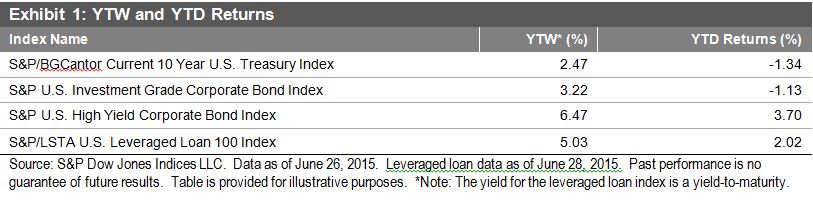

The yield-to-worst (YTW) on the U.S. 10-year Treasury bond, as measured by the S&P/BGCantor Current 10 Year U.S. Treasury Index, increased by 21 bps and ended 34 bps higher. At 2.47%, it appeared the optimism over a Greek settlement was justified. The index has returned -2.90% MTD and -1.94% YTD as of June 26, 2015. The story changed over the weekend, as Prime Minister Alexis Tsipras surprised all by calling a referendum on whether to accept the European terms. The eurozone finance ministers rejected Greece’s request for an extension in order to hold a referendum. As a result, Greek banks have been closed and limiting withdrawals. The YTW of the U.S. 10-year U.S. Treasury bond opened Monday, June 29, 2015, trading at 2.29% as a result of Greece’s news.

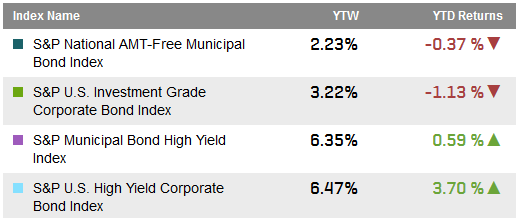

The week’s news affected the S&P U.S. Investment Grade Corporate Bond Index in a similar way, as the YTW rose 13 bps over the week and was 33 bps higher . The index has returned -2.20% MTD and -1.13% YTD as of June 26, 2015.

High yield, as measured by the S&P U.S. High Yield Corporate Bond Index and the S&P/LSTA U.S. Leveraged Loan 100 Index, which represents speculative-grade senior secured bank loans, was less driven by Europe’s news. These indices have returned -1.06% MTD and 3.70% YTD, and -0.61% MTD and 2.02% YTD, respectively, as of June 26 & 28, 2015.

The posts on this blog are opinions, not advice. Please read our Disclaimers.