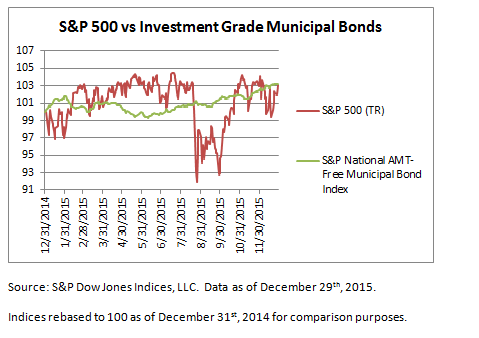

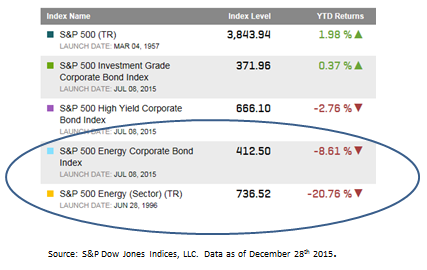

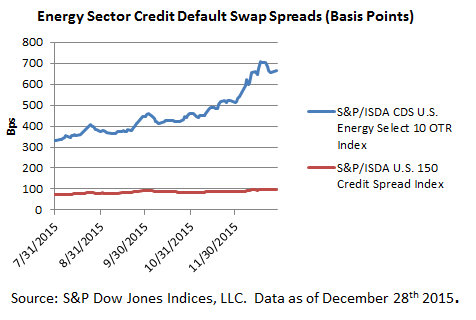

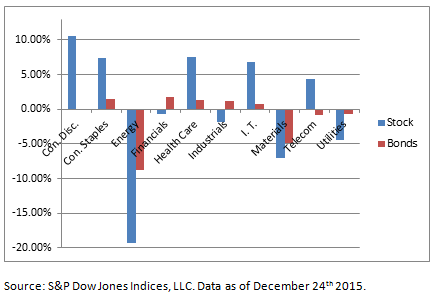

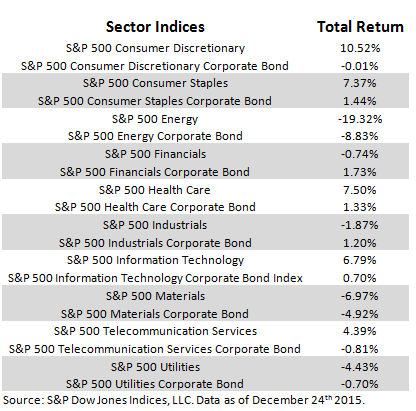

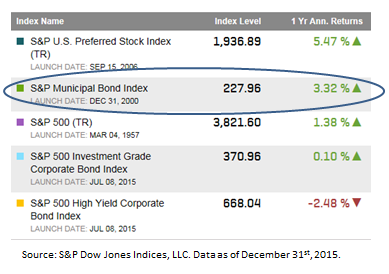

The S&P Municipal Bond Index recorded a positive 3.32% total return in 2015 securing a second place finish among major asset classes. Volatility plagued the equity and commodities markets which also tore into the corporate bond materials and energy sectors. While municipal bonds were steady throughout 2015 it had own challenges as Puerto Rico continues it’s seemingly endless financial struggles.

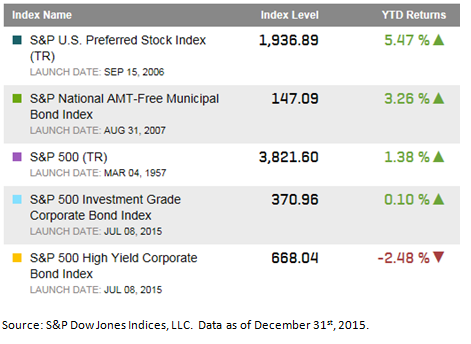

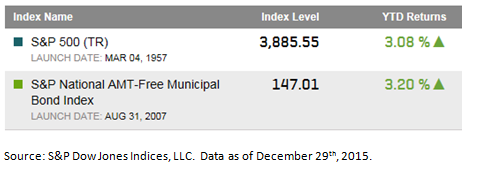

Table 1: Select asset class indices and 2015 total returns

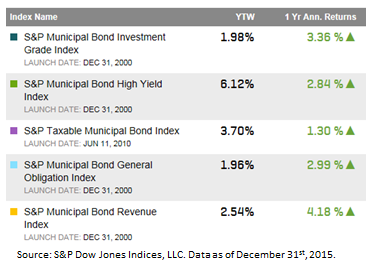

Of the broader municipal bond market segments, taxable municipal bonds had the lowest returns of 1.3% while the broad revenue bond segment recorded a return of over 4%.

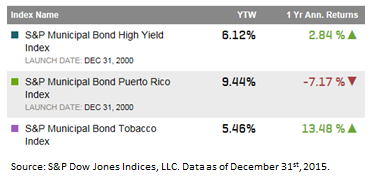

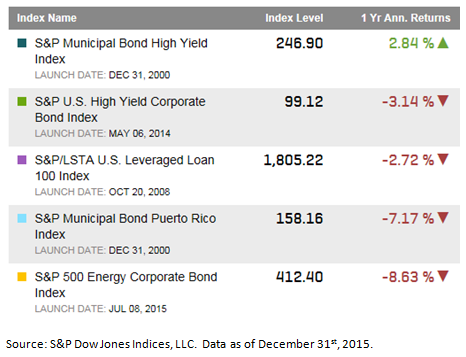

Table 2: Select Municipal Bond Indices, year-end yields and 2015 total returns

The S&P Municipal Bond Puerto Rico Index logged a -7.17% return in 2015 which played a significant role in muting the returns of the S&P Municipal Bond High Yield Index. The S&P Municipal Bond Tobacco Index rebounded in 2015 with a positive 13.48% return driven by successful refundings replacing high cost debt with bonds with lower interest rates.

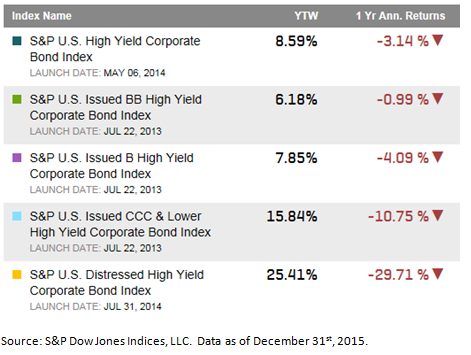

Table 3: Select municipal bond high yield indices, year-end yields and total returns for 2015