The U.S. corporate and municipal bond markets seem to be neck and neck in total return performance for the first three quarters of 2017. However, there are distinct characteristics of both of these markets that have played a key role and could cause the performance to vary significantly going forward.

The intent of this blog post is to bring top of mind some of the potential drivers of performance in each market.

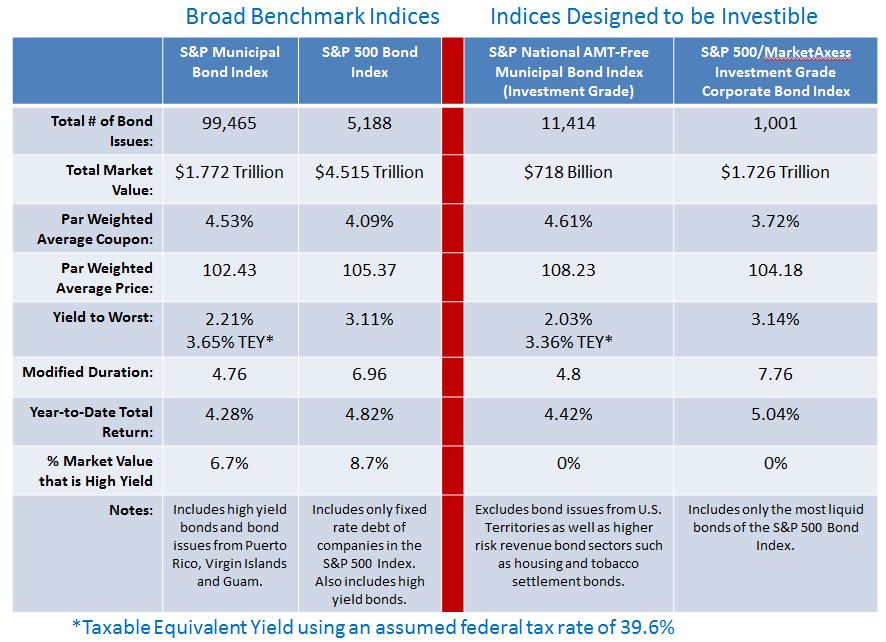

Coupon cash flow: Investment grade, tax-exempt municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index have an average coupon of 4.61% vs. the average coupon of 3.72% of the bonds in the S&P 500/MarketAxess Investment Grade Corporate Bond Index. In a low yield and low expected return environment municipal bonds offer higher interest rate cash flow that is tax-exempt. Advantage: Municipal bonds

Yield: Investment grade tax-exempt municipal bonds on average are yielding 2.03% vs. higher yielding taxable investment grade corporate bonds. However, looking at it from the perspective of Taxable Equivalent Yield (TEY) municipal bonds are currently at higher yields than their corporate bond equivalents. Please refer to table below. Advantage: Municipal bonds

Duration: Investment grade corporate bonds of the issuers of the S&P 500 Index are tracked in the S&P 500/MarketAxess Investment Grade Corporate Bond Index. Their average duration is over 7.75 vs. an average of 4.8 for investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index. In general, in a rising rate environment the lower duration favors municipal bonds. Advantage: Municipal Bonds

Market size: U.S. corporate bonds that are index eligible tend to be very large issues. The market size of the corporate bond market tracked in the S&P 500 Bond Index (broad index) is over $4.5trillion. The broad S&P Municipal Bond Index tracks over $1.77trillion of the $3.8trillion municipal bond market. The larger corporate bond market tends to be more liquid. Advantage : corporate bonds

Diversity & number of bond issues: The nearly 100,000 bond issues tracked in the S&P Municipal Bond Index illustrates that the municipal market has many smaller and less frequent issuers than the corporate bond market. This can result in secondary market liquidity being significantly less for municipal bonds than bonds in the corporate bond market. Municipal bond buyers typically demand a higher yield for this illiquidity – “Liquidity Premium”. Advantage : corporate bonds

New issue supply: Supply of new issue corporate bonds is on a high pace as compared to last year and demand remains strong with many new issues being over-subscribed (more buyers seeking bonds than bonds being sold.) While demand for municipal bonds continues to be extremely strong, new issue supply remains lower than previous years. However, there are some larger municipal bonds on the calendar for sale. Supply is something to keep an eye on for both markets.

Headline risk: Municipal bonds are heavily a retail product and as a result retail sentiment can play a big role in market performance. Real fiscal challenges in both large and small municipalities add to the risk already impacting the market from issuers in Puerto Rico, Illinois and Connecticut. The corporate bond market is currently enjoying a period of lower historical default rates while the municipal bond market is wrestling with the largest default in it’s history – Puerto Rico. Advantage : corporate bonds

Tax code changes: Early days, but the impact of potential tax code changes on both of these markets could be a major factor in performance.

These are some of the factors I keep top of mind to understand the drivers of performance of the corporate and municipal bond markets. As for the future; Bob Dylan once wrote “don’t speak too soon as the wheel’s still in spin” and these are certainly times that are changing.

Table 1: Select bond market indices and their characteristics: