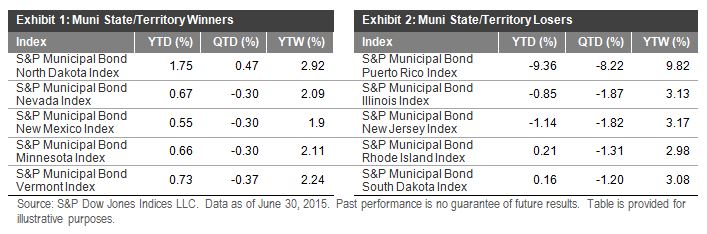

The S&P Municipal Bond North Dakota Index (0.47% QTD) was the only U.S. state or territory index to finish the second quarter in the black. The bonds tracked by the S&P Municipal Bond Puerto Rico Index (-8.22% QTD) have been in the focus of the mainstream media this week following public statements from their governor that the island territory cannot meet their USD 72 billion in outstanding debt obligations. Since Governor Padilla declared the commonwealth’s debt “not payable” on Monday, June 29, 2015, the total return on Puerto Rico muni debt has fallen 7.2%, with the YTW spiking to 9.82%.

The S&P Municipal Bond Puerto Rico General Obligation Index, which includes debt from the Puerto Rico Electric Power Authority (PREPRA), fell 7.85% in 48 hours, with the YTW finishing the quarter at 11.67%. Investors who had been enjoying high yields throughout the Puerto Rico muni saga are finally shoving off the island to safer shores.

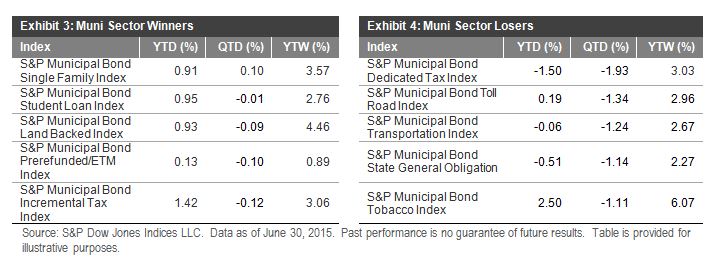

The S&P Municipal Bond Single Family Index, which tracks single-family housing debt, was the only sector-based muni index to finish the quarter in the black, returning 0.10% QTD. In contrast, the S&P Municipal Bond Dedicated Tax Index, which features property, sales, excise, service, motor, etc., was down 1.93%. The highest-returning sector in Q1 2015, the S&P Municipal Bond Tobacco Index (3.66% Q1 2015), joined dedicated tax municipals on this quarter’s loser list after falling 1.11% in Q2 2015, shaving the YTD return to 2.50%.

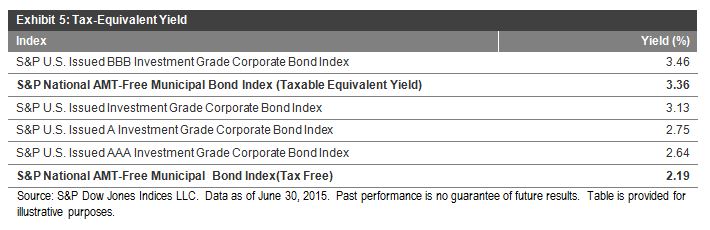

When examining yields and returns on tax-free municipals, it can be important to consider the tax benefit. The investment-grade issues in the S&P National AMT-Free Municipal Bond Index have a tax-equivalent yield of 3.36%, which is superior to the S&P U.S. Issued Investment Grade Corporate Bond Index yield of 3.13%.