On Nov. 8, 2016, Mr. Narendra Modi came on national television and announced that at the stroke of midnight, 500 and 1,000 rupee notes would no longer be legal tender. These notes constituted 86% of the total currency in circulation. This announcement was by far one of the boldest economic decisions taken in recent years. The rationale for this unexpected decision was to remove counterfeit currency notes from the system, end the parallel black market economy, and digitize the Indian economy.

One year later, the topic of demonetization is still being discussed and debated across the length and breadth of India. While many support this bold move, there are others who criticize it. Wherever this debate goes, it’s easy to see that capital markets in India have been on a roll over the past year and have given exponential returns across size, segments, and sectors.

In this blog, we will analyze how capital markets in India have performed since the demonetization announcement was made in November 2016.

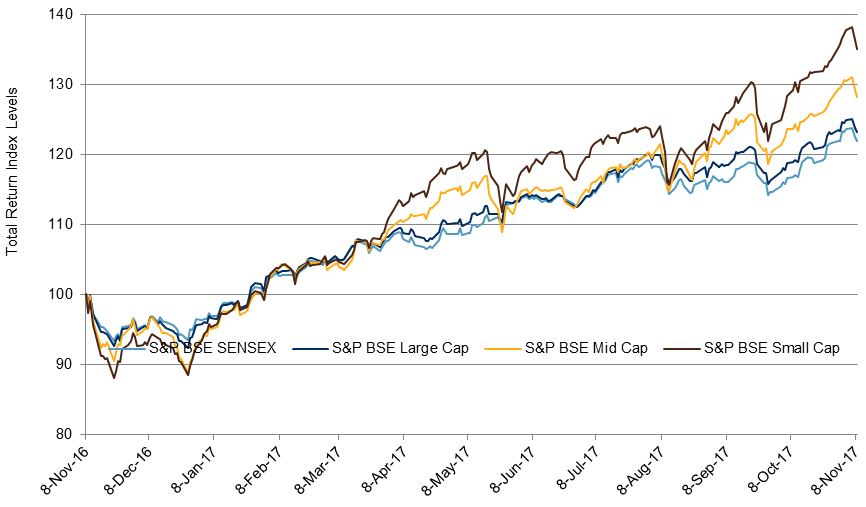

Exhibit 1 and Exhibit 2 showcase the one–year, post-demonetization returns for the four leading size indices in India.

| Exhibit 1: One-Year Absolute Returns of Size Indices | |||

| INDEX | INDEX VALUE ON NOV. 08, 2016 | INDEX VALUE ON NOV. 08, 2017 | ONE-YEAR ABSOLUTE RETURN (%) |

| S&P BSE SENSEX | 38829 | 47355 | 21.96 |

| S&P BSE Large Cap | 3875 | 4773 | 23.19 |

| S&P BSE Mid Cap | 15010 | 19239 | 28.17 |

| S&P BSE Small Cap | 15093 | 20384 | 35.05 |

Source: S&P Dow Jones Indices LLC. Data from Nov. 8, 2016, to Nov. 8, 2017. Past performance is no guarantee of future results. Table is provided for illustrative purposes.

Exhibit 2: Index Total Returns

Source: S&P Dow Jones Indices LLC. Data from Nov. 8, 2016, to Nov. 8, 2017. Index performance based on total return in INR. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

From Exhibits 1 and 2, we can see that all four indices have given high returns. Returns have been promising for large-, mid-, and small-cap segments. The returns of the small- and mid-cap segments have been better than the large-cap segment. The S&P BSE SmallCap and S&P BSE MidCap gave one-year absolute returns of 35.05% and 28.17%, respectively, while the S&P BSE LargeCap and S&P BSE SENSEX gave returns of 23.19% and 21.96%, respectively.

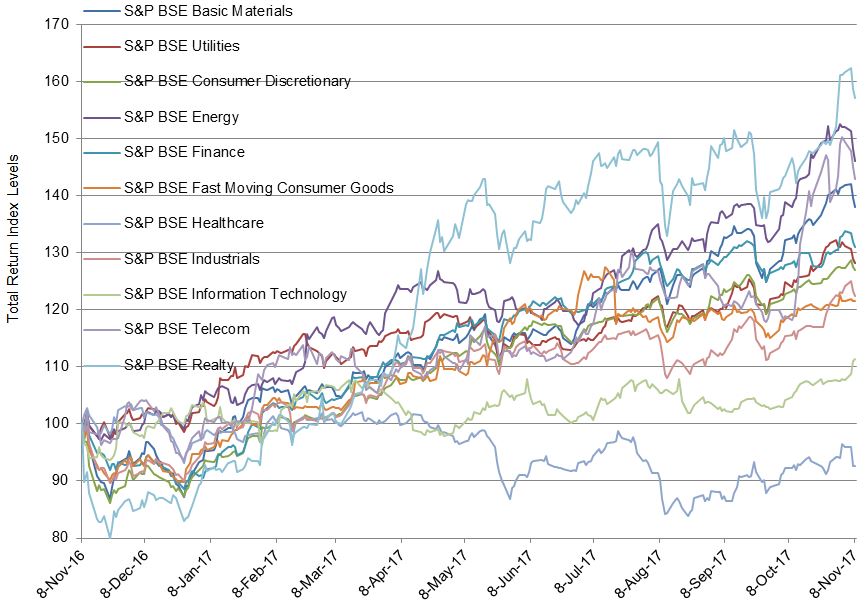

Exhibits 3 and 4 showcase the one-year, post-demonetization returns for the 11 leading sector indices in India.

| Exhibit 3: One-Year Absolute Returns in Sector Indices | |||

| INDEX | INDEX VALUE ON NOV. 08, 2016 | INDEX VALUE ON NOV. 08, 2017 | ONE- YEAR ABSOLUTE RETURN (%) |

| S&P BSE Realty | 1,585.00 | 2,489.31 | 57.05 |

| S&P BSE Energy | 3,566.92 | 5,208.17 | 46.01 |

| S&P BSE Telecom | 1,204.51 | 1,721.65 | 42.93 |

| S&P BSE Basic Materials | 2,983.78 | 4,118.34 | 38.02 |

| S&P BSE Finance | 5,213.94 | 6,828.34 | 30.96 |

| S&P BSE Utilities | 2,070.98 | 2,653.96 | 28.15 |

| S&P BSE Consumer Discretionary | 3,624.96 | 4,605.44 | 27.05 |

| S&P BSE Industrials | 3,423.10 | 4,187.83 | 22.34 |

| S&P BSE Fast Moving Consumer Goods | 10,524.51 | 12,784.46 | 21.47 |

| S&P BSE Information Technology | 11,837.65 | 13,186.50 | 11.39 |

| S&P BSE Healthcare | 16,696.51 | 15,454.32 | -7.44 |

Source: S&P Dow Jones Indices LLC. Data from Nov. 8, 2016, to Nov. 8, 2017. Past performance is no guarantee of future results. Table is provided for illustrative purposes.

Exhibit 4: Index Total Returns

Source: S&P Dow Jones Indices LLC. Data from Nov. 8, 2016, to Nov. 8, 2017. Index performance based on total return in INR. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

From Exhibits 3 and 4, we can see that barring one index, all sector indices have given positive returns. The S&P BSE Realty gave the best one-year absolute return of 57.05%, followed by the S&P BSE Energy and S&P BSE Telecom, which had one-year absolute returns of 46.01% and 42.93%, respectively. The S&P BSE Healthcare was the worst-performing index, with a return of -7.44%.

To summarize, we can say that the bulls have had their way during the 12-year period since the announcement of demonetization was made, and indices across various size segments and sectors have given exponential returns.

The posts on this blog are opinions, not advice. Please read our Disclaimers.