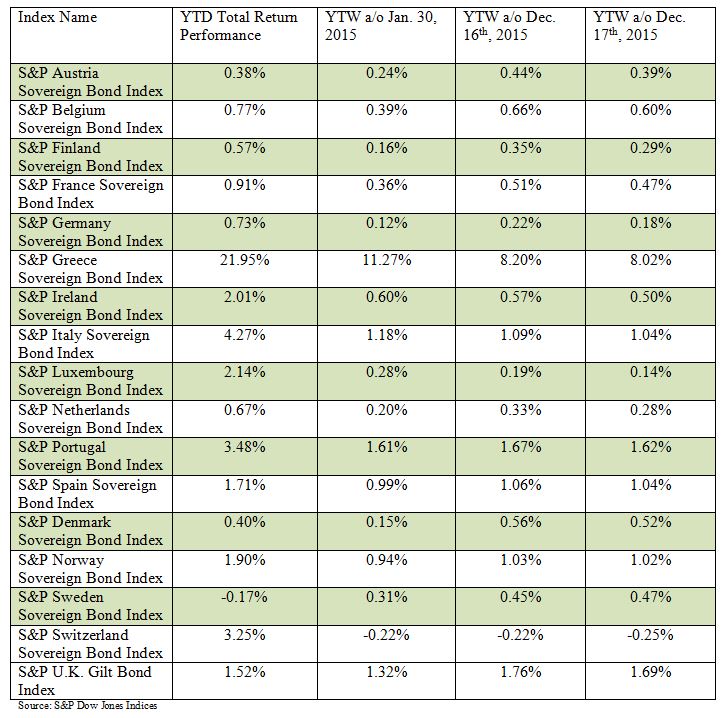

After much anticipation, the US Fed hiked rates 25bps on Wednesday. The US Fed indicated further moves would be dependent on global factors and oil prices – a key detail signifying that future rate hikes seem likely to develop on a slower scale, causing a European government bond market rally on Thursday, sending yields lower in the region. This is quite a different result than earlier this year, when European bond market bonds sold off in fear that a Fed rate hike would lead to a shift away from European government bond markets to the higher yields and high quality of the US government bond market. On Thursday, European government bond market yields moved lower with the S&P U.K. Gilt Bond Index tightening 10bps, the S&P Greece Sovereign Bond Index tightening 18bps, and most other European government bond market yields tightening around 5bps. (See table below).

Performance levels year-to-date vary across Europe. On the higher end, it’s with no surprise that while Greece had a rocky road, high risks are met with high rewards. The S&P Greek Sovereign Bond Index ytd performance is 21.95%. The S&P Italy Sovereign Bond Index ytd return performance is 4.27% and the S&P Portugal Sovereign Bond Index ytd performance is at 3.48%. The S&P Switzerland Sovereign Bond Index comes in at 3.25% performance ytd, while the S&P Germany Sovereign Bond Index has a 0.73% ytd performance.

Since the beginning of the year, yields in the region are largely ending up higher, with a few exceptions. (See table below). 2015 saw considerable volatility with back and forth movement between risk and safety, as well as the launch of the ECB’s QE program. S&P Greece, Ireland, Italy and Luxembourg Sovereign bond indices yields are lower. (See table below).

European bond markets will be keeping a close eye on global factors, as a pick up in the US fed rate hike policy could significantly change Europe’s steady ground, and ultimately hurt a sluggish economy.