The CBOE Volatility Index, or what many investors have come to know as VIX, is the index many follow as a volatility indicator for the stock market. The benefit besides printing the “implied” or expected volatility for prices over the next 30 days, giving a range of expected prices 30 days from now, is that it has acted as a portfolio hedge.

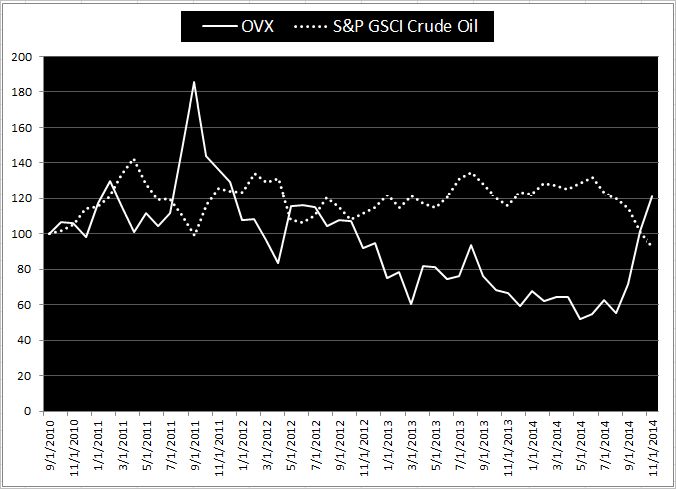

Luckily for commodity investors, especially those in oil right now (and gold last year), there are volatility indices that may hedge losses like the VIX has done for the S&P 500. Notice the in the chart below, the opposite movements with correlation of -0.58 of the S&P GSCI Crude Oil versus the OVX, CBOE Crude Oil Volatility Index.

Historically when the S&P GSCI Crude Oil lost in a month, it lost 5.4% on average. During those months, the OVX returned 7.5% on average. However, when the S&P GSCI Crude Oil lost more than 5.0% in a single month, the OVX provided even more protection with an average return of 16.4%. This is exactly the kind of protection investors may look for in order to hedge the downside risk of the oil price drops. The worst month in history (since Sep 2010) for the S&P GSCI Crude Oil was in May 2012 when the index lost 17.5%. During that month the OVX returned 38.3% and continues to provide strong protection as evidenced by the 118.6% gain since Aug 2014 when the S&P GSCI Crude Oil lost 23.3%. If as an investor since Sep 2010, 10% of OVX was taken from an allocation to the S&P GSCI Crude Oil then the return would have improved from -7.8% to 4.0%, swinging the pendulum from red to black.

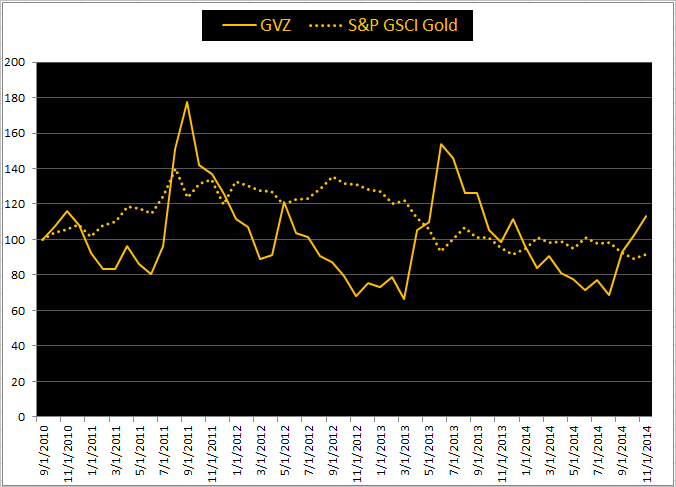

The same argument holds true for the relationship of the S&P GSCI Gold and GVZ, CBOE Gold ETF Volatility Index. Notice the in the chart below, the opposite movements with correlation of -0.59 of the S&P GSCI Gold versus the GVZ.

Historically when the S&P GSCI Gold lost in a month, it lost 4.3% on average. During those months, the GVZ returned 5.2% on average. However, when the S&P GSCI Gold lost more than 5.0% in a single month, the GVZ provided even more protection with an average return of 16.7%. Again, this is exactly the kind of protection investors may look for in order to hedge the downside risk of gold price drops. The worst month in history (since Sep 2010) for the S&P GSCI Gold was in June 2013 when the index lost 12.2%. During that month the GVZ returned 40.3% and provided strong protection as evidenced by the 48.5% gain in 2013 when the S&P GSCI Gold lost 28.3%, the worst year in history since 1981. If as an investor since Sep 2010, 10% of GVZ was taken from an allocation to the S&P GSCI Gold then the return would have improved from -8.6% to 19.1%, an astonishing capital preservation measure in my opinion.

The posts on this blog are opinions, not advice. Please read our Disclaimers.