Within the passive investment arena, smart beta strategies have witnessed a substantial growth in assets, and there is now a swathe of such strategies in the marketplace, many of which bear similar names and share similar objectives. One may therefore expect that all these strategies are similar and that any differences would only elicit interest in academic circles, but our research suggests that the drivers of risk and return for these strategies can be poles apart, even though the strategies appear, at first glance, to be indistinguishable.

Optimized Minimum Variance or Simple Low Volatility: One and the Same Thing?

For example, the minimum variance and low volatility strategies share similar objectives in that they each target less-volatile stocks. The main difference between the two derives from the strictness of their sector- and stock-level constraints. Minimum variance applies strict constraints and involves optimization, whereas low volatility tends to involve selecting the least volatile stocks based on the last 12 months of standard deviation.

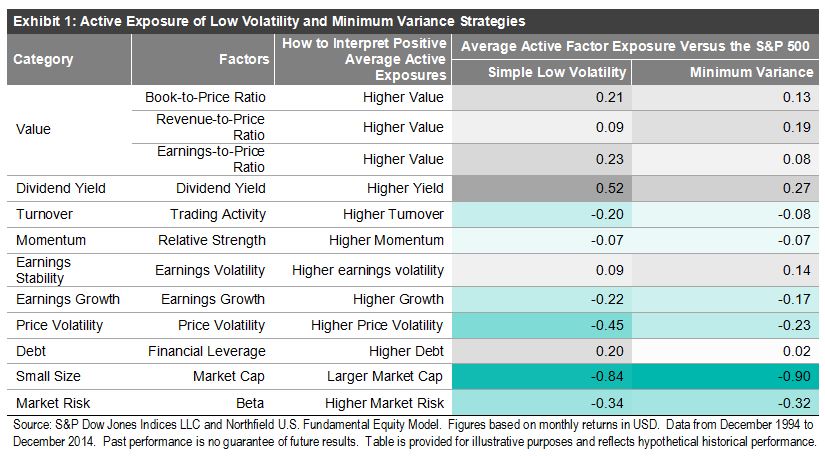

Exhibit 1 shows that these strategies were exposed to different fundamental factors from December 1994 to December 2014. Less surprisingly, both strategies had lower market beta than the S&P 500®, and the simple low volatility strategy had a much lower exposure to price volatility than the minimum variance strategy. More interestingly, both strategies had smaller market-cap stocks than the S&P 500. They also had high exposure to high-dividend-yielding stocks. These differences can also be seen through the different sector exposures of the two strategies.

Additional research by S&P DJI shows that exposures can be different for other strategies (such as dividend strategies, quality, size, etc.), even though they may bear similar names.

For more information on our research, please click here, where you will also find details about:

- How each of the smart beta strategies performed in different macroeconomic and market environments, and

- What happens when a number of factors are blended together in multi-factor portfolios.