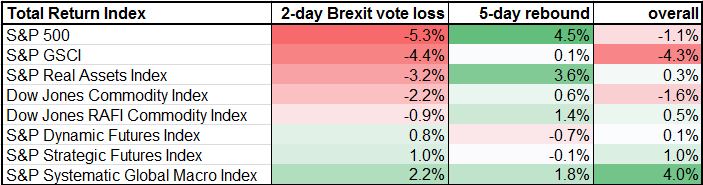

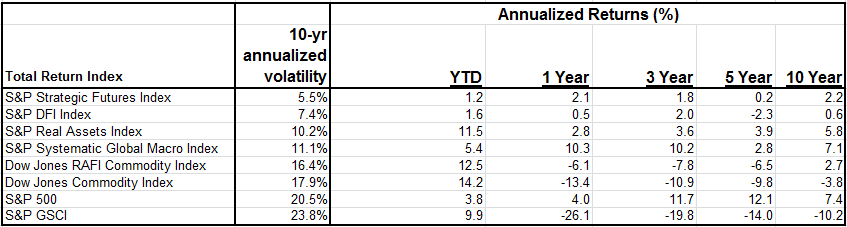

The big cloud on the horizon is neither the labor market nor inflation – it is the expected fallout from Brexit. From the last FOMC minutes it is clear that the Fed, like almost everyone else, is trying to figure out what happens next in Great Britain and Europe. A few things can be identified and are likely to discourage any early Fed action to raise interest rates. First the dollar’s strength may dampen US exports and put further downward pressure on inflation, deterring any thoughts of a rate hike. The larger concern is that financial markets may react the way they did when the vote was announced, adding to uncertainty and volatility. Moreover, Brexit may be dominating the headlines but there are other issues across Europe with concerns about debt levels and banks. All this suggests that stable monetary policy is a better choice than trying to raise interest rates.

For investors and the Fed it is a wait and see game. Those who like rock bottom interest rates are likely to enjoy them for a while longer.

The posts on this blog are opinions, not advice. Please read our Disclaimers.