The S&P Municipal Bond Puerto Rico Index is down over 16% since mid-year and over 20% for the last 12 months. The ‘storm’ has continued into October as the index is down 2% month to date.

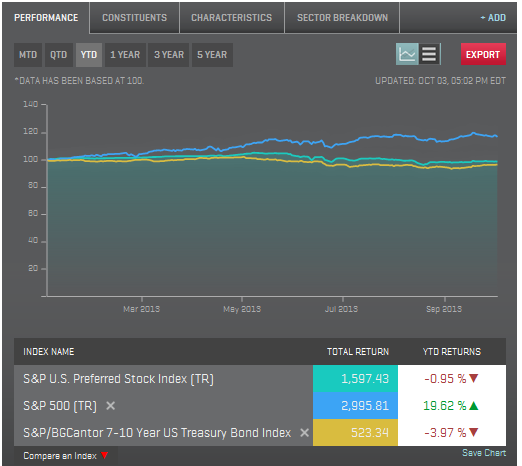

The Puerto Rico bond market debacle weighs on the rest of the municipal bond market despite its relative high quality. For the year to date, tax-free investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index are down over 3.5% as yields have risen by about 100bps. (As a comparison, investment grade corporate bonds tracked in the S&P U.S. Issued Investment Grade Corporate Bond Index are down just about 2.5% as yields have risen by about 50bps).

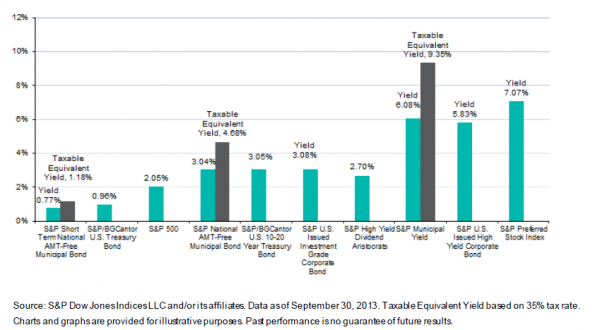

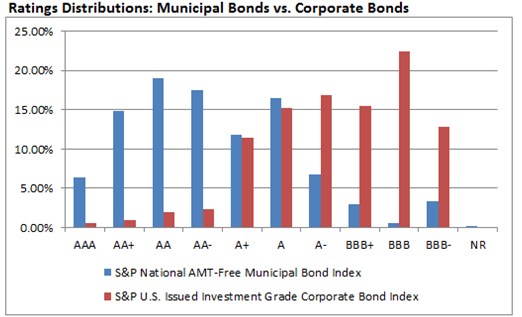

A quick look at the quality of investment grade municipal bonds compared to the corporate bond market can be seen in the graph below.

Join S&P Dow Jones Indices for a Municipal Bond Event in New York, NY on October 17th

Attend this half-day seminar and hear financial industry leaders discuss the challenges facing the municipal bond market in a rising interest rate environment. Keynote speaker, Jim Lebenthal, co-founder of Lebenthal Asset Management, will examine the overall health of the market and explore current opportunities in U.S. infrastructure and municipal bonds. Our panel moderators include Tom Keene, anchor of Bloomberg Surveillance and Frederick Gabriel, Editor of InvestmentNews. CFA®, CIMA®, CFP® Credit Available.

Register Now: http://now.eloqua.com/es.asp?s=795&e=746099&elq=d8d00fceb16d47be87cb548953325adf

The posts on this blog are opinions, not advice. Please read our Disclaimers.