Factor-based investing in equities is a well-established concept supported by over four decades of research. However, factor-based investing in fixed income remains in its nascent stages. Our analysis has found that factor-based fixed income strategies implemented in a rules-based, transparent index can represent an alternative tool for fixed income portfolio construction. In the next few blogs, we will detail our approach to and back-tested results of employing credit spread (value) and volatility as factors in order to systematically construct a portfolio of U.S. investment-grade corporate bonds.

Investment Philosophy

In practice, an active portfolio manager for a corporate bond mandate mostly focuses on credit returns, specializing in expressing views on the direction of credit spreads and security selection. We propose a two-factor model to seek to collect an active return from security selection, identifying relative value opportunity in credit returns while keeping portfolio duration and credit duration natural to the underlying universe.

Two Factors: Volatility and Credit Spread

To achieve better security selection, we chose two factors that empirically have demonstrated a strong relationship between factor exposure and performance statistics and that have long been incorporated in investment analysis by corporate bond portfolio managers. Our selection of factors was by no means exhaustive.

The fixed income investment community has long used volatility in analyzing bond valuations and identifying investment opportunities. We have defined volatility as the standard deviation of bond yield changes for the trailing six-month period. All else being equal, the more volatile the bond yield is, the higher the yield needs to be in order to compensate for the volatility risk.

For the credit spread factor, we consider the option-adjusted spread (OAS), which represents the yield compensation for bearing credit risk and other risks associated with credit. OAS is a common measure of valuation for corporate bonds.

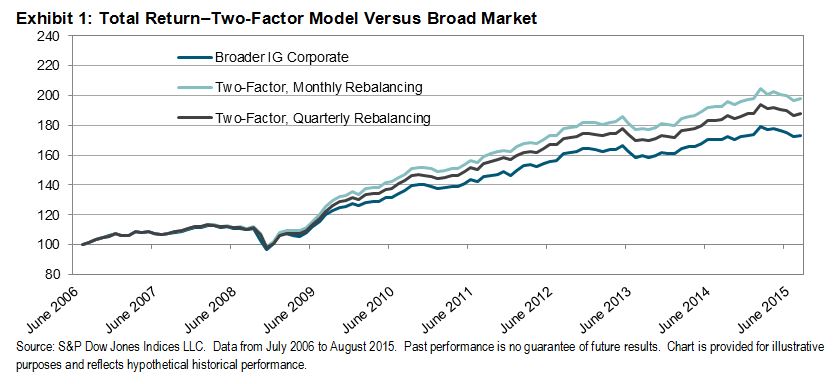

Back-Testing Total Return

Exhibit 1 shows the cumulative total return for our two-factor model versus the broad market. In the next post, we will demonstrate how we identify these two factors.