Dividends and stock buybacks are two ways that a company returns capital to its shareholders. Investors can benefit from both, but is there a synergy that can result from combining them?

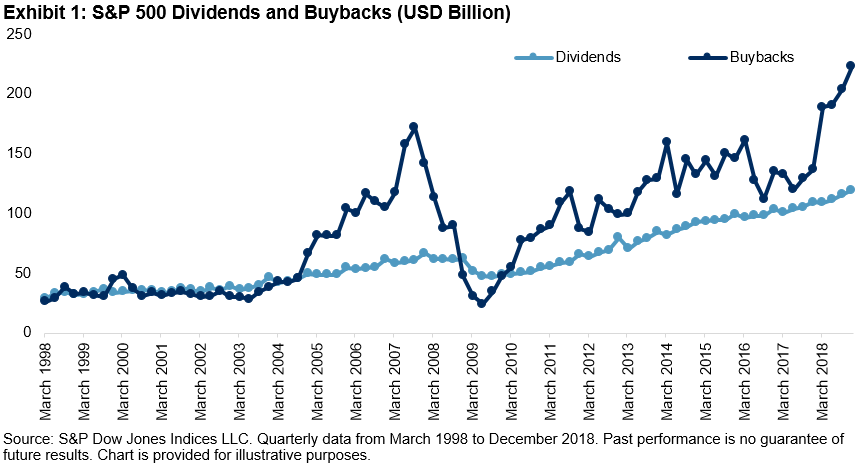

We’ve seen a surge in both buyback value and the number of participating companies in recent years. In 2018, 444 of S&P 500® companies spent USD 806 billion on buybacks.[1] Additionally, more dividend-growing companies have begun repurchasing shares while consistently increasing dividend distribution. Exhibit 1 shows this trend in the S&P 500 Dividend Aristocrats®.

To evaluate the two forms of shareholder payouts, we compared dividend yield[2] and buybackyield[3] (see Exhibit 2). Buyback yield was significantly lower than dividend yield before 2003 and became quite unstable until the end of the financial crisis. From then on, buyback yield surpassed dividend yield.

Choosing between dividends and share repurchases is a contentious debate. Income-oriented investors may prefer dividends, while growth-oriented investors may desire the capital appreciation that buybacks bring. Although either payout strategy can benefit investors over time, an alternative and holistic strategy would be to integrate the two.

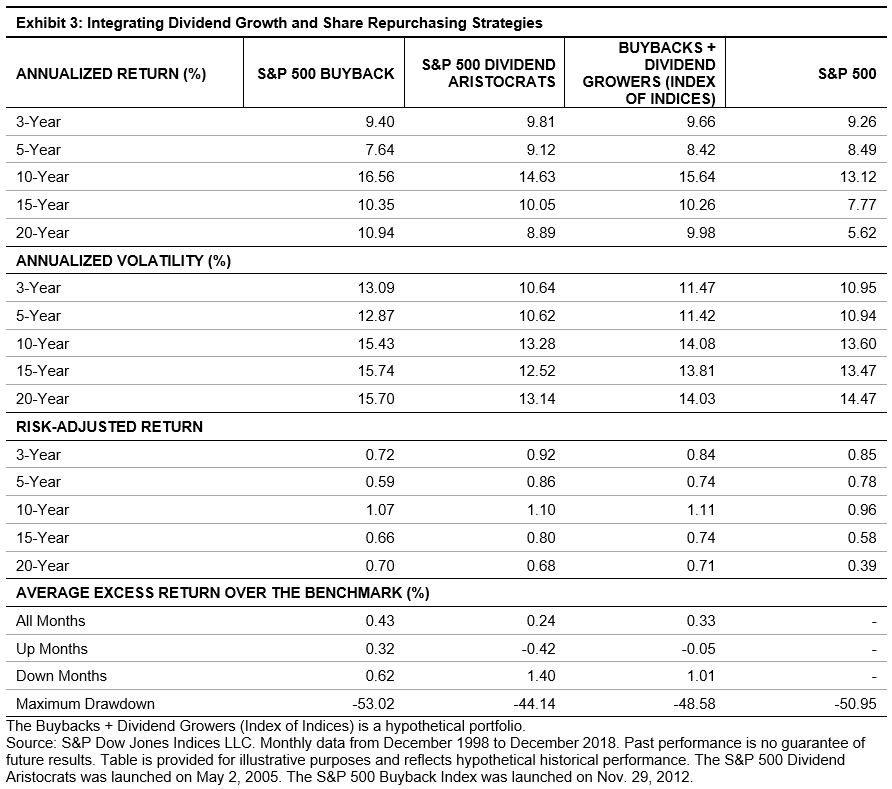

Using the S&P 500 Buyback Index[4] and the S&P 500 Dividend Aristocrats,[5] we formed a hypothetical portfolio of companies with sustainable dividend yield and high buyback yield. The hypothetical index of indices approach is a simple guideline because there is a possibility of overlap between the two strategies. However, we find that overlap between the two indices is fairly low—6.4% on average when measuring on a quarterly basis from December 1998 to December 2018. The combined strategy does indeed display the highest risk-adjusted return over the long-term investment horizon (see Exhibit 3), indicating that investors could benefit from integrating both factors.

[1] “S&P 500 Q4 2018 Buybacks Set 4th Consecutive Quarterly Record at $223 Billion,” S&P Dow Jones Indices.

[2] Dividend yield is the annual dividend amount relative to the market value.

[3] Buyback yield is the stock buyback value relative to the market value.

[4] The S&P 500 Buyback Index is designed to measure the performance of the top 100 stocks with the highest buyback ratios in the S&P 500. For more information, please visit https://spindices.com/indices/strategy/sp-500-buyback-index.

[5] The S&P 500 Dividend Aristocrats is designed to measure the performance of S&P 500 companies that have increased dividends every year for the last 25 consecutive years. As of March 29, 2019, the index contains 57 issues. For more information, please visit https://spindices.com/indices/strategy/sp-500-dividend-aristocrats.

The posts on this blog are opinions, not advice. Please read our Disclaimers.