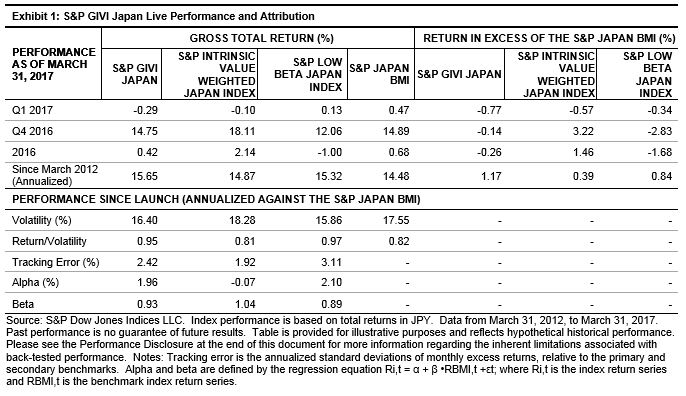

The S&P GIVI (Global Intrinsic Value Index) Japan posted an impressive five-year live track record. It is one of the few multi-factor indices in the market, and it was launched five years ago. Since its launch in March 2012, the S&P GIVI Japan has outperformed its benchmark, the S&P Japan BMI, by 1.17% per year, with a tracking error of 2.42%. There has been a larger contribution from the low beta component (0.84%) than from the intrinsic value component (0.39%). The sequential combination of low beta and intrinsic value appears to have added value. In terms of risk-adjusted performance, the S&P GIVI Japan had a risk-adjusted return of 0.95, versus 0.82 for its benchmark, due to the reduction in volatility. The annualized alpha for the S&P GIVI Japan was 1.96%, with a beta of 0.93 against its benchmark.

Having gone through a major sell-off in the last quarter of 2016, Japanese equities, as measured by the S&P Japan BMI, increased 0.47% in the first quarter of 2017. This was backed by better-than-expected manufacturing and service PMIs; however, a strong Japanese yen remained a major challenge, along with sluggish GDP growth and stagnant inflation. A combination of ongoing economic improvements and higher expectations for profit growth led to a rebound for cyclically sensitive sectors in Japan, such as energy and materials.

The S&P GIVI Japan underperformed its benchmark index by 20 bps in the third quarter of 2016.[1] In the first quarter of 2017, the intrinsic value leg and the low beta leg of the S&P GIVI Japan underperformed the benchmark. The three-year correlation between the excess return of the two legs continued to drop, reaching a low of -0.79.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

What happens to the cumulative returns when the daily returns move in opposite directions? In this case, the magnitude of the returns matters, but not the order. If a market participant were to pursue both strategies, it would likely be a losing proposition in a choppy market. The only way to profit is by picking whether the larger absolute return will be positive or negative and using the standard long index for the larger absolute positive return and the inverse index, which is like a short position, for the larger absolute negative return. If the magnitudes of the opposite consecutive returns are the same, the directional order makes no difference, as shown in the first column of Exhibit 2, and there is a certain loss for both the standard and inverse indices. However, there is a chance to win if opting for only one strategy with a correct bet on the bigger absolute return, regardless of order.

What happens to the cumulative returns when the daily returns move in opposite directions? In this case, the magnitude of the returns matters, but not the order. If a market participant were to pursue both strategies, it would likely be a losing proposition in a choppy market. The only way to profit is by picking whether the larger absolute return will be positive or negative and using the standard long index for the larger absolute positive return and the inverse index, which is like a short position, for the larger absolute negative return. If the magnitudes of the opposite consecutive returns are the same, the directional order makes no difference, as shown in the first column of Exhibit 2, and there is a certain loss for both the standard and inverse indices. However, there is a chance to win if opting for only one strategy with a correct bet on the bigger absolute return, regardless of order. What conclusions can be drawn for 2x leveraged indices when daily returns are compounded? Similar results are observed when comparing the standard indices to the 2x leveraged indices, which double the daily return. The compounded returns when there are two days of consecutive losses or gains show that the 2x leveraged version has a better payoff profile, since it loses less than double the standard index return but gains more than double. If a market participant is sure about commodity trends over time, then the 2x leveraged index may be a winning bet, even if the direction is uncertain.

What conclusions can be drawn for 2x leveraged indices when daily returns are compounded? Similar results are observed when comparing the standard indices to the 2x leveraged indices, which double the daily return. The compounded returns when there are two days of consecutive losses or gains show that the 2x leveraged version has a better payoff profile, since it loses less than double the standard index return but gains more than double. If a market participant is sure about commodity trends over time, then the 2x leveraged index may be a winning bet, even if the direction is uncertain.