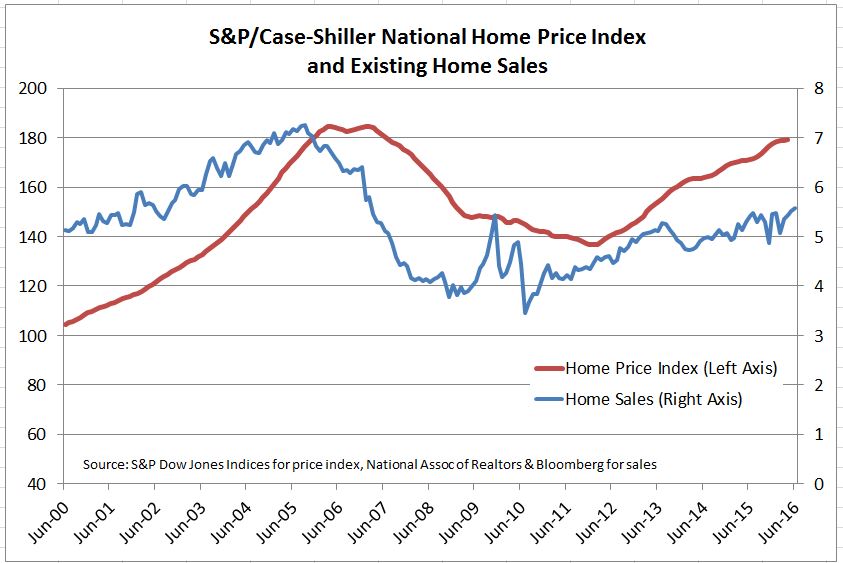

House sales and prices are rising. Home sales in June were 5.57 million at annual rates, the highest since February 2007 when national home prices peaked. Currently prices as measured by the S&P/Case-Shiller National Home Price Index are climbing at a 5% annual rate and are a mere 3% from their all-time peak.

What next? The next S&P/Case-Shiller Home Price Index report will be released on Tuesday morning at 9 AM – check to see if the advance continues. The data will be posted at www.spdji.com.