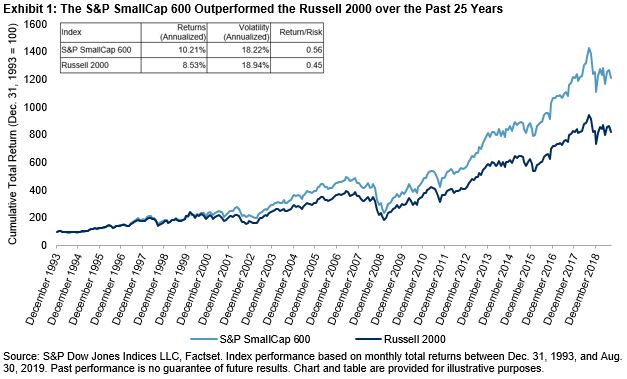

We recently published the 10-year anniversary edition of the paper “A Tale of Two Small-Cap Benchmarks,” which gives insight into why the S&P SmallCap 600® outperformed the Russell 2000, historically.[1] Our latest paper also showed that, in the period from Dec. 31, 2002, to Dec. 31, 2018, profitable companies typically outperformed unprofitable companies in the U.S. small-cap market.[2] Given the S&P SmallCap 600 employs a profitability screen, this blog uses both returns-based and holdings-based factor analyses to gauge the actual impact compared with the Russell 2000.[3]

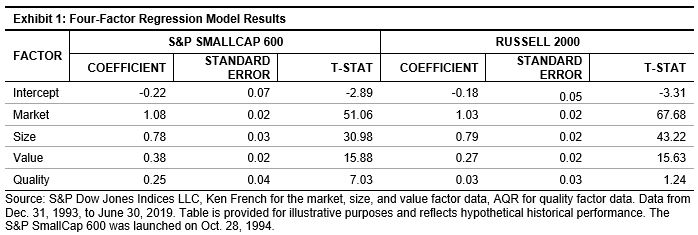

We begin with a returns-based regression analysis,[4] adding a quality factor to the standard Fama-French three-factor (market, size, and value) model. We use profitability as a proxy for quality given it is a key component in measuring quality. Exhibit 1 shows the regression results from the period between Dec. 31, 1993, and June 30, 2019.

Exhibit 1 shows that the two benchmarks had similar exposures to the standard three factors. However, there was a stark contrast in quality factor exposures: the S&P SmallCap 600 had a positive and statistically significant exposure to quality, while the Russell 2000’s near-zero exposure was statistically insignificant. This suggests that the S&P SmallCap 600 benefited by better capturing the quality factor returns, historically.

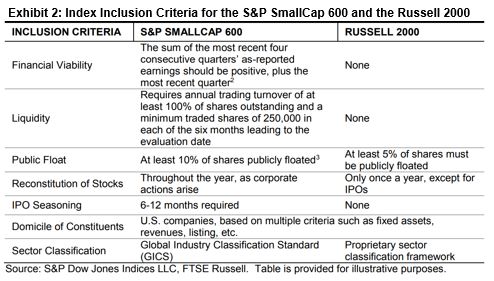

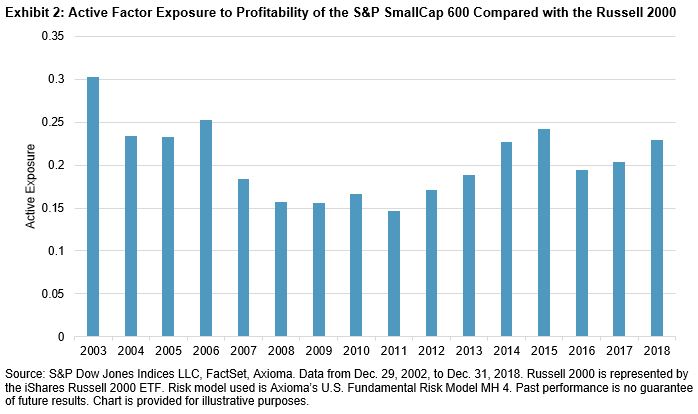

Next, we use a commercial risk model to see the active fundamental factor exposures for the S&P SmallCap 600 compared with the Russell 2000. This method could be considered a more‑robust process in measuring factor exposures since it looks at each benchmark’s holdings instead of relying on return regressions. Exhibit 2 shows the average active exposure of the profitability factor for the S&P SmallCap 600 relative to the Russell 2000 in each of the last 16 years. There is clearly a consistent, positive active exposure to the profitability factor for the S&P SmallCap 600, regardless of market environment.

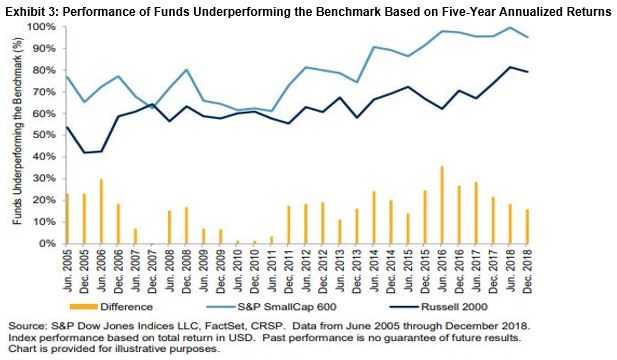

Exhibit 3 gives a summary of average annual active exposures and factor returns of all factors in the model. The last column shows the impact—or excess return—attributable to each factor, calculated as the product of the active exposure and factor return.

Out of all factors in the model, the S&P SmallCap 600 had the highest tilt toward the profitability factor, and this positive tilt contributed to its outperformance over the Russell 2000; the compounded impact attributable to the profitability factor is approximately 0.71% on an average annualized basis.

As a result, the S&P SmallCap 600’s profitability requirement resulted in a positive quality tilt relative to the Russell 2000. This tilt played a material role in explaining the long-term outperformance of the S&P SmallCap 600.

For more information, check out our research paper “A Tale of Two Small-Cap Benchmarks: 10 Years Later.”

[1] Also see our previous blog, “Index Construction Matters in U.S. SmallCap,” by Aye Soe.

[2] See Exhibit 7 in A Tale of Two Small-Cap Benchmarks: 10 Years Later for more details.

[3] See Exhibit 3 in A Tale of Two Small-Cap Benchmarks: 10 Years Later for more details.

[4] See Exhibit 14 in A Tale of Two Small-Cap Benchmarks: 10 Years Later for more details.

The posts on this blog are opinions, not advice. Please read our Disclaimers.