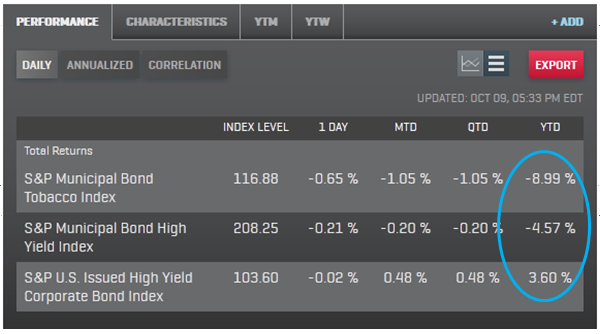

Tobacco settlement bonds tracked by the S&P Municipal Bond Tobacco Index are down nearly 9% year to date as yields have risen by over 255bps as the credit risk of these long duration bonds is questioned. Recent arbitration results have been positive but uncertainty over future disputes and tobacco consumption are pulling these long duration bonds down. The average duration of the S&P Municipal Bond Tobacco Index is over 11.5 years.

The S&P Municipal Bond Index, which includes tobacco settlement bond issues that are below investment grade, is down over 4.5% year to date with yields rising by over 150bps. The tobacco bond exposure helps lengthen the duration of the index to over 9 years.

By comparison, the S&P U.S. Issued High Yield Corporate Bond Index has a duration of over 4.8 years and is up 3.6% year to date.

To learn more on the municipal bond market, join us for an event in New York next Thursday, “Where are Municipal Bonds Creating Opportunities for You?” Keynote speaker, Jim Lebenthal, co-founder of Lebenthal Asset Management, will examine the overall health of the market and explore current opportunities in U.S. infrastructure and municipal bonds. Click here to register and for more details.

The posts on this blog are opinions, not advice. Please read our Disclaimers.