Up until September 18, yields on the S&P/BGCantor Current 10 Year U.S. Treasury Bond Index crept high enough to ensure a loss of -1.21% for September. Since then, rates have come down 18 basis points to Friday’s close of the index at 2.44%. Currently the 10-year is trading another 2 basis points tighter at a 2.42%.

Month-to-date the S&P U.S. Issued High Yield Corporate Bond Index is returning 0.51% and on the year it has returned 4.06% year-to-date. A more positive start to the month than the -2.05% the index returned for September. Like July’s decline, a heightened concern for a rise and rates and a quick withdrawal of funds from the sector led to dramatic loss for the month. The question for October will be if interest rate remain low, will the high yield sector bounce back from here like it did in August?

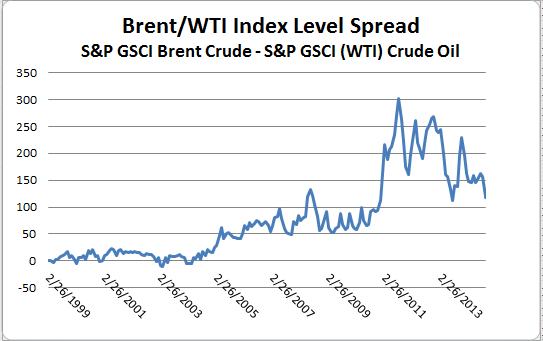

An interesting chart that might represent how U.S. rates could remain low on the back of the European economy for a while shows the yield difference between the S&P Eurozone Sovereign Bond 7-10 Years Index and the S&P/BGCantor 7-10 Year US Treasury Bond Index.

Source: S&P Dow Jones Indices, October 3, 2014

The posts on this blog are opinions, not advice. Please read our Disclaimers.