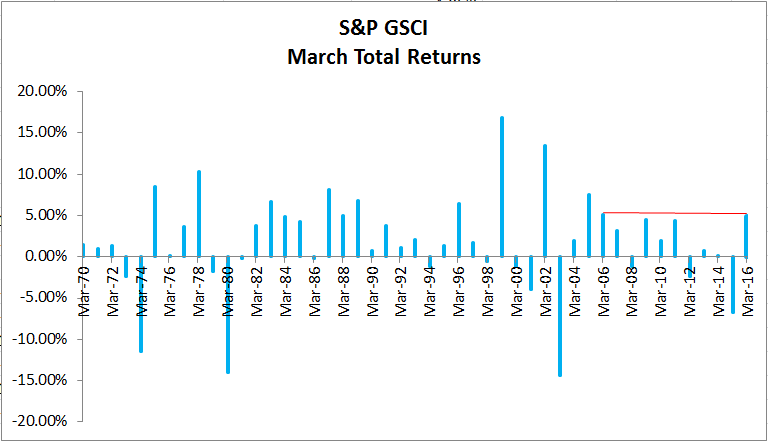

In the first half of March, the S&P GSCI Total Return had added 9.6% and staged its biggest comeback ever, gaining 18.8% from its bottom on Jan. 20, 2016. Unfortunately, the index gave up 4.3% since March 17, 2016, losing about half its March gain. Despite the loss, the index posted its first positive monthly gain of 4.9% (data ending Mar. 30, 2016) since Oct. 2015. March’s commodity return is historically big and is the biggest March since March 2006, when the index gained 5.1%.

All 14 commodities in the Agriculture (8) and Energy (6) sectors in the S&P GSCI TR gained in March. This has not happened since July 2012. In fact, all commodities inside the agriculture sector have never been positive together in any historical March.

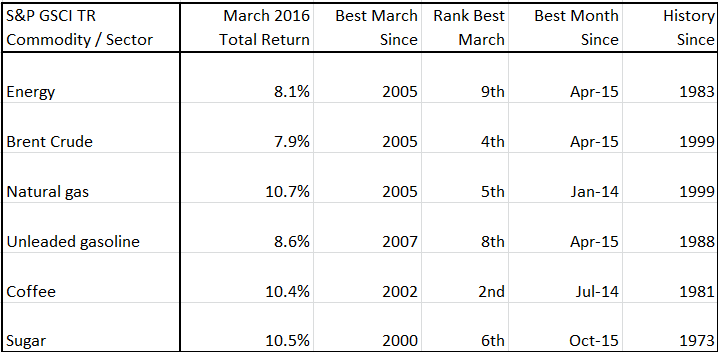

March 2016 has also been a historically big month for the energy sector and some of the constituents inside it, in addition to coffee and sugar. For example, coffee gained 10.4% in March, it was the best March since March 2002 and the second best March since 1981, and the best month since July 2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.