Factor investing in Asia has grown at a rapid pace, with smart beta passive AUM growing at a 42% compound annual growth rate over the past five years, albeit from a relatively lower base.[1] With increasing awareness of climate change and related risks, investors may look to integrate carbon screening into their factor portfolios.

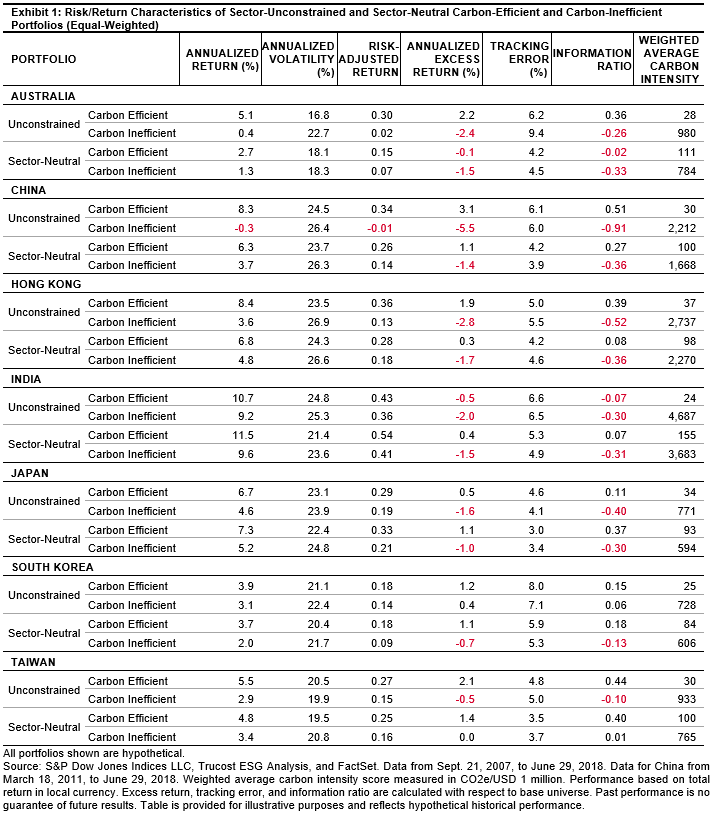

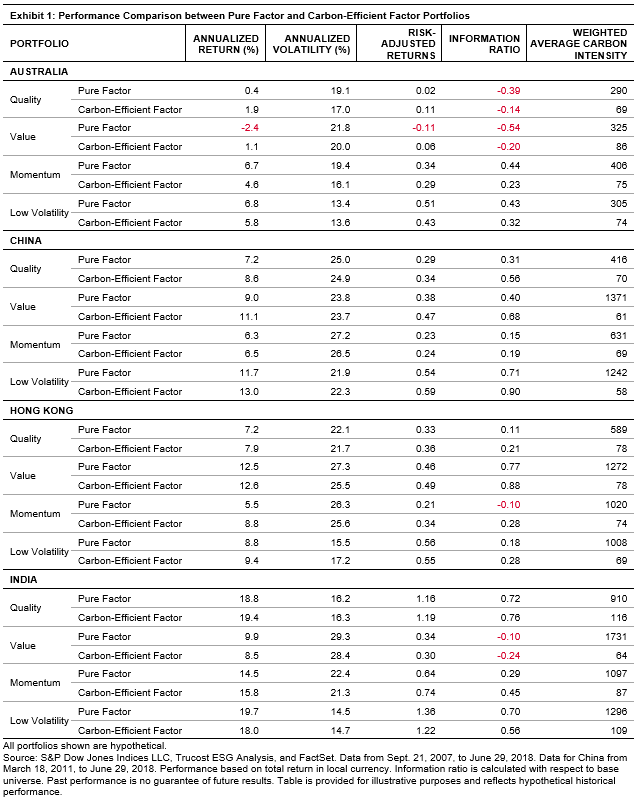

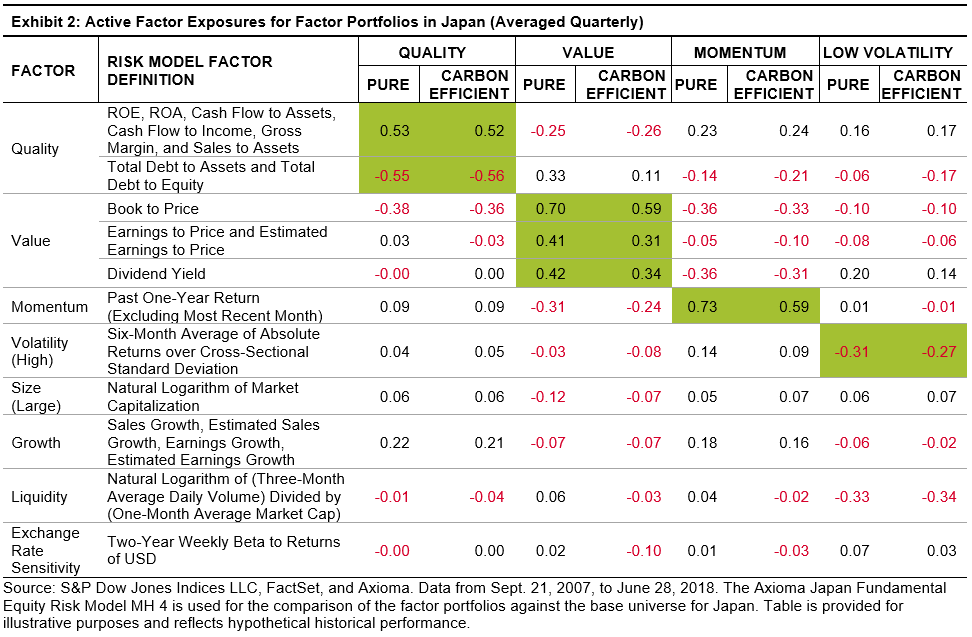

In our research paper, Integrating Low-Carbon and Factor Strategies in Asia, we constructed pure factor portfolios (momentum, value, quality, and low volatility) and studied the impact of carbon screening on these portfolios in seven Asian markets—Australia, China, Hong Kong, India, Japan, South Korea, and Taiwan. The pure factor portfolios were constructed by selecting the top quintile of stocks by factor scores from each market from their respective base universe. The carbon-efficient factor portfolios included the same number of stocks as in their respective pure factor portfolios, but were selected from the carbon-screened universe, from which the 33% of stocks with the highest carbon intensity scores were removed. The pure factor and carbon-efficient portfolios were unconstrained by sectors and were equally weighted. The carbon-efficient screening affected the performance and carbon intensity of each factor portfolio differently (see Exhibit 1).

Overall, the carbon screening resulted in higher carbon intensity reductions to the low volatility and value factors than to the quality and momentum factors across Asian markets. Carbon-efficient screening also improved risk-adjusted returns for the quality, value, and momentum portfolios. In contrast, low volatility factor performance was adversely affected by the carbon-efficient screening.

Additionally, carbon screening resulted in different sector exposures when compared with the pure factor portfolios. For example, compared with the pure quality portfolios, the carbon-screened quality portfolios tended to overweight Financials and Information Technology and underweight Materials and Consumer Staples (except in Australia). On the other hand, compared with the pure value portfolios, the carbon-screened value portfolios tended to overweight Financials and Consumer Discretionary and underweight Materials and Energy. For the momentum and low volatility factors, carbon-efficient factor portfolios tended to overweight Financials and Consumer Discretionary and underweight Materials with respect to pure factor portfolios.

Exhibit 2 shows the active factor exposures (in terms of the number of standard deviations) of the carbon-efficient factor portfolios versus their respective pure factor portfolios in Japan. In most cases, the impact of carbon-efficient screening was modest on the targeted factor exposures. Similar observations were made in other Asian markets. We can conclude from these results that carbon-efficient screening did not result in the loss of targeted active factor exposure.

[1] Banerjee, Alka, “ETFs and the Factor-Based Investing Landscape,” Forum Views: One World One BBF, Vol. 8, Issue 1, pp. 154-156, April 2019.

The posts on this blog are opinions, not advice. Please read our Disclaimers.