As Asian market participants have become more aware of the importance of portfolio diversification, they have been paying more attention to the U.S. corporate bond market. The S&P 500 Bond Index seeks to measure the broad and relatively liquid U.S. corporate bond market, and it is designed to be a corporate-bond counterpart to the iconic S&P 500, widely regarded as the best single gauge of large-cap U.S. equities. In addition to the popularity of the equity index, Asian market participants should be familiar with some of the index constituents like Apple, JPMorgan Chase, Microsoft, and Wal-Mart.

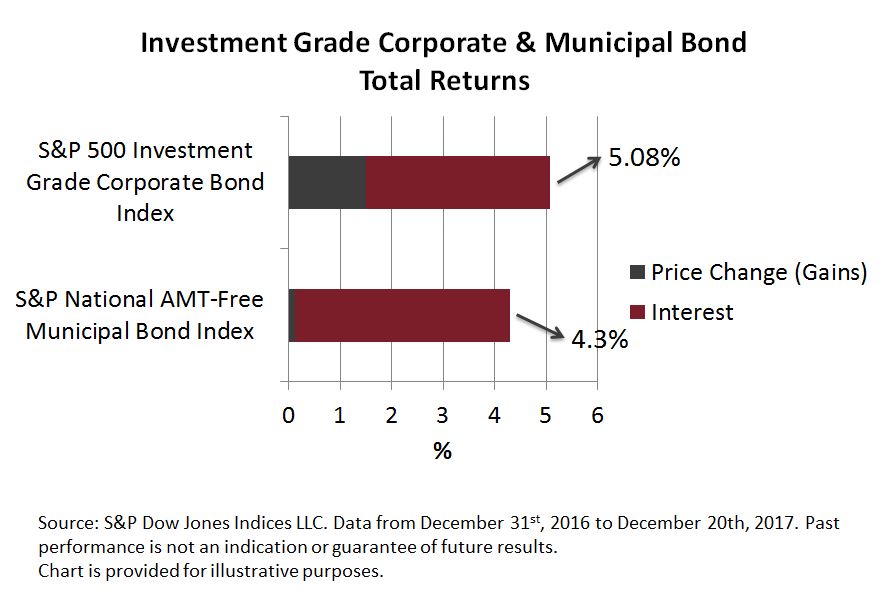

Since 90% of the index is made up of investment-grade debt from blue-chip companies, it can be viewed as a proxy for the U.S. investment-grade bond market. As of Dec. 26, 2017, the index delivered a YTD total return of 5.52%, while its yield-to-maturity tightened 5 bps to 3.32%.

The S&P 500 Bond Index market value is larger than China’s and Japan’s corporate bond markets; it’s even larger than the sum of all Pan Asia local currency corporate bond markets. The S&P 500 Bond Index currently tracks over 5,000 constituents with a combined market value of USD 4.6 trillion.

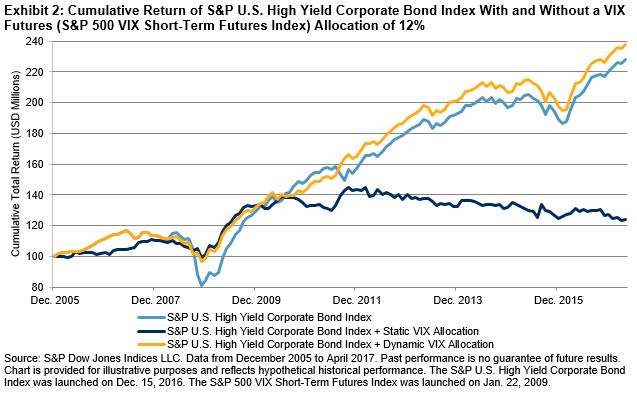

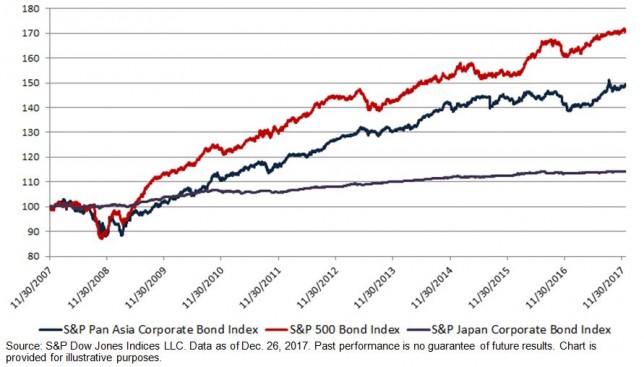

Over the past decade, the S&P 500 Bond Index rose 5.66% annually; it outperformed the S&P Pan Asia Corporate Bond Index and the S&P Japan Corporate Bond Index, which gained 4.15% and 1.36%, respectively, in the same period.

Hence, the S&P 500 Bond Index could offer Asian market participants the benefits of familiarity, good returns, and stable yields.

Exhibit 1: Total Return Comparison of the S&P 500 Bond Index, the S&P Pan Asia Corporate Bond Index, and the S&P Japan Corporate Bond Index

The posts on this blog are opinions, not advice. Please read our Disclaimers.