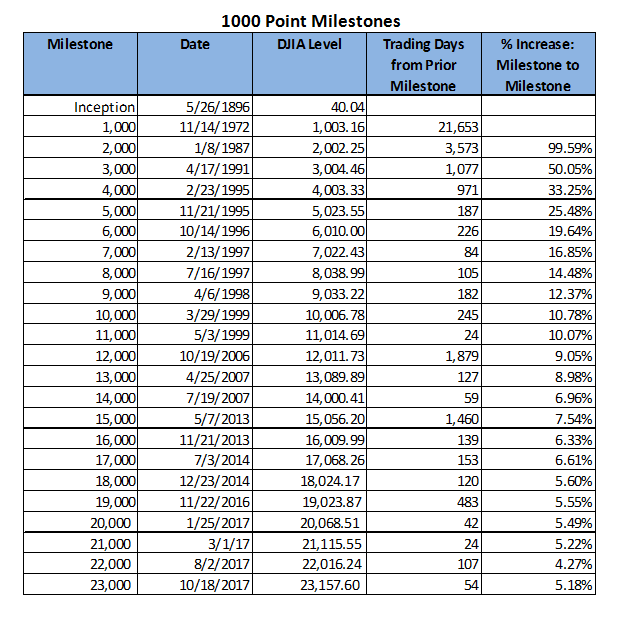

Today, the Dow Jones Industrial Average closed above 23,000 for the first time – offered here are a few factoids associated with that milestone:

- A Record – there have been four (4) 1000 point thresholds crossed in 2017, the most of any year since the DJIA’s inception in 1896.

- Less Impact Per Milestone – of course, as the Average gains in value each 1000 points represents a smaller percentage movement. In this case, the move from 22,000 to 23,000 results in a 5.18% return.

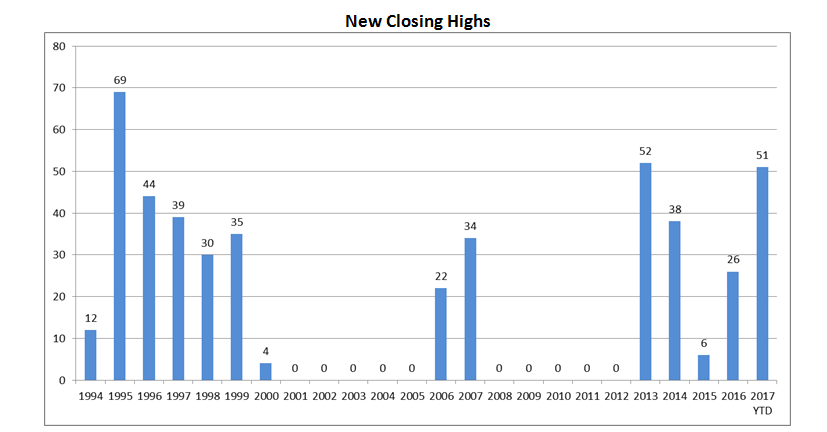

- A Steady Advance – there have been 51 new highs achieved year to date, the most since 2013 when the DJIA struck a new high 52 times. Prior to that, the most new highs were marked in 1995 (69 new highs).