Advisors today share a problem new to the careers of all but the eldest of us. As I discussed in a recent webinar, at Giralda Advisors, we call it the Portfolio Problem — unique in the last 30 years and arguably the most significant issue facing financial planning professionals over the next several years, if not decades.

The Portfolio Problem arises from these facts:

- Most investors need a sizeable allocation to equities in their portfolios

- Equities are the primary driver to help them achieve their long-term financial goals and stay ahead of inflation

- However, equities are volatile and subject to significant drawdowns

- Non-equity asset classes, a key purpose of which is to buffer the risk of equities, have become problematic

- Fixed income investments, in particular, are poised for historically poor returns for the next several years, as their 30-year bull run fueled by declining interest rates is coming to an end — this is what makes the Portfolio Problem unique in the last three decades

- Attempts to enhance fixed income returns introduce their own problems — increased risk and increased correlation with equities — that compromise the mission of this asset class

- Diversification itself does not always protect the portfolio from equity risk

- Contagion among asset classes, which occurs in times of extreme market stress, is immune to diversification

- Even in the best of environments, portfolio risk mitigation through diversification is not guaranteed

So, how does a financial advisor solve the Portfolio Problem? We believe the answer may lie in an approach we call risk-managed investing (RMI). RMI attempts to explicitly mitigate equity risk at its source — directly within the equity investment itself, via dampening volatility and/or limiting downside potential. Let us illustrate by example how this can be done.

The two primary risks facing equity investors include recurring bear markets and sudden, severe market crashes. An effective RMI strategy attempts to address both of these risks.

Our RMI approach seeks to tackle bear market risk through a momentum-based sector rotation strategy. After detailed modeling and rigorous testing with basic industry sector indexes, we developed a strategy that provides buy and sell signals with the goal of exiting early from sectors that lead market declines. We execute the strategy with highly liquid industry sector ETFs. An illustration of the sector activity within our Sector Dynamics RMI strategy is shown in the graph below.

We address market crash risk with an RMI strategy that incorporates a custom-designed suite of tail risk hedges. These hedges are delivered via swaps whose value is derived from proprietary volatility-based indexes. The idea is to capture and monetize the spikes in volatility that typically accompany sharp equity market declines and to do so very cost-effectively. Several of these indexes are based on signaled exposure to VIX, itself a very popular volatility-based index.

We benchmark our RMI strategies against relevant indexes. Three in particular developed by S&P/CBOE that are very well suited to RMI are:

- PPUT — an index of the S&P 500 and a rolling put

- CLL — an index of the S&P 500 and a rolling collar

- VXTH — an index of the S&P 500 and a VIX-based tail risk hedge

Indexing has played an important role in our RMI efforts, from strategy development, to product construction, to benchmarking. By using accessible indexing tools, a properly implemented RMI strategy can provide a sophisticated, innovative approach to mitigating downside portfolio risk — thereby elegantly solving the Portfolio Problem.

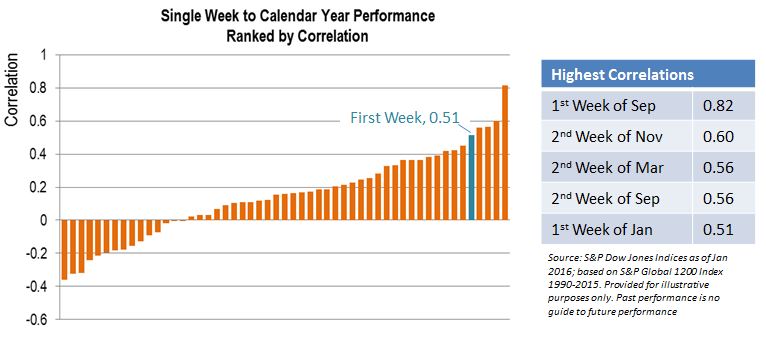

Not all weeks are equally important

Not all weeks are equally important