The overall medical trend rates covering all services have continued to be modest in the S&P data through the 3rd quarter of 2014—increasing up to 3.5% on a 12-month moving average basis as of September[1].

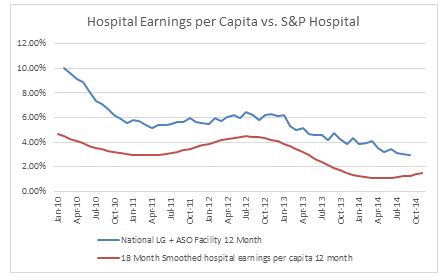

Milliman uses the S&P claims based indices to create a Health Cost Index Claims Based Forecast that uses economic factors and scenarios to project these indices out three years. The economy has continued to pick up with a robust real GDP of 5% in the 3rd quarter after 4.6% in the 2nd quarter, but dropping off to 2.6% on the advance GDP estimate for the 4th quarter[2]. Beyond the time lag in inflation used in our forecasts, our longer inflation scenario reflects inflation moving to 2.1% by 2017, which reflects the Philadelphia Federal Reserve December 2014 Livingston Survey of forecasters. In recent months our hospital forecasts continue to come in somewhat lower than expected. We believe this is at least partially due to the Medicare penalties on excess hospital readmission rates, which has a spill-over effect on commercial business[3]. Not only are the readmission rates dropping, but also initial admission rates may be declining due to longer observation times (due to the 72 hour rule) in the ER—thus eliminating some admissions. At the same time, reduced admissions appear to be pushing up practitioner trends to some degree, partially offsetting the hospital slow down. As a result of these Medicare mandated changes in the hospital sector, hospital employment and wages have been growing slower than population growth for some time. A comparison of hospital wages per capita (on an 18 month smoothed moving average basis) vs. S&P hospital trends is shown in Chart A below. The dip in 2010-2011 was likely due to the effects of the recession and loss of medical coverage by individuals being laid off after the government COBRA subsidy ended.

Chart A

With respect to our future trend forecasts, we expect trends to continue to rise steadily over the next few years reflecting the strengthening economy and the impact of new drugs. Also, once the hospital programs to reduce readmissions and the impact of longer ER observation times mature, the removal of this source of downward pressure is likely to further put upward pressure on trends.