The U.K. has been one of the worst-hit countries in developed markets in terms of dividend cuts in 2020. One in two dividend-paying companies in the S&P United Kingdom BMI have cut dividends, while half of the remaining companies are also expected to cut dividends.1 A tough year indeed for equity income managers, as opportunity to differentiate abates in the near term. This blog explores why this may be so and draws attention to the benefits of indexing under the current environment.

Selection Pool for Dividend Growth Strategies Has Shrunk Significantly

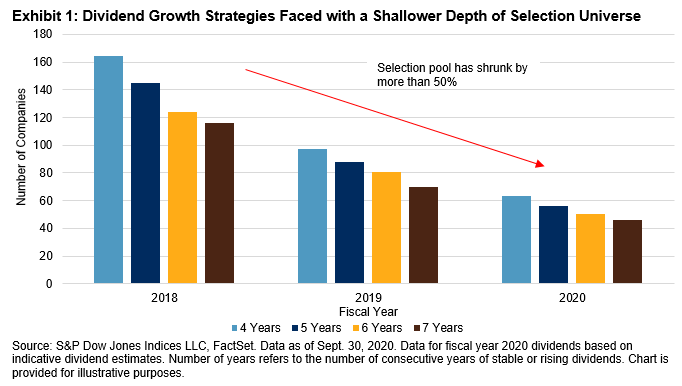

Prior to the pandemic, there were a little over 300 dividend-paying companies within the S&P United Kingdom BMI, but this has now fallen to just under 200. Despite the reduction, this may still appear to be a sizable selection universe for dividend funds. However, the impact could be amplified depending on the type of dividend strategy. For example, a consistent dividend growth strategy would select companies that have maintained stable or growing dividends for a certain number of consecutive years. Exhibit 1 illustrates that the number of such companies has fallen by more than 50% since 2018.2

Dividend Portfolios Could See Convergence in Holdings

At present, approximately GBP 60 billion3 of assets are currently in U.K. dividend-based strategies, mostly in active funds. Many of them may employ dividend growth strategies. The potential implication of a reduced selection pool is an increased likelihood of holdings overlap between these active dividend funds.

While an accurate comparison of holdings between active funds is challenged by inconsistent reporting dates and incomplete disclosures, there were some interesting observations.

Sustainable dividend payers such as GlaxoSmithKline, Phoenix Group, British American Tobacco, Legal & General Group, and RELX were among names found to be commonly present in many of the largest income funds,4 all of which are also present in the S&P UK High Yield Dividend Aristocrats® Index. Intriguingly, the top four active income funds, with combined assets of almost GBP 15 billion, were each also observed to have at least 35%, and an average of 46%, of their respective assets invested in stocks within the S&P UK High Yield Dividend Aristocrats Index,5 a figure that could rise even further.

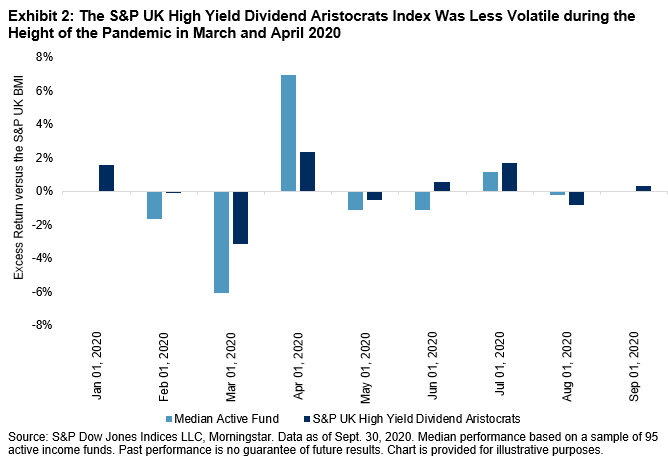

A potential consequence of commonality of dividend portfolios is convergence in performance. Although inconclusive, the performance difference between the median active fund and its passive counterpart, the S&P UK High Yield Dividend Aristocrats Index, has converged to a tighter range in recent months, as shown in Exhibit 2. It is also worth highlighting that the index posted meaningful outperformance of 2.6% YTD as of Sept. 30, 2020.

Diminishing Value of Active Income Funds in Recent Years

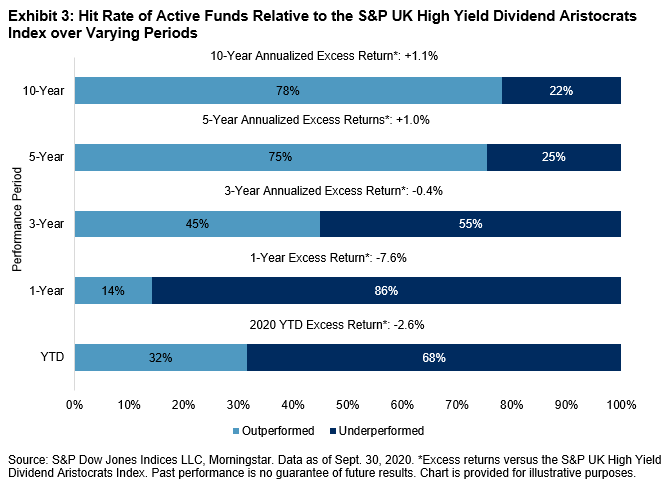

Historically, active manager selection has indeed shown to add value. Exhibit 3 shows that at least 75% of active funds were able to outperform the S&P UK High Yield Dividend Aristocrats Index over the 5- and 10-year periods ending Sept. 30, 2020. However, the tide shifted in recent years, when only 14% of funds outperformed over the past year. Going forward, outperformance may prove to be a greater challenge for the aforementioned reasons.

It is also worth noting that this analysis used gross-of-fees returns and does not include the 1% average management fee imposed by active funds. Thus, on a net-of-fees basis, a large part of the long-term excess returns would have been eroded by fees (see annualized excess returns in Exhibit 3).

Grounds for Hope

Equity income investors choosing to stay the course have reason to take comfort from some of the drivers of dividend cuts. First, unlike the Global Financial Crisis, in 2020 companies acted prudently by pre-emptively cutting dividends to shore up balance sheets. Second, regulatory and political pressure forced many companies to suspend their dividends. Both are reasons to believe that many of these companies may be better positioned to resume dividend payments in the future. In fact, some already have.

A narrower selection pool and relatively higher fees may continue to limit the opportunity for active funds to differentiate, and we highlight their recent underperformance versus an alternative passive income benchmark. As such, the S&P UK High Yield Dividend Aristocrats Index can be a compelling passive solution for capturing U.K. dividends.

1 Based on indicative dividends for fiscal year 2020.

2 Fiscal year 2018, mostly paid in calendar year 2019.

3 Based on a screen of open-ended income funds in Morningstar.

4 Based on holdings data reported by Morningstar.

5 Two funds had last reported holdings on June 30, 2020, and one other only had 50% of holdings (by weight) disclosed.

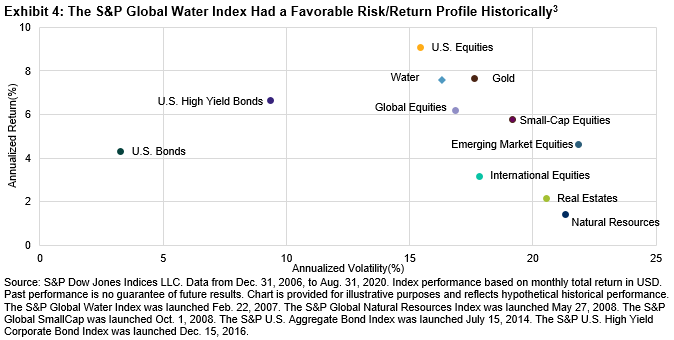

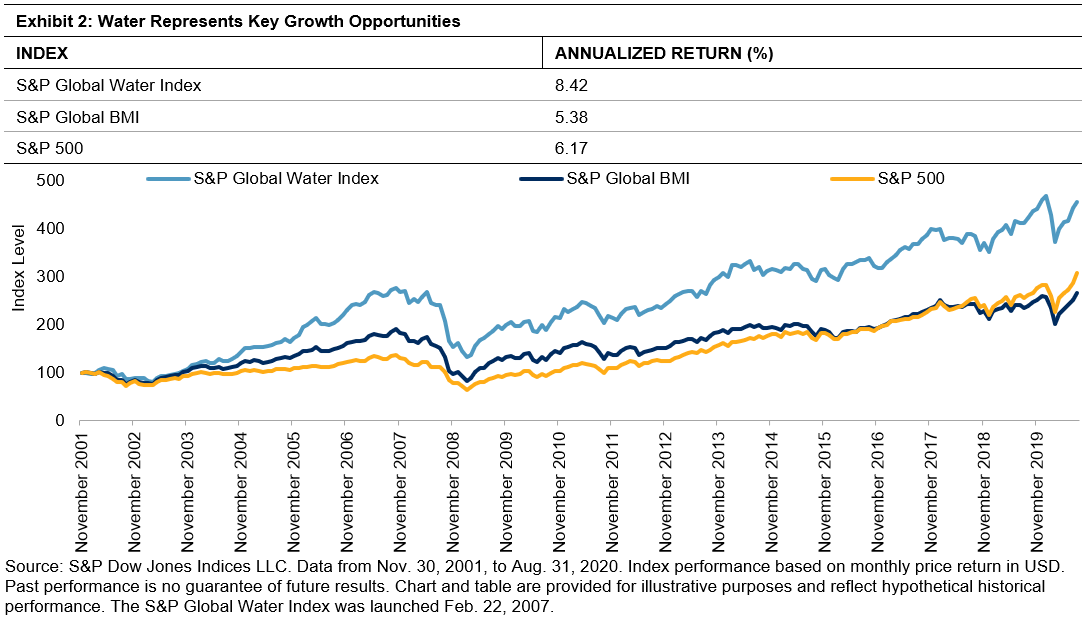

The S&P Global Water Index also provided favorable risk/return characteristics over the long run compared with key traditional asset classes, including real estate, small-cap equities, international equities, emerging market equities, and gold (see Exhibit 4). The favorable long-term risk/return characteristics compared with the

The S&P Global Water Index also provided favorable risk/return characteristics over the long run compared with key traditional asset classes, including real estate, small-cap equities, international equities, emerging market equities, and gold (see Exhibit 4). The favorable long-term risk/return characteristics compared with the