On June 3, 2015, the PBoC announced the opening of the China onshore repo market; the offshore RMB-clearing and participating banks will be allowed to trade bonds on repos in the onshore interbank bond market. This is an important development for the offshore RMB market, as it will broaden the offshore RMB supply and support further RMB capital account reform.

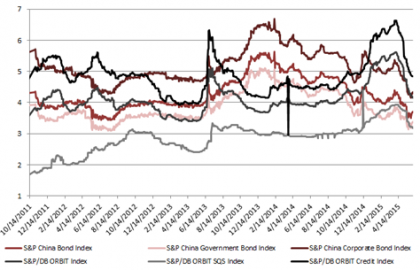

By connecting the onshore and offshore money markets, the difference in interest rates between the two markets is expected to narrow. In fact, if we look at the yield performance of the offshore market, represented by the S&P/DB ORBIT Index, and the onshore market, represented by the S&P China Bond Index, we see that the spread has significantly reduced from 206 bps in early 2014 to 17 bps as of June 3, 2015. The offshore yield has traded above the onshore yield since 2014, on the back of the weakening currency and tightening liquidity in the offshore market. Beyond the convergence, their responses to market conditions have also become more in-sync, particularly during the recent rate cut. It is interesting to note that the correlation between the two yield performances was -0.8 in 2014, whereas in 2015 YTD, it rose to 0.8; this implies that the two markets may be becoming more correlated.

Nevertheless, some differences remain. For example, in the perspective of monetary policy and liquidity, the onshore and offshore RMB money markets have different market dynamics. Additionally, in terms of market structure, some of the issuers in the offshore market are foreign names and a portion of the offshore RMB bonds received international bond-level ratings, whereas the onshore market is dominated by domestic issuers, and they are rated by local ratings agencies only.

Please see the yield chart in Exhibit 1 and index performance in Exhibit 2.