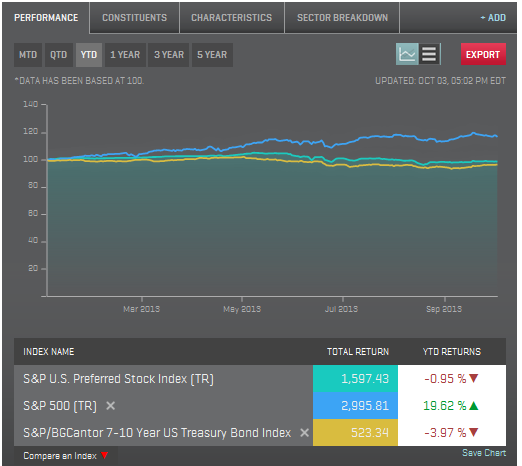

Preferred stocks have a split personality, part equity and part bond. The bond characteristics of preferred stock has, at least for the time being, become the ‘Mr. Hyde’ of the asset class. The high dividends that preferred stock owners enjoy can be compared to future interest payments of bonds. Like bonds, the prospect of the Fed tapering and causing rising interest rates has helped bring the 2013 YTD returns for the S&P U.S. Preferred Stock Index to -1%. Meanwhile, the S&P 500 has seen over 19.6% total return.

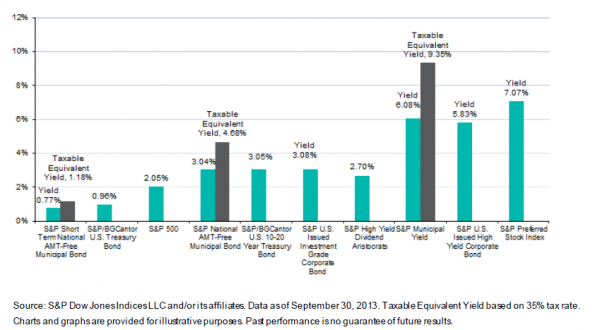

The dividend cash flow ends up being an important characteristic of the preferred asset class. With a yield over 7%, the S&P U.S. Preferred Stock Index reflects a yield of over 120bps higher than U.S. high yield bonds as tracked by the S&P U.S. Issued High Yield Corporate Bond Index.

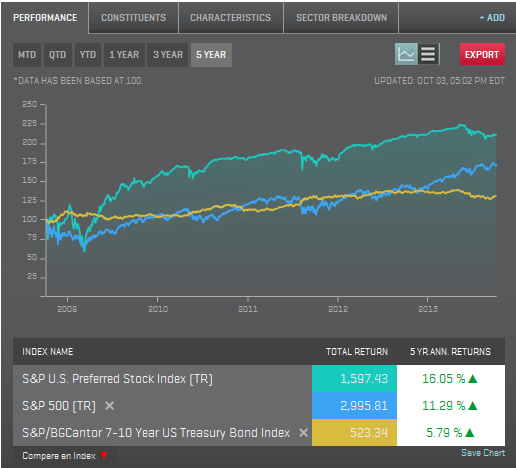

Over the long haul, those higher dividends have helped create a total return advantage over the S&P 500. A five year look back tells the story as the S&P U.S. Preferred Stock Index has returned over 16%, while the S&P 500 returned over 11%.

Which future will it be for U.S. Preferred Stock, Dr. Jekyll or Mr. Hyde?

The posts on this blog are opinions, not advice. Please read our Disclaimers.