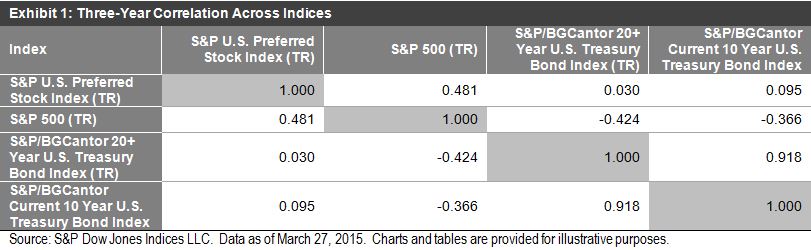

Over a three-year period, the annualized returns of the U.S. preferred market have been more bond-like than equity-like. The S&P U.S. Preferred Stock Index had a three-year annualized return of 7.95% as of March 27, 2015 while long U.S. Treasury bonds have returned 8.14% in the same period. Meanwhile, the three-year annualized return of the S&P 500 has been well over 15%. All of this is pointed out by J.R. Rieger in his recent blog post: U.S. Preferred Stock: Equity & Bond Characteristics Helping or Hurting Performance?

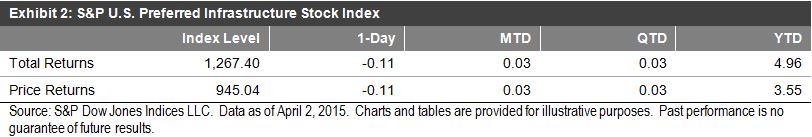

In order to address the growing interest in the infrastructure market, S&P Dow Jones Indices recently launched an index designed to track an additional segment of the preferred market: the S&P U.S. Preferred Infrastructure Stock Index. The index has returned 0.03% MTD and 4.96% YTD on a total rate of return basis, as of April 2, 2015. Returns for 2015 have all been positive at 3.37% (January), 1.11% (February), and 0.39% (March), while the dividend yield was 5.88% as of April 2, 2015.

As mentioned in J.R.’s post: “While it is easy to relate the performance of preferred stock and long-term bonds to interest rate changes, the two asset classes have shown a low correlation to each other over the last three years. Actually, the S&P U.S. Preferred Stock Index has had a higher correlation to the S&P 500 than it did to long-term bonds. There is a danger in just looking at the last three years, of course, as interest rates have been held low during the period.”

Below are three visuals. The first reports on the three-year correlation across four index types, while the second shows the returns of the S&P U.S. Preferred Infrastructure Stock Index. The graphic that concludes this piece reports on the historical total returns of U.S. preferred infrastructure stocks.

Source: S&P Dow Jones Indices, LLC. Data as of April 2, 2015. Past performance is no guarantee of future results. Charts and tables are provided for illustrative purposes and may reflect hypothetical historical performance. Please see the Performance Disclosures at the end of this document for more information regarding the inherent limitations associated with back-tested performance.

Source: S&P Dow Jones Indices, LLC. Data as of April 2, 2015. Past performance is no guarantee of future results. Charts and tables are provided for illustrative purposes and may reflect hypothetical historical performance. Please see the Performance Disclosures at the end of this document for more information regarding the inherent limitations associated with back-tested performance.