August housing starts, reported today, were disappointing at 956,000 units, a drop of 14.4% from July and 8% from August last year. Only twice this year have monthly reports of housing starts topped a million units at annual rates – from 1991 to the financial crisis in 2008, starts were never below one million. To a large extent building houses hasn’t recovered from the financial crisis. If one uses the average number of houses started from 1995 through 2004 as a pre-boom-bust normal measure, housing starts in August were 59% of the normal level.

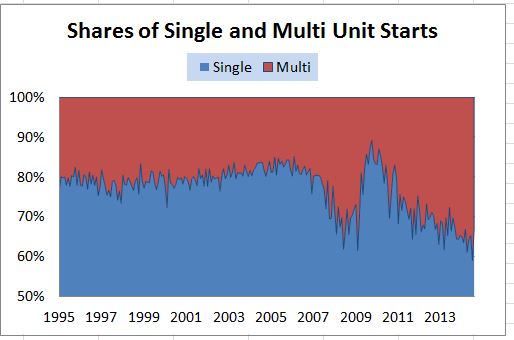

The details suggest there is much more to the story. Single family homes started in August were 50% of the normal rate while multi-family homes (apartments) were at 94% of the normal pace. The chart shows that there was a change in the shares of single family homes and apartments. The single family share (in blue) dropped beginning in 2007, rebounded briefly in 2009 when the government provided tax benefits to first time home buyers and then fell from 2010 on.

What happened to keep people in apartments? Renters who decided not to become home buyers are a part of the story. The New York Fed (click here) provides an analysis of why people are renting rather switching to being home-owners. First time home buyers account for 30% to 50% of home sales. The principal answers, in the chart from the New York Fed, are not enough money, too much debt or credit isn’t good enough. The damage of the financial crisis is still with us. Mortgage rates and home prices are barely mentioned. Moreover, both renters and home owners expect moderate increases the home prices, enough to stay a bit ahead of inflation. About 60% believe owning a home is a good or very good investment; another 29% are neutral on investment value; with little difference between renters and home owners. The idea that the financial crisis relief should have focused more people in debt may make sense.

The posts on this blog are opinions, not advice. Please read our Disclaimers.