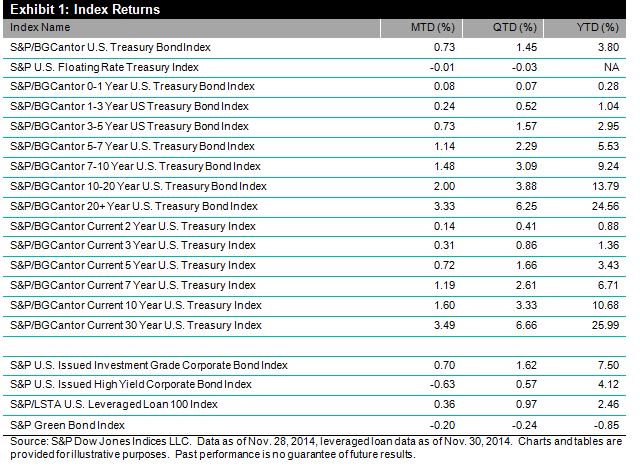

Long duration was the trade to have for the month of November. The yield-to-worst of the S&P/BGCantor Current 30-Year U.S. Treasury Index closed the month at 2.90%, 17 bps tighter than at the beginning of the month, which was 3.06%. The 10-year yield-to-worst, as measured by the S&P/BGCantor Current 10 Year U.S. Treasury Index tightened by 16 bps.

Investment-grade corporate bonds, as measured by the S&P U.S. Issued Investment Grade Corporate Bond Index, returned 0.7% for the month. Together with the index’s October gain of 0.9%, the past two months make up for the September loss of -1.17%.

High yield bonds ended in the red in November, as the S&P U.S. Issued High Yield Corporate Bond Index returned -0.63% for the month. Unlike the high-yield index, the S&P/LSTA U.S. Leveraged Loan 100 Index was in the black for the month, as senior bank loans returned 0.36%. Though still representing more than half of the YTD return of high-yield bonds (2.46% versus 4.12%), the steady return and lower volatility of leveraged loans are a plus to the sector.

Green bonds, with a duration just under five years (at 4.92), also had a negative return for the month (-0.20%), as the S&P Green Bond Index has underperformed for the year, returning -0.85% YTD.