We publish a series of dashboards at the end of each month to summarize market performance in a number of regions. These dashboards include monthly reports on Risk and Volatility, as well as Factor Dashboards for the U.S. and for Europe on a quarterly basis. With June behind us, a half-yearly summary is in order. Highlighted below are two key themes and trends that have emerged in Europe during the first two quarters of 2017.

The French election caused concern, but the Centrist was mightier than Le Pen.

There were significant elections in Europe during the past six months. Those in the Netherlands and (especially) in France were seen as barometers for Euroscepticism on the continent. They also allowed investors to see whether there would be a continuation of the trend towards economic nationalism and populism that has been observed in various countries globally.

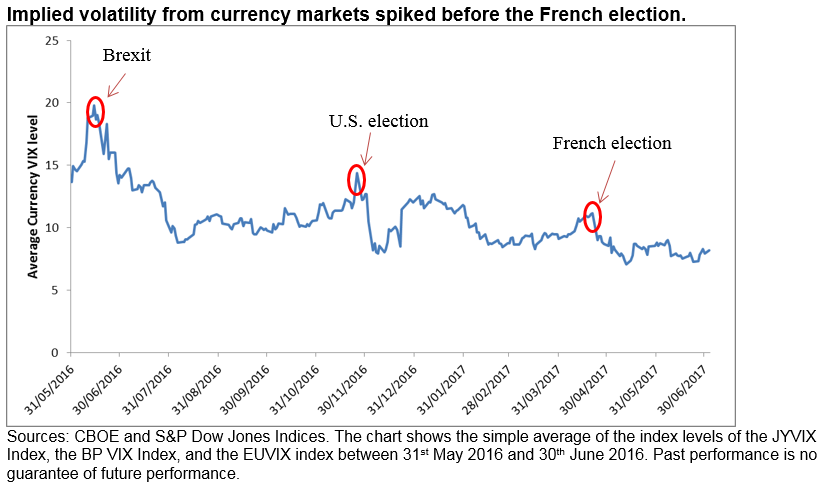

Following the surprise results in several votes in 2016, many investors had come to treat polling data with some suspicion. The possibility of ‘Frexit’ in the event of a victory for Marine Le Pen’s National Front heightened the tension. This nervousness over the outcome of the elections and focus on political risk can be observed in the implied volatility of the currency markets. Taking the average of three such measures – the CBOE/CME FX Yen Volatility IndexSM, the CBOE/CME FX British Pound Volatility IndexSM, and the CBOE EuroCurrency Volatility Index – it is clear that investors’ volatility expectations for the three currency markets have trended downwards over the past year. Nevertheless, there was an increase in average volatility expectations for the three currencies leading up to the French election and a fall once the outcome was observed. We could also observe this pattern around the time of the U.K. Brexit referendum and the U.S. general election.

Brexit weighed on equity market performance

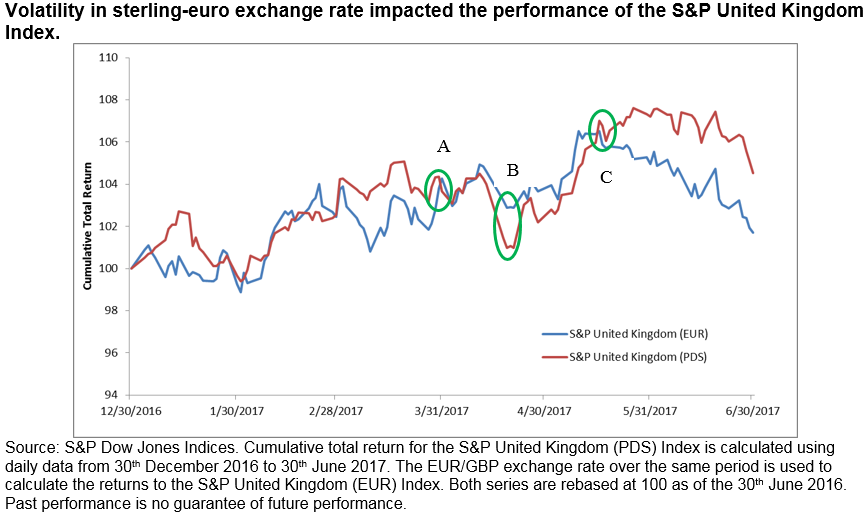

After months of speculation about when the U.K. would formally notify the European Union of its intention to leave, Prime Minister Theresa May announced that the two year negotiation period would commence at the end of March (point A in the chart below). Rather than turning attention to the negotiation immediately, however, the Prime Minister’s decision to call a snap election (point B in the chart) propelled U.K. politics into the limelight once again.

Expectations of an increased majority for the incumbent Conservative Party, which was seen as making a “soft” Brexit more likely, initially helped sterling appreciate against the euro. The impact of the currency movement was evident from the strong performance of the S&P United Kingdom Index (in pounds sterling) in May compared to the same index denominated in euros. The subsequent tightening of the polls (point C) and the realization that no political party had secured a Parliamentary majority saw a complete reversal in this trend.