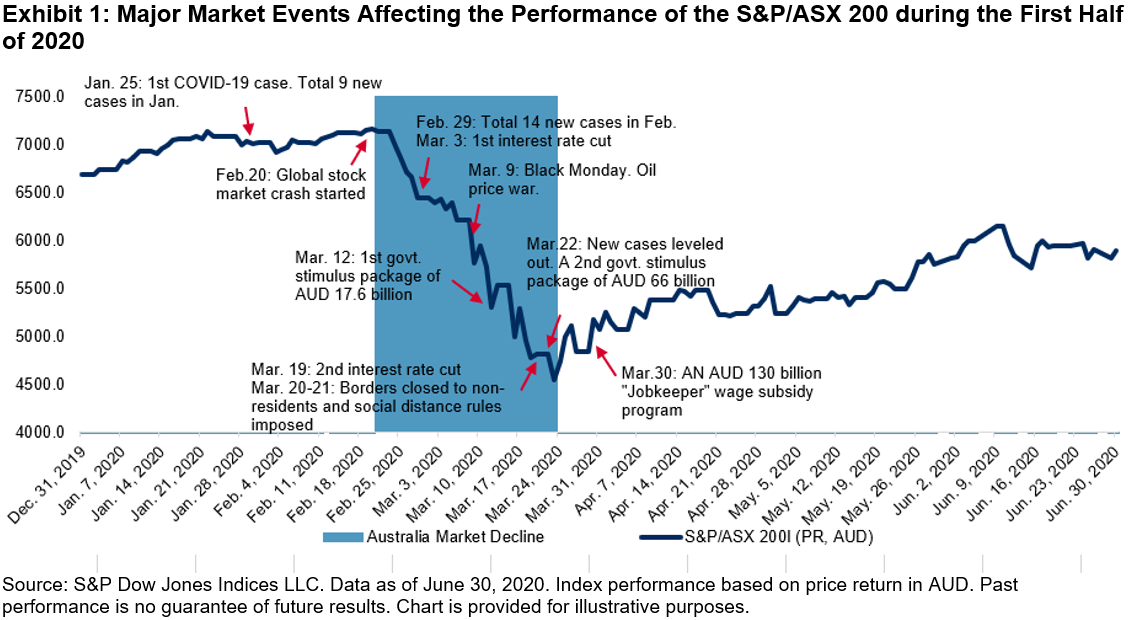

In our paper “How Smart Beta Strategies Work in the Australian Market,” we examined the long-term performance characteristics of S&P DJI’s Australian factor indices in different market trends. In the first half of 2020, the Australian equities market had a roller coaster response to the coronavirus outbreak, global market crash, and government stimulus packages. While most of the factor indices behaved similarly to their long-term performance characteristics, some did not. In this blog, we divided the first six months of 2020 into three time periods based on the varying price trends of the S&P/ASX 200 and reviewed how the Australian factor indices reacted in each of these different periods with the decomposition of their returns based on factor attributions for periods.

Despite the worldwide spread of coronavirus, the Australian equities market gained 7.5% during the period from Dec. 31, 2019, to Feb. 20, 2020, largely supported by the stronger-than-expected economic data. Apart from the S&P/ASX 200 Momentum, which gained 11.3%, the rest of the S&P DJI Australian factor indices underperformed the S&P/ASX 200.

Momentum and quality factors have historically tended to outperform their benchmarks during uptrend markets. According to the factor attribution shown in Exhibit 3, style factors (especially medium-term momentum), industry biases, and stock-specific risk all positively contributed to the S&P/ASX Momentum return and resulted in strong outperformance during this period. For the S&P/ASX 200 Quality Index, despite the positive return impact contributed by style factors, industry biases (overweight in Steel and Insurance and underweight in Banks and REITs) and stock-specific risks were unfavorable for the S&P/ASX Quality Index return, and the index underperformed slightly for the period.

With increasing concerns about the coronavirus outbreak, global recession, and disruption to corporate supply chains and sales, the Australian market experienced a sharp decline starting on Feb. 20, 2020, together with the global stock market crash and oil price decline. Over the period from Feb. 20, 2020, to March 23, 2020, the S&P/ASX 200 dropped 35.9%. According to the factor index research outlined in our paper, quality and low volatility indices tended to outperform while value and small-cap indices tended to lag the benchmark during bearish markets.

During this market decline, most factor indices’ performances tended to align with their long-term characteristics. However, we noticed that the outperformance of the low volatility index was not as pronounced as what we saw in previous market sell-offs. According to the factor attribution, both the style factor exposures and stock-specific risk positively affected the return of the S&P/ASX 200 Low Volatility Index. However, the strong industry bias to REITs (one of the worst-performing industries during this period) severely dragged the index return and eroded the outperformance of the index.

Following a series of health and safety measures (closing borders, imposing social distance rules), interest rate cuts, and government stimulus and subsidy packages, the S&P/ASX 200 started to rebound after touching its lowest point on March 23, 2020. The S&P/ASX 200 posted a gain of 30.1% during the market rally from March 23, 2020, to June 30, 2020. Historically, momentum, quality, and small-cap indices tended to outperform their benchmarks, while value, dividend, and low volatility tended to underperform during bullish markets. However, in this recent rally, the S&P/ASX Quality Index underperformed the S&P/ASX 200 by 3.8% while the S&P/ASX Dividend Opportunities Index outperformed by 2.3%.

For the S&P/ASX 200 Quality Index, the targeted exposures to profitability and leverage, as well as the industry biases, contributed positively to the index return. The unintended exposure to short-term momentum negatively affected the index, resulting in underperformance. For the S&P/ASX Dividend Opportunities Index, the dividend yield and value factors generated negative returns in this period, though the industry biases (underweight in Consumer Staples and REITs; overweight in Metals & Mining [ex-Gold & Steel], Utilities, and Consumer Discretionary) and stock-specific risk contributed positively to the dividend index performance and led to index outperformance.

Overall, the S&P/ASX 200 Momentum and S&P/ASX 200 Quality Index were the best-performing Australian factor indices in the first half of 2020, while the S&P/ASX 200 Enhanced Value performed the worst. Most factor indices aligned with their long-term cyclical characteristics, with a small number of them showing different behavior largely due to industry biases and unintended factor exposures.

The posts on this blog are opinions, not advice. Please read our Disclaimers.