The S&P ESG Index Series is aimed toward those who are looking to incorporate environmental, social, and governance (ESG) considerations into their investment products. These indices seek to provide similar overall industry group weights as their underlying index while simultaneously offering an enhanced ESG profile.

Within the European equities market, the S&P Europe 350 ESG Index is designed to measure the constituents that meet sustainability criteria from the headline S&P Europe 350®, which tracks 16 major European markets and covers approximately 70% of the region’s market capitalization. The S&P Europe 350 ESG Index is a unique strategy, designed for the ESG-conscious investor seeking broad market exposure in Europe through an index that is efficient to replicate.

How Is the S&P Europe 350 ESG Index Constructed?

The first step is to apply exclusions focused on business activities (controversial weapons, tobacco, thermal coal), ESG scores, and United National Global Compact (UNGC) scores. The remaining eligible companies are ordered by S&P DJI ESG Score within their GICS® industry groups, and constituents are selected targeting 75% of the market capitalization in each S&P Europe 350 industry group.

Please see the index methodology for a full breakdown of the index construction rules.

Why Choose the S&P Europe 350 ESG Index?

- The S&P Europe 350 ESG Index utilizes both ESG screens and ESG scores. This is an established methodology that resonates with the European market—almost 70% of the more than USD 4 billion invested in the S&P 500® ESG Index, which uses the same methodology, is invested in products listed in Europe.

- The index uses market-leading S&P Global ESG datasets that are built on a foundation of hundreds of ESG data points collected from public sources, as well as direct company dialogue. Companies are assessed against unique ESG surveys for 61 industries, based on salient ESG risks and opportunities.

- S&P Global Media & Stakeholder Analysis (MSA)—an ongoing ESG controversy monitoring ensures any constituent that experiences a significant ESG incident between rebalances can quickly be removed from the S&P Europe 350 ESG Index.

- The methodology incorporates E&S characteristics (via S&P DJI ESG Scores) and proxies for good governance (i.e., companies with low UNGC scores are excluded and controversies monitoring using the MSA) and therefore potentially aligns with Article 8 of the EU Sustainable Finance Disclosure Regulation.

Why Incorporate S&P DJI ESG Scores?

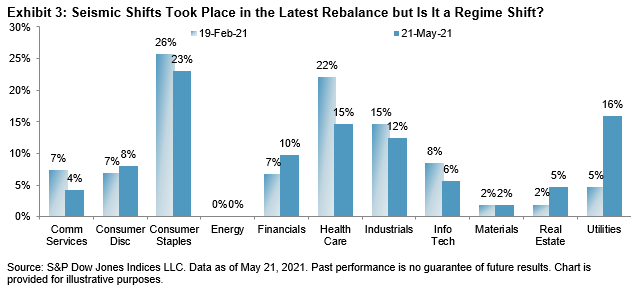

The results of the April 2021 index rebalance emphasize the importance of incorporating S&P DJI ESG Scores into the index methodology. Seven of the top 10 constituent exclusions were due to ESG scores (see Exhibit 1).

For instance, Novo Nordisk has had a deteriorating ESG score over the past few years, decreasing from 98 in 2018 down to a score of 69 in 2020. Notable areas of material weakness for the company are human capital development and innovation management.

The S&P Europe 350 ESG Index had 246 constituents as of April 2021, as companies with low-ESG scores or those companies conducting business activities which are not consistent with ESG norms from the underlying index were excluded. The index offers an improved S&P DJI ESG Score of 6.85%* over the benchmark, as well as a low tracking error of 1.04%. The result is a broad European index that incorporates robust ESG objectives for sustainably conscious investors.

* ESG Score Improvement is calculated as the difference between the index-level ESG score of the ESG index and the index-level ESG score of its underlying index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.