For corporate bond managers, credit analysis is a key step in the investment process, one that lays the foundation for their credit outlook and investment strategies. Credit analysis assesses bond issuers’ creditworthiness and evaluates their ability to make timely interest and principal payments. Credit analysis is critical in helping bond managers assess the state of the credit cycle we are in, select bonds of healthy credit quality, and avoid names that could potentially suffer large principal loss. The analysis includes qualitative and quantitative components. On the quantitative side, credit ratios that measure leverage, interest coverage, liquidity, and profitability allow for the evaluation of a bond issuer’s financial risk profile.

Can we incorporate credit analysis into a rules-based methodology to capture some of the alpha and/or mitigate credit risk generated by active portfolio management? Credit ratio analysis, being quantitative, offers such an opportunity. To do so, we propose a rules-based model that uses credit ratios to screen out the least creditworthy issuers, thereby constructing a corporate bond portfolio with strong credit quality. We acknowledge that ratio analysis is only one part of credit analysis, and though necessary, it is not sufficient to assess an issuer’s creditworthiness. Therefore, instead of actively selecting companies with healthy ratios, we seek to use credit ratios to screen out companies at the bottom of the ranks, indicating financial stress.

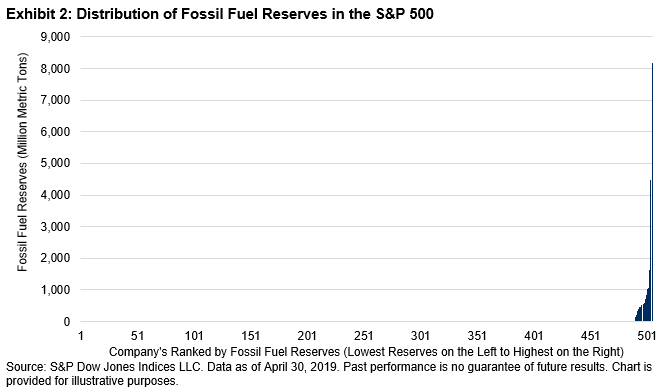

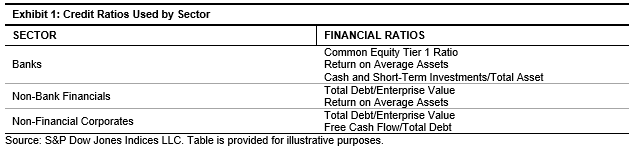

The methodology involves two steps. First, we construct a representative investable universe from the broad investment-grade and high-yield corporate bond universe, respectively, by applying criteria on bond size (minimum size of USD 750 million for investment grade and USD 400 million for high yield), maturity (2 years-10.5 years), and spread duration (greater than or equal to 1). In line with the objective of constructing a quality credit portfolio for the high-yield universe, we exclude bonds with a credit rating below “B-.” Second, we group bond issuers by sector (banks, non-bank financials, and non-financial corporates), and use a set of sector-specific credit ratios on leverage, interest coverage, liquidity, and profitability to rank issuers within sectors (see Exhibit 1).

For the applicable ratio within each sector, we calculate a trimmed z-score for every issuer and then standardize the scores within the sector. We rank issuers by the average of the standardized z-scores within their respective sector. The bottom 20% of issuers in each sector are then screened out. The remaining issuers are equally weighted, and bonds issued by the same issuer are equally weighted in the portfolio. The portfolio rebalances quarterly at the end of February, May, August, and November each year.

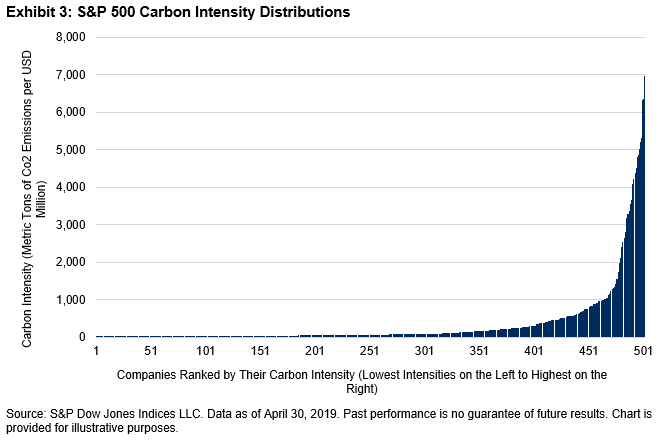

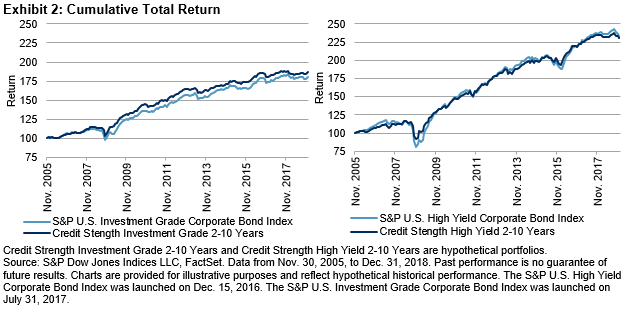

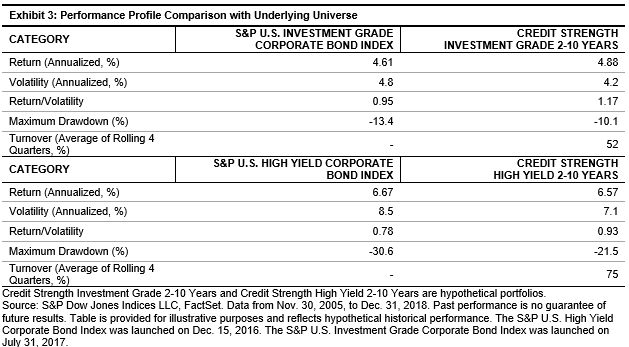

Exhibits 2 and 3 compare the back-tested performance of the credit strength portfolios with the underlying broad market indices. For investment-grade and high-yield bonds, credit strength portfolios reduced return volatility and improved risk-adjusted returns. The maximum drawdown was lower than the underlying universes during market downturns.

Exhibits 2 and 3 compare the back-tested performance of the credit strength portfolios with the underlying broad market indices. For investment-grade and high-yield bonds, credit strength portfolios reduced return volatility and improved risk-adjusted returns. The maximum drawdown was lower than the underlying universes during market downturns.

The back test shows that incorporating credit ratio analysis in a rules-based portfolio construction process resulted in potentially more desirable risk/return characteristics for investment-grade and high-yield corporate bonds. In our next blog, we will further explore the benefits of downside protection and sector diversification that the credit strength strategy offers.

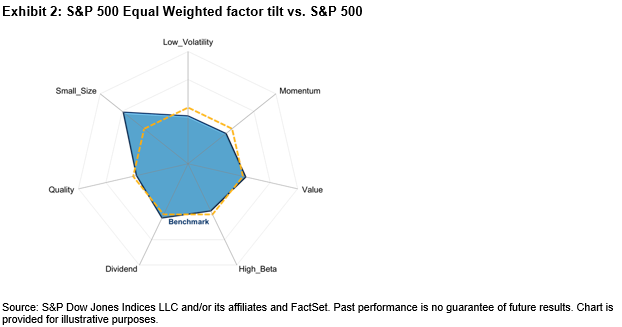

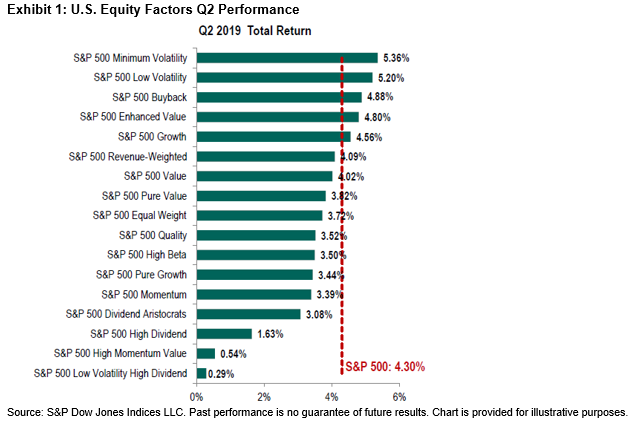

Equal Weight is a particularly good illustration of the small-size effect, since it holds the same stocks as the cap-weighted S&P 500. Exhibit 2’s factor exposure chart makes Equal Weight’s small cap tilt clear. Given

Equal Weight is a particularly good illustration of the small-size effect, since it holds the same stocks as the cap-weighted S&P 500. Exhibit 2’s factor exposure chart makes Equal Weight’s small cap tilt clear. Given