President Trump said he will make an announcement during the week of Oct. 30, 2017, regarding his nomination for who will replace Chairwoman Janet Yellen when her term ends in January 2018. Most reports suggest current Fed Governor Jerome Powell will get the nod over Stanford University economics Professor John Taylor. Mr. Taylor could still be named to the role of vice chair; however, an announcement on that position is weeks away. While Mr. Taylor would most likely provide a more hawkish influence, Mr. Powell offers a status quo approach from a monetary policy perspective. The FOMC continues to communicate its intentions to gradually raise interest rates and normalize its balance sheet while working in a low unemployment, low inflationary environment.

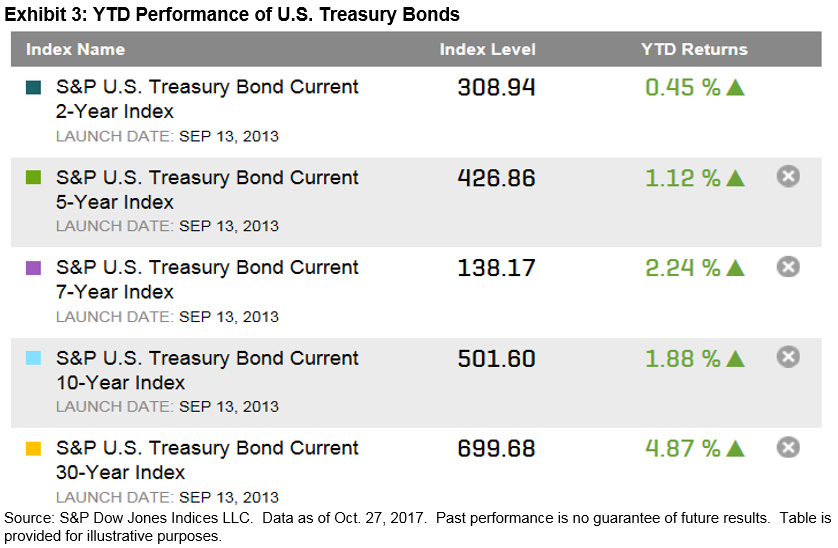

Nearly two years into the current (albeit slow) tightening cycle, the bond market continues to question the prospects for long-term growth. On Dec. 15, 2015, the Fed raised its rates for the first time since 2005. Since then, there have been three more rate hikes, for a total of 100 bps. The two-year yield has increased 115 bps (see Exhibit 1), however the long end of the curve has fallen, producing a much flatter yield curve. The yield on the 30-year on-the-run bond is actually 17 bps tighter than it was in October 2015 despite the lift in short-term rates.

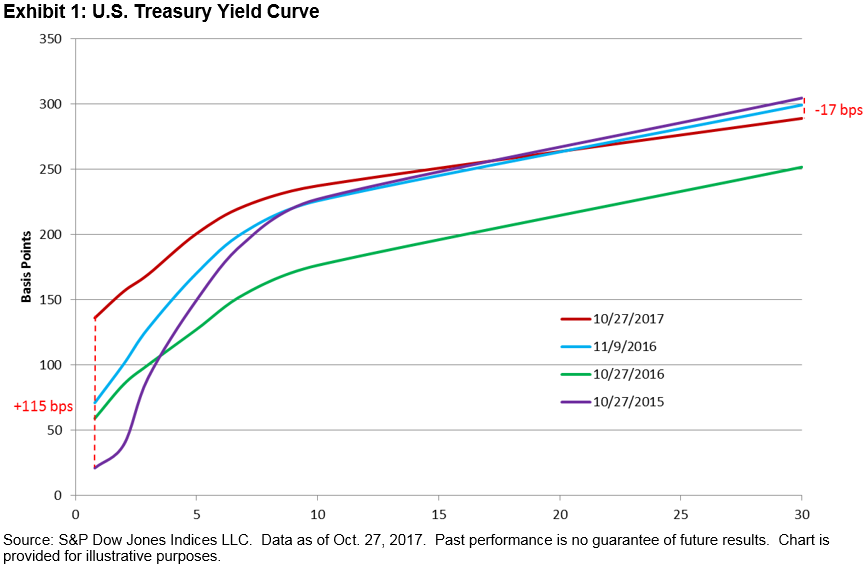

Using the series of S&P U.S. Treasury Bond Current Indices, which is a series of security indices that seek to measure the most recently issued bond for each maturity, we can view yield spreads between key maturity ranges of the yield curve (see Exhibit 2). In normal economic times, spreads between longer-dated maturities and shorter-dated maturities should be positive, representing a combination of positive growth expectations, positive inflation expectations and, in general, an indication of stable or improving economic conditions. Conversely, spreads that are contracting may indicate market anticipation of slowing growth, slowing inflation, or worsening economic conditions.

Almost every segment of the yield curve is flatter now than at any time over the past 10-year period (see Exhibit 2). The 2/30 spread, which represents the majority of the total yield curve, has experienced the greatest amount of flattening and was 270 bps tighter as of October 2017 than its high point in January 2011.

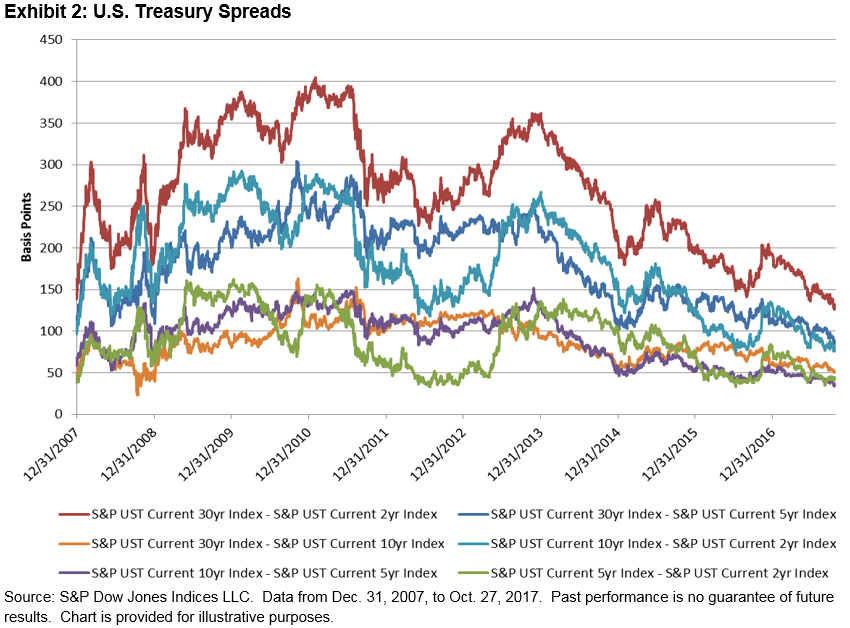

As a result of the overall flattening, U.S. Treasury bonds have performed well in 2017 (see Exhibit 3). Each of the 2-, 5-, 7-, 10-, and 30-year current indices had positive YTD performance, with the S&P U.S. Treasury Bond Current 30-Year Index returning 4.87% as of Oct. 27, 2017.