By now we’re very familiar with the oft discussed “Low Vol Anomaly”. Diverging from conventional finance theory, which tells us that risk and return are directly related, low volatility stocks have outperformed over time and, as expected, with lower volatility. Ample research and evidence point to the existence of a low volatility factor comparable to other factors such as beta or small size or cheap valuation. Because this seems to fly in the face of what we think we know about risk and return, the low volatility factor is often referred to as the low volatility “anomaly.” The S&P 500 Low Volatility Index, for example, outperformed its parent S&P 500 (annual growth rate of 10.9% and 9.8%, respectively) despite exhibiting lower risk in the period between 1991 and 2015.

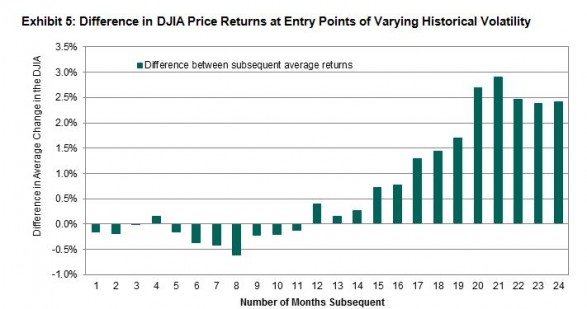

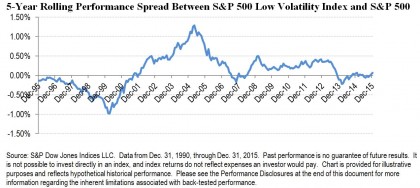

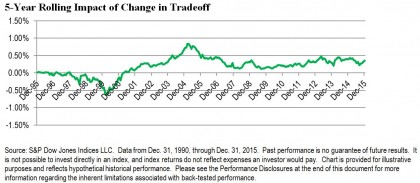

These returns are a snapshot spanning a 25-year period. Low Vol has, of course, underperformed at times during this period, most notably during the inflation of the technology bubble. The chart below maps the five-year performance spread on a rolling basis for a better picture of how Low Vol has behaved over time. Recently Low Vol’s performance spread has drifted around zero. Does this imply that the “low volatility anomaly” is spluttering?

We recently developed a simple methodology that can be used to assess the performance of factor (or other) indices compared to their cap-weighted parents. The methodology attributes a factor index’s excess returns both to its incremental (or decremental) level of risk and to a changed tradeoff between risk and return. We ascribe Low Vol’s “anomaly” to the tradeoff portion of the performance differential and the chart below tracks this element of return on a rolling 5-year basis. The recent performance challenges of Low Vol are attributable to its reduced level of risk in an environment that, until recently, has been favorable for risk-taking. Contrary to what the performance differentials suggested, the low volatility anomaly, as defined by improved tradeoff between risk and return, is alive and well.

The posts on this blog are opinions, not advice. Please read our Disclaimers.