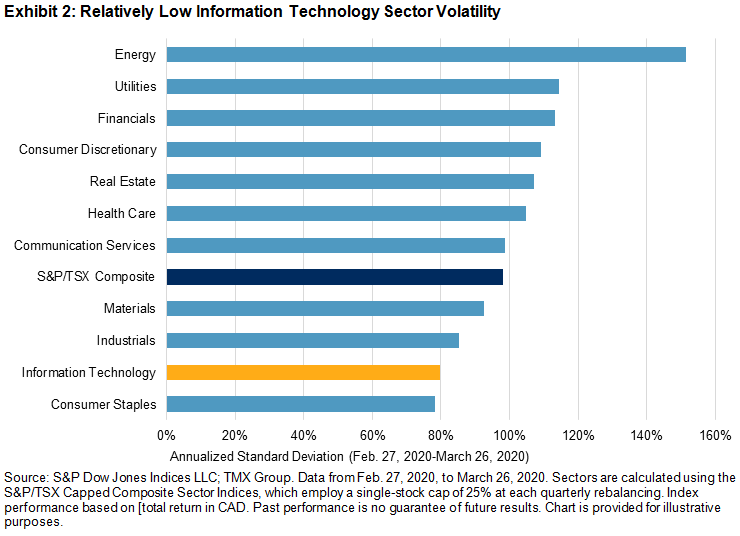

The S&P/TSX Capped Information Technology Index gained a whopping 62% in 2019, topping all other Canadian equity sectors and beating the broad market S&P/TSX Composite by about 40%. Given the traditionally cyclical nature of the Information Technology sector and its outsized gains during the bull market, the sector might be expected to lag during the COVID-19 downturn.

However, Information Technology continued to outperform YTD through March 26, surpassing the traditionally defensive Consumer Staples, Utilities, and Communication Services sectors. In addition, it experienced the second-lowest volatility during the crisis period out of the 11 S&P/TSX Capped Sector Indices.

So, why has Information Technology been so resilient despite a steep market downturn and growing expectations that there will be a historically deep recession? For one, this pandemic-driven economic shutdown will clearly affect industries differently compared with what has played out in past recessions. With consumers and businesses forced to remain home in isolation, many technology-related companies are likely to see increased demand for their services. We are seeing this play out in the U.S. and many other markets, as stock prices of companies in many technology-related areas including e-commerce, software, semiconductors, communications equipment, and others have fared well due to expectations that the world will rely heavily upon these products and services during the pandemic and in the ensuing recovery.

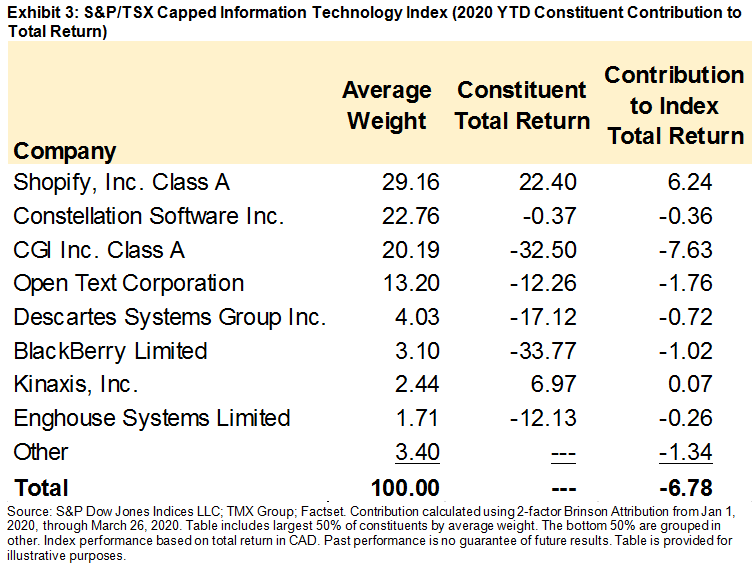

In addition, as most keen Canadian market observers are aware, Shopify, a leading provider of e-commerce software solutions to businesses, is the largest Canadian Information Technology company and has performed well in the recent environment. As Exhibit 3 illustrates, the strength of Shopify has been the largest single driver of S&P/TSX Capped Information Technology Index performance in 2020. However, other large constituents such as Constellation Software, Open Text Corporation, and Kinaxis contributed to the sector outperformance as well.

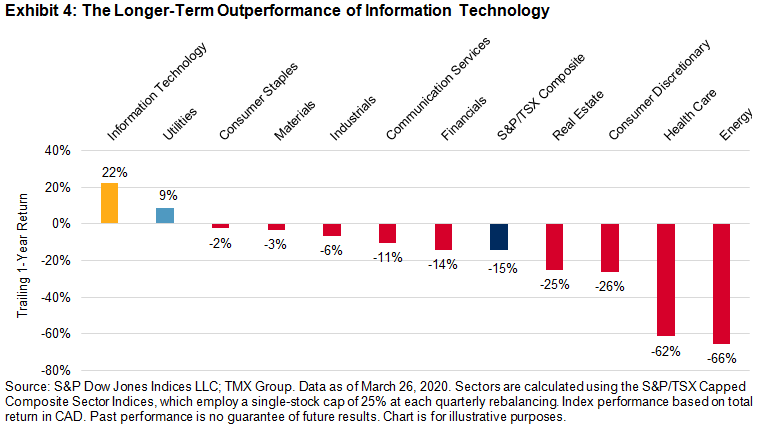

It’s important to recall that the recent relative outperformance of the Information Technology sector is an extension of a longer-term trend. In fact, despite recent declines, the S&P/TSX Capped Information Technology Index remains up 22% over the trailing 12 months, outperforming the S&P/TSX Composite by 37% and easily beating all other sectors.

While the Canadian equity market has fallen sharply during the COVID-19 crisis, there has been wide divergence across equity sectors. Given the sharp decline in oil prices, Energy companies have taken the steepest hit, while Health Care has fallen sharply due to the sector’s unusually large exposure to the cannabis industry. Unsurprisingly, defensive sectors such as Utilities, Consumer Staples, and Communication Services have fared relatively well, along with Information Technology, which has thus far proven to be an unlikely beneficiary from this unique downturn.

The posts on this blog are opinions, not advice. Please read our Disclaimers.