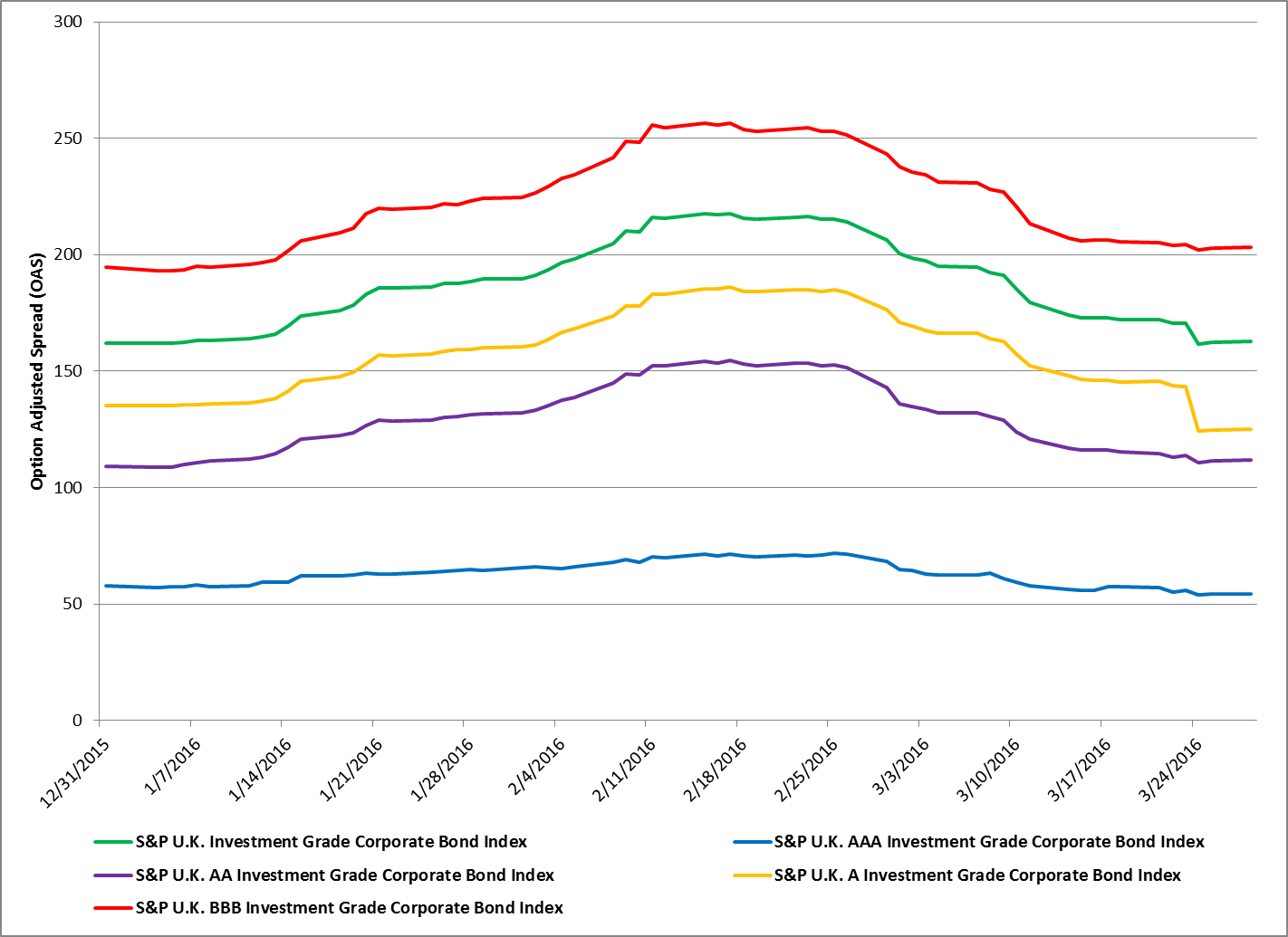

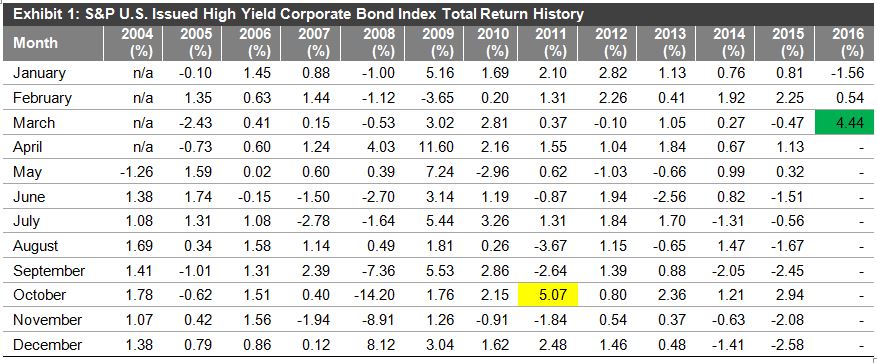

As with the weather for the northern hemisphere, the U.S. high-yield market seems to be making a comeback. The 0.54% return in February for the S&P U.S. Issued High Yield Corporate Bond Index appears to be the green shoot of return for high-yield bonds. March 2016 followed the prior month’s gain with a blossom of its own. The index returned 4.5% for the month, which was the largest monthly return since October 2011’s return of 5.07%. Year-to-date, the index returned 3.36%, which is refreshing to high-yield investors, who, before this month, had not seen a positive year-to-date return since November 2015.

The S&P 500 High Yield Corporate Bond Index performance behaved similarly returning 3.43% for March, which was the index’s largest return since a 3.86% return in October, 2011.

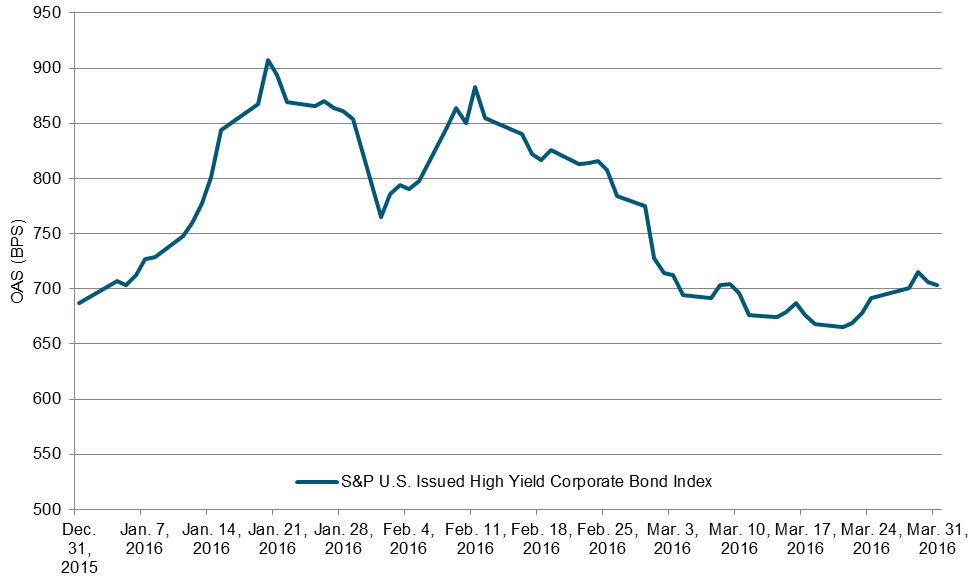

High yield option-adjusted spreads (OAS) for the year have double peaked, reaching highs of 907 and 883 bps on Jan. 20, 2016, and Feb. 11, 2016, respectively. Since then, the OAS spread has tightened by 180 bps, giving bankers a window of opportunity to work with issuers in providing more debt to the market before any possible additional rate increase by Fed. According to IFRMarkets, 57% of Q1 2016 high-yield issuance was sold in March, and at USD 6.3 billion, with the last week of March being the busiest for 2016. Next week, an additional USD 3-5 billion more is expected. Notable new issues for the week were included the following.

- T Mobile USA, Inc., with USD 1 billion of an eight-year maturity and a coupon of 6%.

- Western Digital Corp., with USD3.35 billion of an eight-year maturity and a coupon of 10.5%.

- HD Supply Inc., with USD 1 billion of an eight-year maturity and a coupon of 5.75%.

- BPCE S.A., with USD 750 million of a six-year maturity and a coupon of 8.25%.Exhibit 2: OAS History for the S&P U.S. Issued High Yield Corporate Bond Index

Source: S&P Dow Jones Indices LLC. Data as of March 31, 2016. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

The posts on this blog are opinions, not advice. Please read our Disclaimers.