Second marriages, Dr. Johnson reminds us, sometimes represent the triumph of hope over experience. The same applies to many arguments for active investment management.

Last week, e.g., The Wall Street Journal announced, with a note of triumph, that “So far this year, actively managed U.S. stock mutual funds have outperformed funds trying to clone the market’s overall performance.” As of April 30, the Journal reported, the average active fund was up by 2.25%, against the 1.92% return of the S&P 500. Leaving aside methodological issues like how the 2.25% is computed (simple average or asset-weighted average?) and the statistical significance of a 33 basis point difference, there’s a more important difficulty with this comparison.

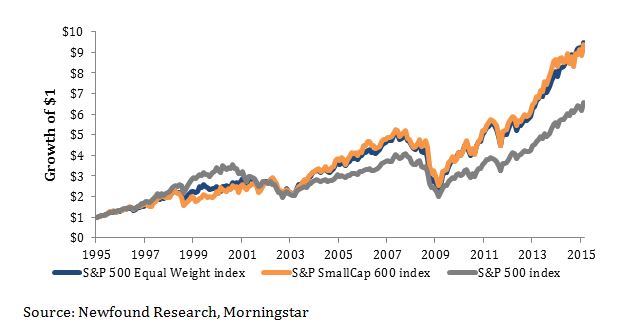

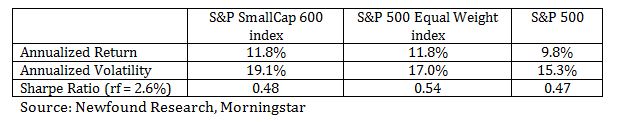

Despite my personal affection for the S&P 500, it is not the appropriate benchmark for all U.S. equity portfolios, let alone for an arbitrary average of mutual funds. In the four months ended April 30, e.g., the S&P 400 MidCap Index rose by 3.74%, and the S&P 500 Growth Index was up 2.96%. So if the Journal’s average fund tilted toward midcap or growth stocks, it would automatically gain an advantage in this period. In fact, almost the entirety of the 33 basis point gap might be due to the tendency of equal-weighted indices to outperform their cap-weighted counterparts. (In the first four months of 2014, the S&P 500 Equal Weight Index was up by 2.21%.)

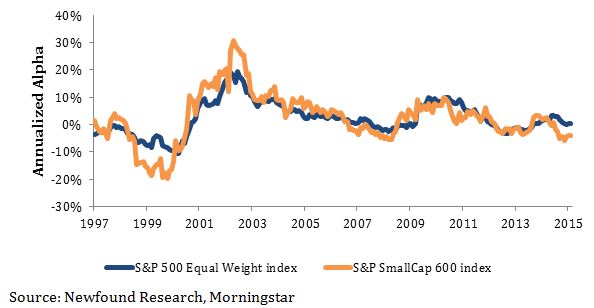

The proper way to benchmark active managers is one by one. For some strategies, the cap-weighted S&P 500 will be perfectly appropriate; for others, different benchmarks will provide the asset owner with more insight. The point of benchmarking, after all, is to understand to what degree a manager’s results come from factor tilts which can readily be indicized. If fund owners do not calculate their manager’s outperformance, or “alpha,” against the correct benchmark, they are at great risk of paying active fees for performance that could have been obtained passively.

And here, of course, lies the problem for all active investors: there is no natural source of alpha. If I’m to be above average, someone else must be below average, and the weighted sum of the winners’ outperformance must be exactly equal (before costs) to the weighted sum of the losers’ underperformance. Passive investors avoid becoming the source of someone else’s alpha. It’s a strategy firmly founded on experience, rather than hope.

The posts on this blog are opinions, not advice. Please read our Disclaimers.